Following the release of the July US consumer inflation data, the US dollar initially came under selling pressure but then refused to fall further. It even managed to turn positive against the likes of the Aussie dollar and came off its worst levels vs., the euro and pound. The lack of a sharper downward move for the dollar is partly because of the fact the softer producer prices data that were released a day earlier had already seen investors build short dollar positions in anticipation of further weakness in CPI. While the CPI matched prior analyst expectations, it wasn’t soft enough to trigger a fresh wave of dollar selling. Instead, we saw some profit-taking on the short dollar trades, and this helped to keep the major pairs in a holding pattern. Still, the disinflation process continues, and the Fed should start cutting rates from next month. The key question is whether the US central bank will opt for 25 or 50 basis points in September, and at what pace it will continue thereafter. The US dollar weakness should persist I reckon, which should keep the AUD/USD forecast bullish. But the Aussie is now going to face a fresh test from upcoming Australian jobs and Chinese industrial data.

US CPI slightly weaker

Following a weaker PPI report on Tuesday, investors were hoping for a weaker CPI print today compared to a headline and core prints of +0.2% expected. Well, the monthly figures were bang in line with the expectations and so there was a bit of disappointment as some traders had front-run a softish results. But if you don’t apply rounding, the headline CPI was just 0.155% and Core CPI was 0.165%. What’s more, the year-over-year rate fell to 2.9% on the headline front, below expectations of 3.0%. What’s more, this was the first month with CPI inflation below the 3.0% mark since March 2021. All told, I reckon the weaker inflation data should now pave the way for the first rate cut since 2020.

Focus turns to the Australian and Chinese data

The AUD/USD has found a bit of resistance around the 0.6635/0.6645 area with investors unwilling to take too much risk ahead of the Australian employment data and Chinese industrial data due for release in the early hours of Thursday.

If Australian employment data, due at 02:30 BST, comes in around the expected 20K figure with the unemployment rate seen steady at 4.1%, then this scenario should further boost the AUD/USD forecast. But then the focus will immediately shift to the Chinese data, at 03:00 BST. China’s industrial production is seen easing to 5.2% y/y from 5.3% y/y previously while retail sales are seen rising to 2.6% y/y from 2.0% y/y the month before.

AUD/USD forecast: Technical analysis

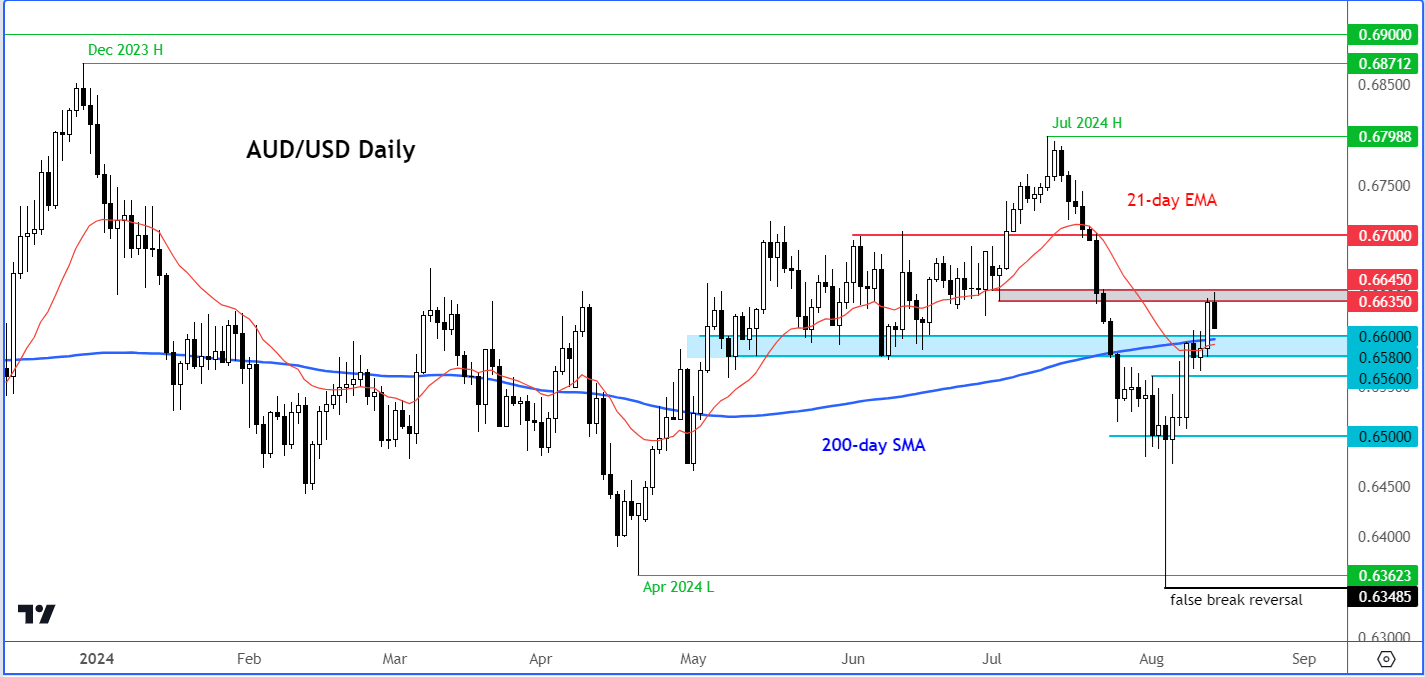

The AUD/USD has been on an upward trend since it formed a false break reversal pattern below the previous low of around 0.6362. The strong rebound from this point has pushed rates past several key levels, including 0.6500, 0.6565, and the 200-day moving average around 0.6600. These are now important support levels to monitor on Thursday, with particular focus on the 0.6600 mark – the first line of defence for the bulls. For as long as these levels hold, the path of least resistance would remain to the upside despite today’s weakness.

In terms of resistance, the key area is between 0.6635 to 0.6645 area where the AUD/USD had previously found resistance.

Source: TradingView.com

Looking at the AUD/USD chart, it looks like it wants to reclaim the 200-day moving average and resistance in the zone between 0.6580 to 0.6600 area. If it can do that and rise back above the 0.6600 handle, I think that would create a strong bullish reversal pattern, following a double bottom or a false break reversal against the April low of 0.6362 we saw on Monday. That scenario would certainly boost the AUD/USD forecast, especially if the equity markets can sustain their gains. Meanwhile, short-term support is seen around 0.6560, followed by 0.6520.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R