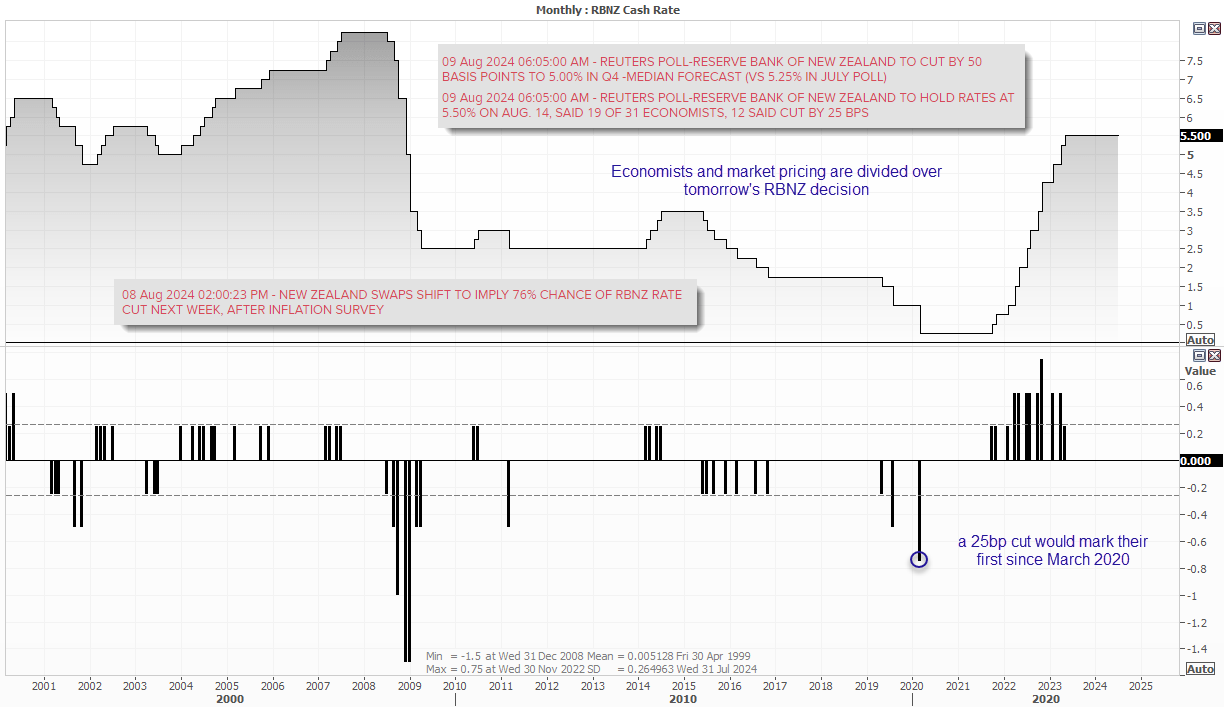

There is speculation that the RBNZ could cut their cash rate by 25bp tomorrow, from 5.5% to 5.25%. Rates have been held here for nine consecutive meetings, and a cut would mark their first since March 2020. The question is whether they will cut at all, and will they signal more at tomorrow’s meeting?

Not for the first time, economists and money markets disagree

60% of economists polled by Reuters expect the RBNZ to hold rates tomorrow, yet swaps markets imply an 76% chance of a cut. Even if they do cut rates, they likely need to signal further cuts for NZD/USD to have a meaningful move lower.

Economic data over the past month has seen unemployment rise to a 3-year high of 4.6%, employment costs slow for a fifth quarter to 3.6% and 1 and 2-year inflation forecasts to 2.4% and 2% respectively. So there clearly is a case building for easing, although economists suspect it will come closer to the end of the year.

It was only two meetings ago that the RBNZ surprised with a discussion on hiking rates, only to do a reversal at their last meeting. Their last statement noted that domestic price pressures remain strong, and that monetary policy needs to “remain restrictive”.

Finally balanced decision: I suspect a not-so-dovish cut, or a dovish hold

I therefore see a cut tomorrow as a finely balanced decision. I doubt the RBNZ will simply signal further cuts if they do cut tomorrow. Therefore, it could be a not-so-dovish cut, or dovish hold by signalling cuts. Yes, the economy is slowing and their rates remain high in a relative basis, but do they really gain much by telegraphing a rate cut cycle tomorrow?

The RBA have retained their hawkish bias and continue to talk a hawkish game. Unless we see a drop in wages and employment this week, that is very unlikely to change. Although hot prints could help any hawkish comments from governor Bullock’s speech on Friday carry more weight. The Bank of Canada have already cut twice in a row and any futures decisions will be down to incoming data. They RBNZ seem more likely to take this approach if they cut tomorrow in my view and not come out swinging (as much as we’d like them to for the sake of volatility).

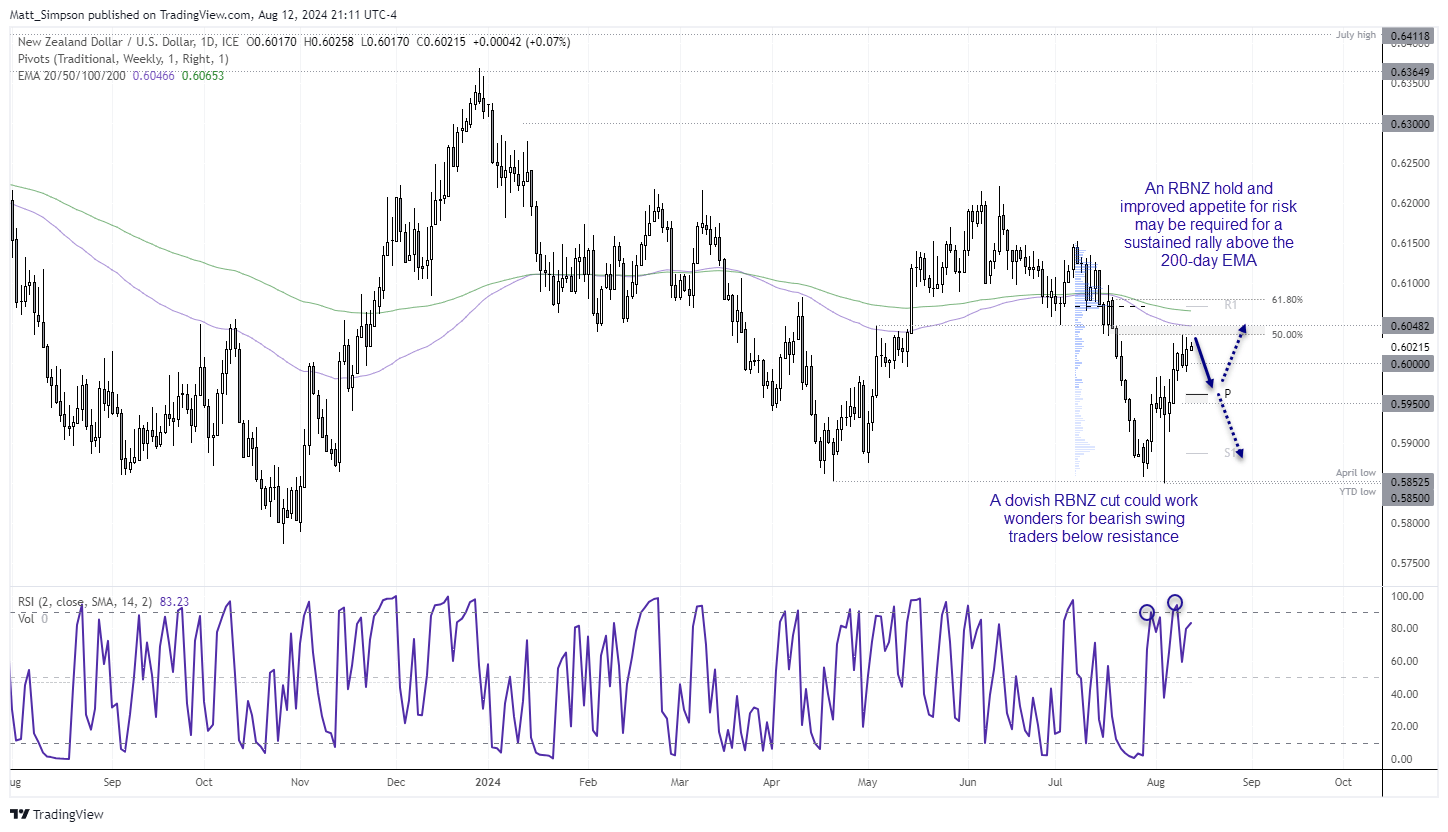

NZD/USD scenarios for RBNZ interest rate decision:

- Most bullish: RBNZ hold rates and signal no cuts

- Bullish: RBNZ hold rates but hint at a potential cut this year

- Slightly bearish: RBNZ cut, hint at future cuts depending on incoming data

- Most bearish: RBNZ cut, signal further cuts

NZD/USD technical analysis:

A dovish RBNZ cut could work wonders for bearish swing traders tomorrow. Prices have rebounded nearly 3% from last week’s YTD low, and resistance from the 100-day EMA, 50% retracement and 0.6048 level sits just overhead. A 200-day EMA also sits just above the tight resistance cluster. The daily RSI (2) has reached overbought twice during this rally and it is trying to form a slight bearish divergence.

Should bearish momentum return, a drop back to the weekly pivot or 0.5950 area seems within easy reach over the near term.

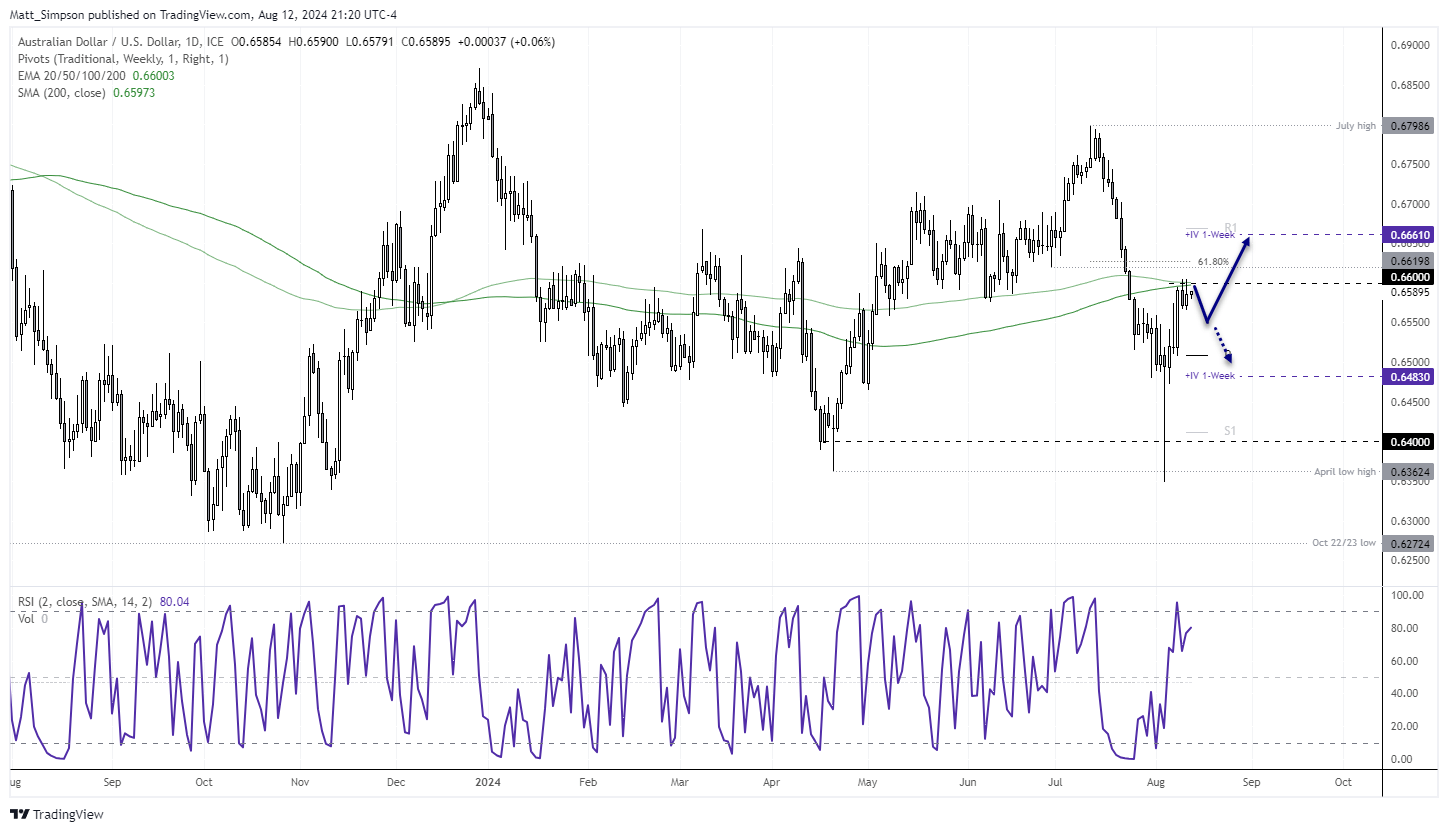

AUD/USD technical analysis:

I retain my earlier view that AUD/USD could break back above its 200-day averages. But given the significance of these averages, a pullback could be due first. Bulls could seek dips within Thursday’s large bullish range in anticipation of a sustained break above 66c, although note resistance around 0.6620 which includes a 61.8% Fibonacci level and a prior support/resistance level.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge