- AUD/USD and ASX 200 futures have either returned to or broken above the levels they were trading prior to the US inflation report on Tuesday

- US 2-year yields remain higher, with Fed rate cut probability lower ahead of key US producer price inflation numbers later today

- Riskier asset classes appear to be taking their cues from US equity markets right now

Despite lacklustre corporate earnings and rebound in US bond yields, the spectacular rally in AUD/USD and Australia’s ASX 200 only gathered pace in the second half of Thursday’s trading session, leaving both markets eyeing off potential topside breaks.

Risk rebound goes into overdrive

While these markets are not alone in exhibiting unusually elevated levels of investors euphoria right now – just look at what other equity and riskier asset classes have done over the past two sessions post the US inflation report plunge – beyond momentum and euphoria, what else is underpinning the move?

The headline writers suggest the move reflects growing Fed rate cut bets, but while the expected amount of easing has grown a little over the past two days, were still only talking about four cuts over 2024, less than what was seen before the US inflation report and well below the more than seven cuts that were priced in just a month ago.

But rates markets are signalling caution

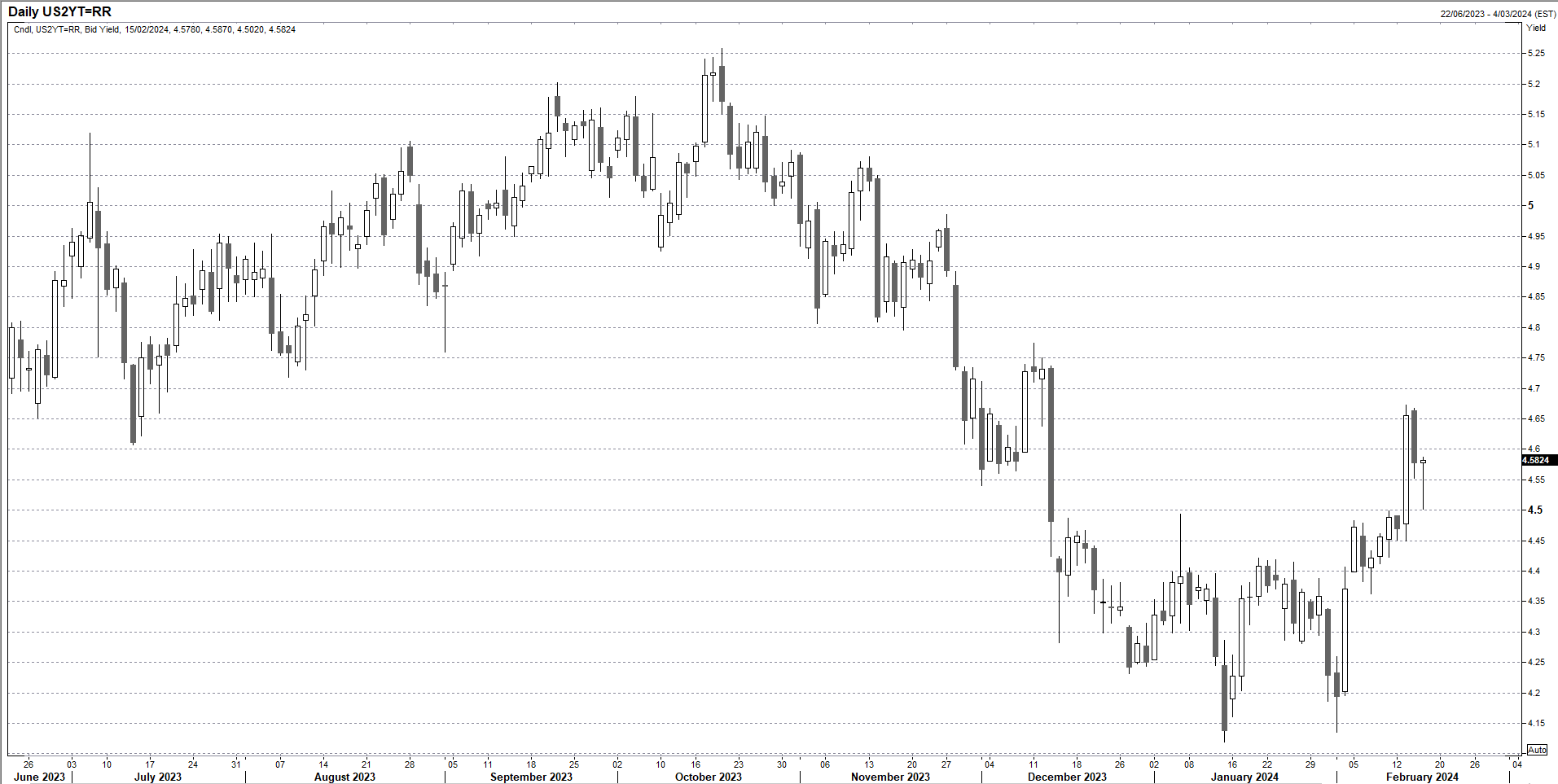

US two-year yields – an indicator many traders regard as being one of if not the most influential on broader markets – remain above the levels where they traded prior to the US inflation report on Tuesday. Of note, following the release of weak US retail sales and industrial production reports on Thursday, yields dipped to the top of the former range they traded in earlier in the year but couldn’t sustain the move, rebounding sharply to finish the session roughly where they started.

Source: Refinitiv

That warns of potential further upside for shorter-dated US yields in the near-term, delivering the type of scenario that could drag longer-dated yields higher along for the ride. With the US producer price inflation report out later Friday, I get the sense rates have begun discounting the risk it too may show some signs of reemerging inflationary pressures.

But that risk is not resonating with broader markets. Focus seems to be on US equities, especially riskier constituents which continue to ramp often late in the North American session.

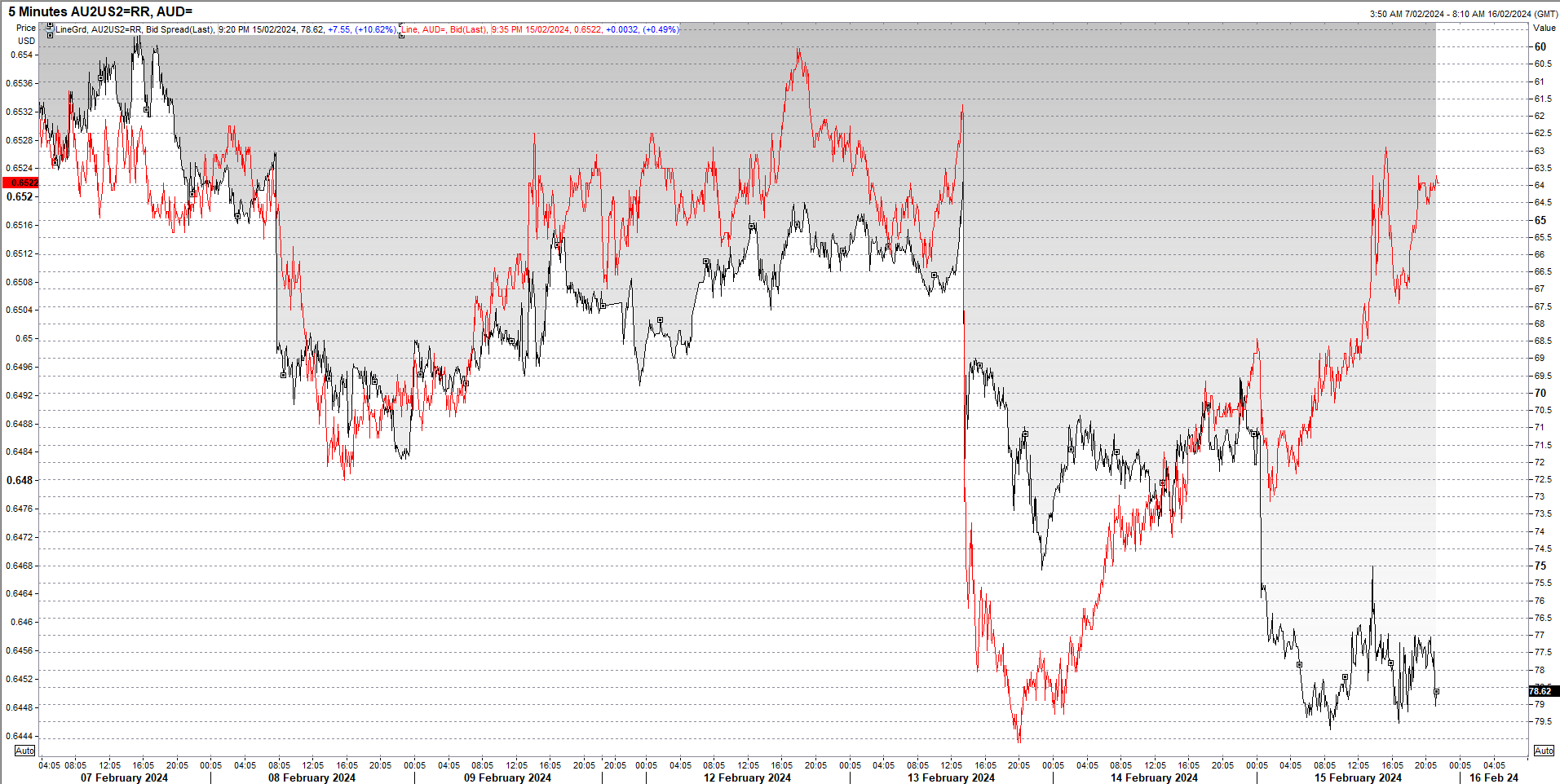

AUD/USD disconnects from rate differentials

AUD/USD (red line below) appears to be paying close attention to stocks, rallying right back to where it was trading prior to the US inflation report, just like the S&P 500. The recovery has come despite the US yield advantage over Australia for two-year yields (black line, inverted on the chart below) blowing out to the highest level since October on Thursday as another soft Australian employment report added to RBA rate cut bets. When the yield spread was last this wide, AUD/USD was trading nearly two cents lower than where is does today.

AUD/USD resembles a slingshot

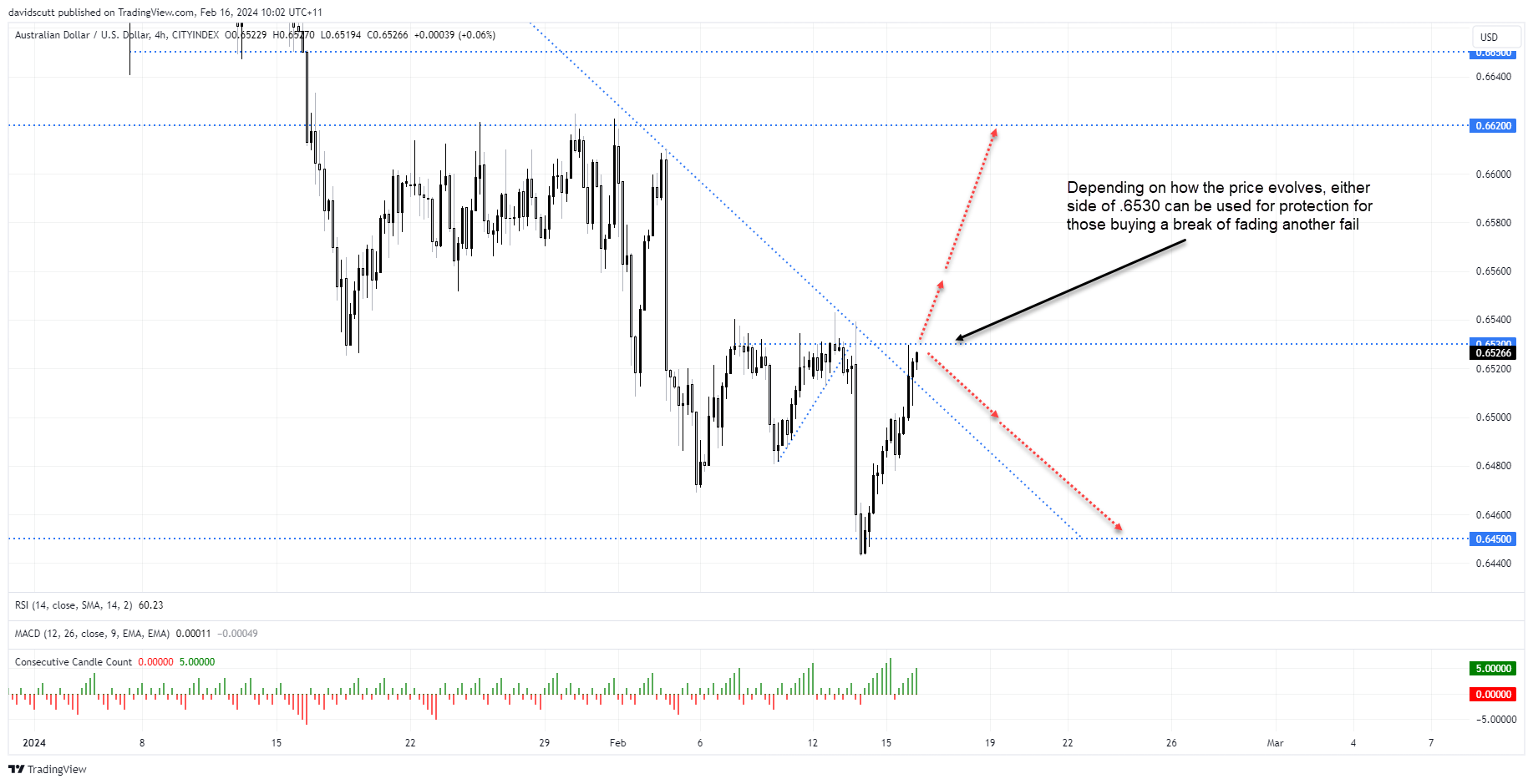

However, while I’m unconvinced by the fundamentals underpinning the rebound, I’m not going to fight the tape when the bulls want to charge. As a result of the late rally on Thursday, AUD/USD has broken through the downtrend it’s been stuck in since late December, leaving only resistance from .6530 standing in the way of a push to higher ground.

The rebound from Tuesday’s lows has been simply relentless, with only one down candle logged on the four-hourly chart since, separating the 12 up candles either side. Unsurprisingly, whether you’re talking RSI or MACD, momentum is breaking and swinging to the topside.

Should AUD/USD clear the last of the wicks from failed attempts above .6530 earlier this month, there’s not a lot of visible resistance to speak of until .6620, perhaps a bit around .6560. The pair looks primed for a break, resembling a slingshot.

Should AUD/USD break and hold above .6530, those considering longs targeting a push towards .6620 could place a stop below for protection. Alternatively, if the pair can’t break .6530 with the momentum it is carrying, it will also provide a decent level to get short targeting a push back to .6450. A stop above .6530 would provide protection.

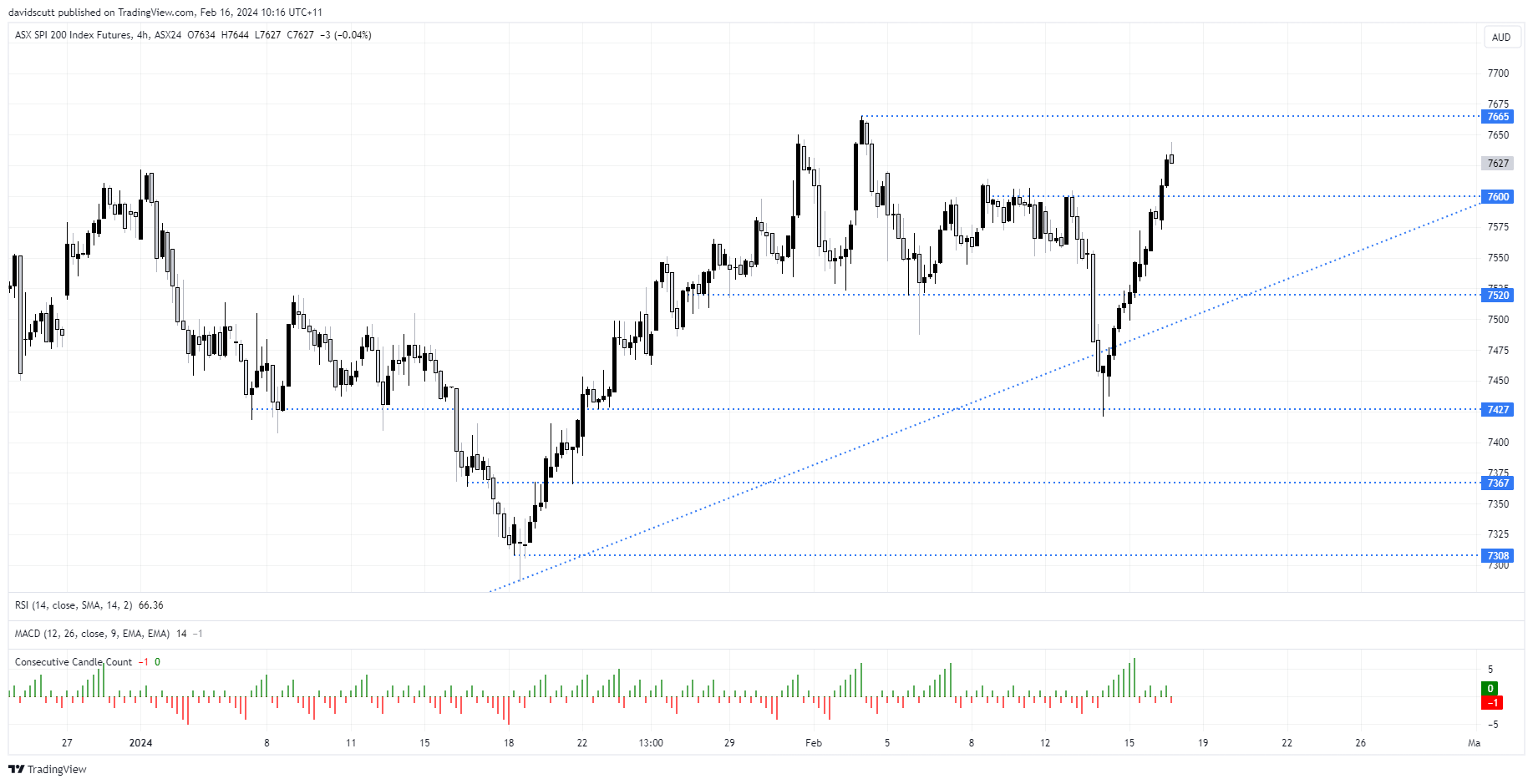

Momentum has ASX 200 futures eyeing record highs

Like AUD/USD, ASX 200 futures have been motoring over recent sessions, surging close to 3%, setting the underlying index on course for another potential record high. That’s despite expensive valuations across several key sectors such as financials and healthcare and a largely underwhelming reporting season report card so far. Yes, there has been some takeover activity in what’s left of Australia’s increasingly limited listed technology sector, but beyond momentum, the fundamentals hardly cream buy at these levels.

While some may want to chase the market to record highs, I’d prefer to see how the near-term price action plays out. Yes, momentum is totally to the upside but that makes it vulnerable to an abrupt rug pull should the focus return to what rates and fundamentals are suggesting.

Resistance is located at .7665 with support located around 7600 and again at 7520.

-- Written by David Scutt

Follow David on Twitter @scutty