- Australian retail sales rose 0.9% in September, tripling economist forecasts

- Sales grew in every state and across every category bar one

- Higher Australian interest rates are generally a positive for AUD/USD but a negative for ASX 200

Australian retail sales surged in September, solidifying the view the Reserve Bank of Australia (RBA) is likely to restart its interest rate hiking cycle when it meets on November 7. On top of an uncomfortably strong inflation report for the September quarter, both in headline and underlying terms, and continued strength in Australian property prices, the question is arguably becoming not whether the RBA will hike the cash rate again but how many times it will hike?

The answer to that question will be important to the AUD/USD and ASX 200 given the influence interest rates play in determining their performance.

The big retail sales beat

The Australian Bureau of Statistics (ABS) said retail sales rose 0.9% in September, three times greater than the median economist forecast. It was the second largest nominal gain this year and came on top of an upwardly revised 0.3% increase in August.

Signaling broad strength, sales rose in every state and every category aside from cafes, restaurants and takeaway food services which was unchanged from a month earlier.

While rapid population growth and inflation are contributing to higher nominal sales, the biggest factor is remains strength in demand, helped by tight labour market conditions and a pickup in wages.

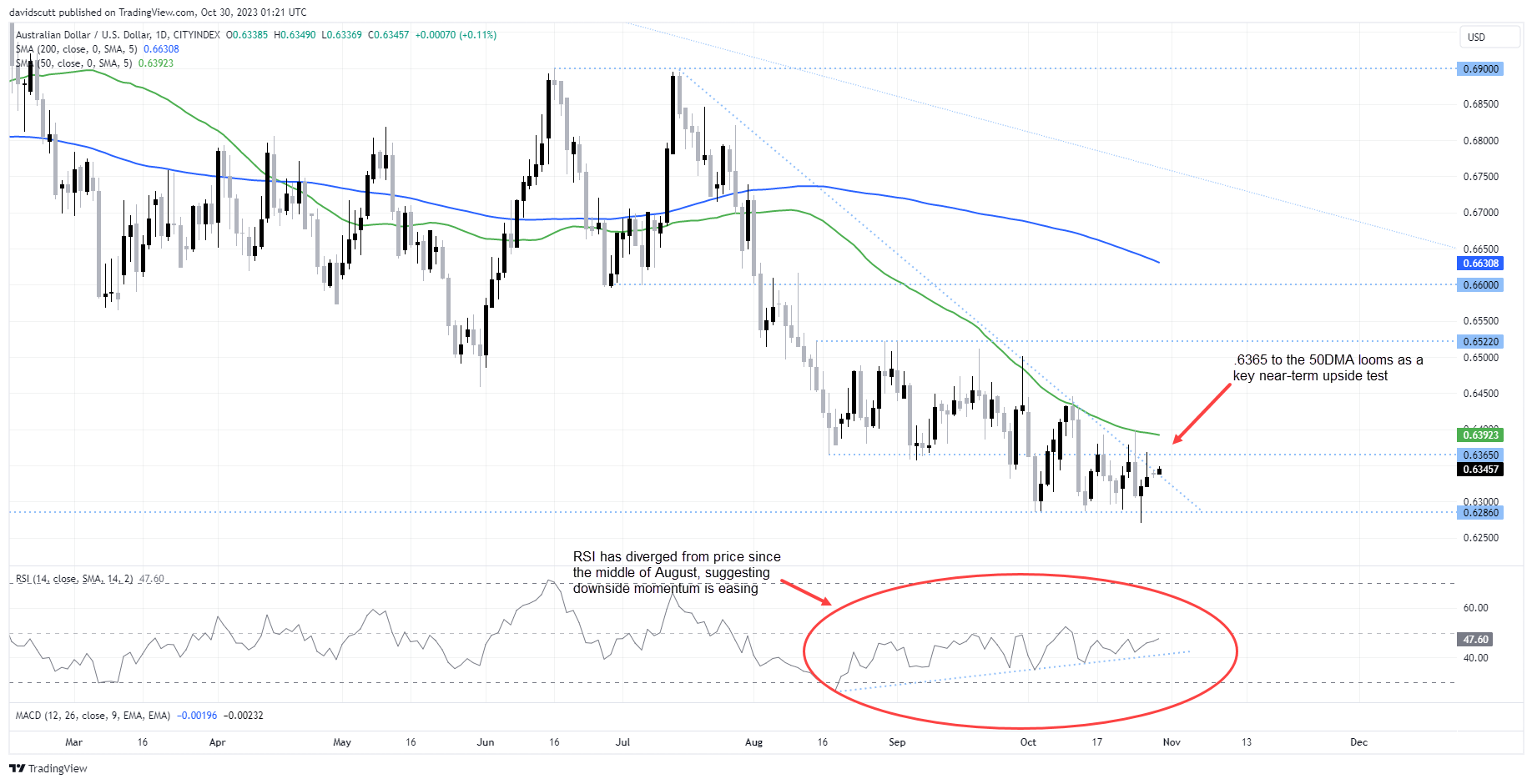

AUD/USD threatens to break downtrend

Two things stand out looking at the AUD/USD daily. The first is how important .6286 is on the downside, constantly repelling attempts to push the pair lower over the course of October. The second is the difficulty the pair has breaking through the 50-day moving average over the past month, failing on multiple occasions, keeping the AUD/USD downtrend running from August intact.

However, after the retail sales beat, the AUD/USD has traded through the downtrend, signaling a potential shift in directional risks. It’s too early to tell whether the break it will stick but with RSI diverging from price in recent months, and given the proximity to strong downside support, the likelihood appears to be strengthening.

For those considering longs, .6365 to .6400 is a key zone to watch, coinciding with resistance at .6365 and the 50-day MA just below the figure. To get excited about longer-term upside, AUD/USD likely need to break and hold above these levels. If that eventuates, .6522 would be the next upside target.

On the downside, .6286 has found buyers consistently during October, providing decent protection against another lurch lower. As stop below would offer protection for those considering long trades.

From a fundamental perspective, given significant geopolitical risks and ongoing pessimism towards the outlook for China’s economy, those headwinds would probably need to dissipate to generate meaningful upside in AUD/USD.

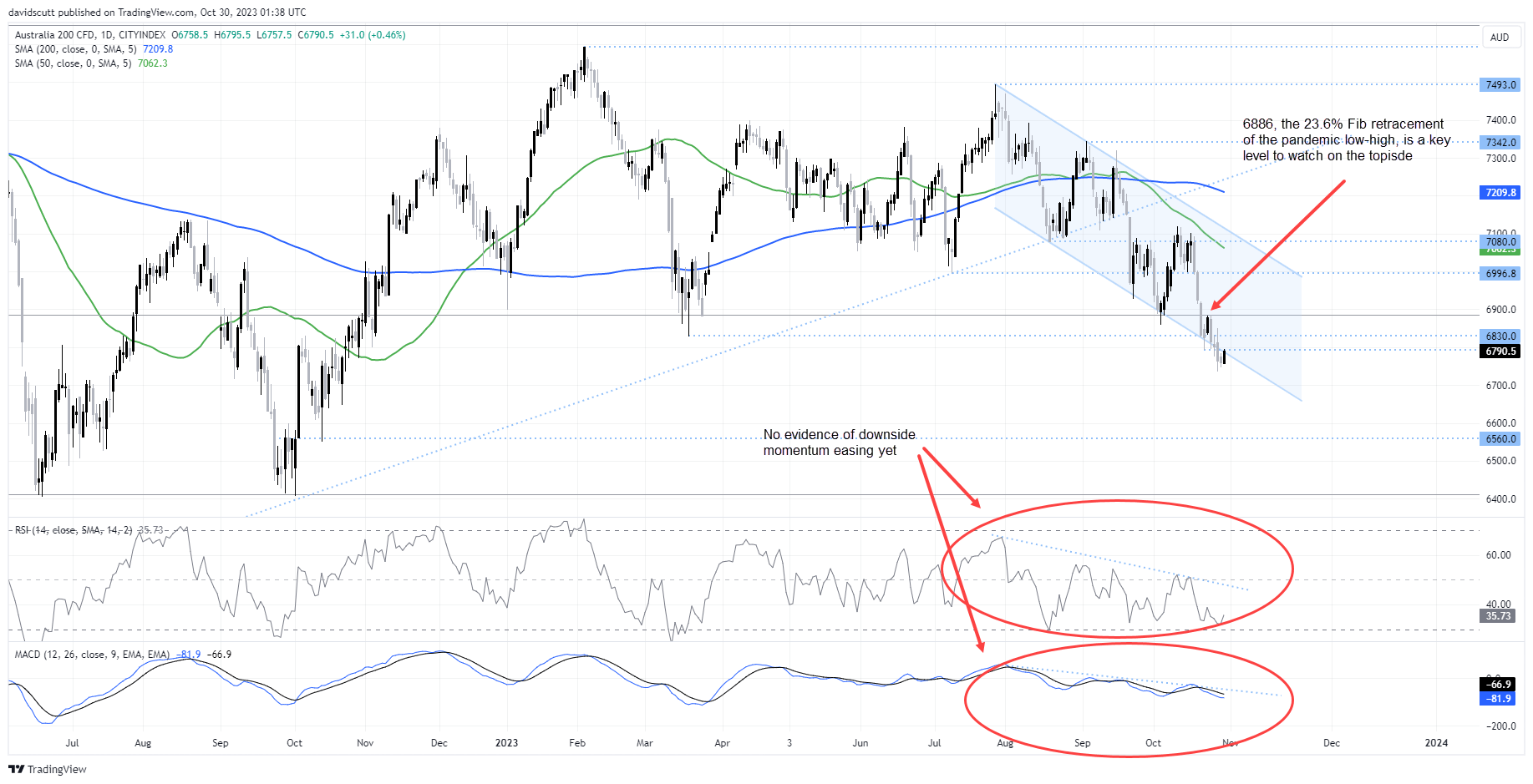

Downside risks remain for ASX 200

While the prospect of tighter monetary policy from the RBA is a net-net positive for the Australian dollar, for the ASX 200 it’s the opposite story, making the high-yielding index comparatively less appealing while simultaneously attempting to limit demand.

The index looks terrible on the daily chart with price, RSI and MACD continuing to point to downside in the near-term. Should bids around 6750 evaporate, there’s not a lot of visible downside support on the charts until you get to 6560. A break there would open the door to a retest of major support at 6400, the double-bottom hit last year.

On the topside, minor resistance is evident around 6790 and 6830. To get excited about a meaningful turnaround for Australia’s benchmark share index, a break and hold above 6886 would likely be required.

-- Written by David Scutt

Follow David on Twitter @scutty