It seems crude oil prices weren’t stretched at their lows yesterday as I’d suggested, given prices fell another -3.5% and closed beneath the 2024 open price to form an outside day. As noted in my article, futures traders piled into shorts and weak data from China suggests it could have further to fall over the coming weeks. But having already fallen -16% in two weeks and the YTD low of 64.45 in easy reach, bears may want to remain nimble on this notoriously volatile market.

Gold prices remain elevated yet stuck in a choppy range between the September low and all-time high. A soft US inflation report is likely required to help it retest its highs and continue its bullish trend.

It was mixed for currencies with the US dollar stuck in the middle of the rankings on Tuesday. The safety of the yen and Swiss franc appealed to traders ahead of US CPI data as they were the strongest FX majors, CAD, EUR and AUD were the weakest. EUR/USD fell to a three-week low and trades less than 20-pips above the 1.10 handle. USD/JPY reversed most of Monday’s losses and trades just 40-ips above the August low.

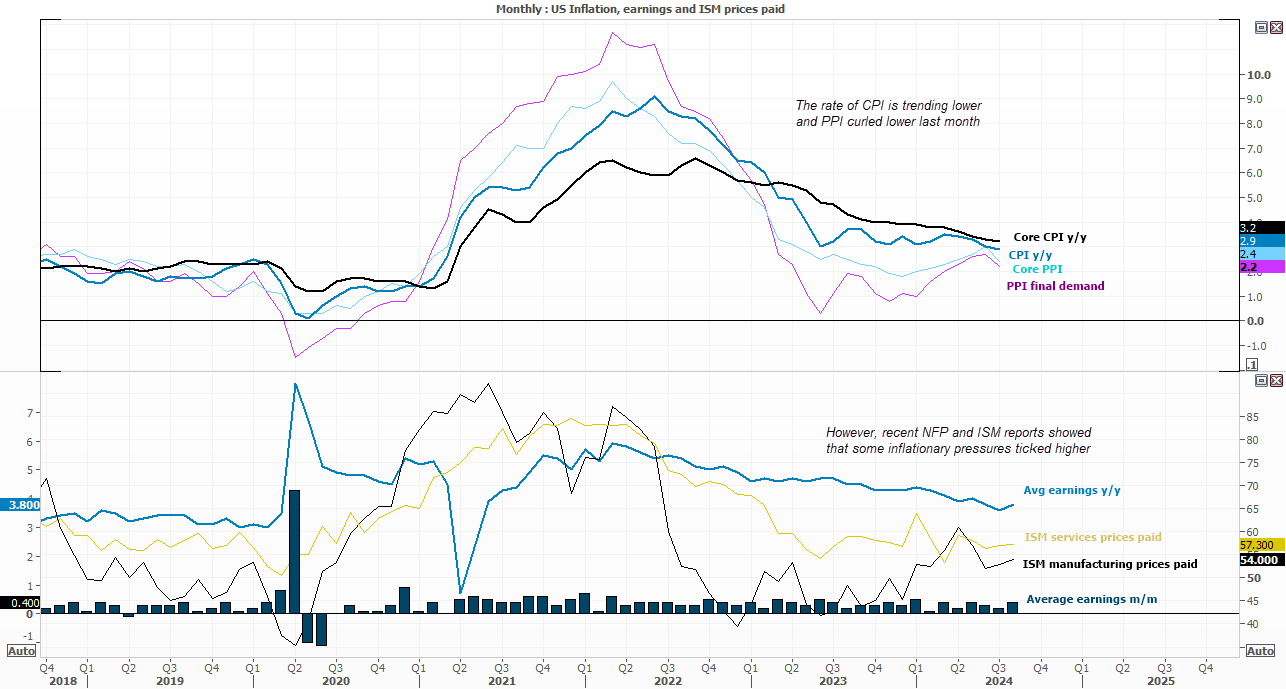

Economists continue to favour three 25bp Fed cuts this year, yet market pricing still sees 100bp according to Fed fund futures. FFF also assigns a 52% probability of a 50bp cut in November, although that could change if today’s inflation data comes in hot. US bond yields continued lower overnight.

The Presidential debate and US CPI are the main events today

Although it is debatable as to how much of a market-mover the Trump-Harris debate will actually be. It might require one of them to crash and burn to generate a flurry of headlines worthy enough of moving markets, but it seems more likely that both candidates will simply appeal to a well-established base and do little to sway the swing voters.

US inflation will be closely watched to see if they justify the 50bp November cut currently estimated by Fed fund futures with a 52% probability. The rate of inflation has been trending lower for some time and producer prices curled lower recently, but take note that inflationary pressures ticked higher in recent ISM and NFP reports. Could today’s inflation figures have an upside surprise and sow further doubt on a 50np cut? If so, it could see the US dollar extend its gains and weigh further on risk.

Events in focus (AEDT):

- 08:45 – NZ manufacturing sales, visitors and migration

- 09:00 – JP Tankan (Reuters)

- 11:00 – AU inflation expectations (Melbourne Institute)

- 11:00 – US Presidential debate between Harris, Trump

- 16:00 – UK construction output, industrial production, index of services, manufacturing production, trade balance

- 18:00 – CN outstanding loan growth

- 22:30 – US CPI, real earnings

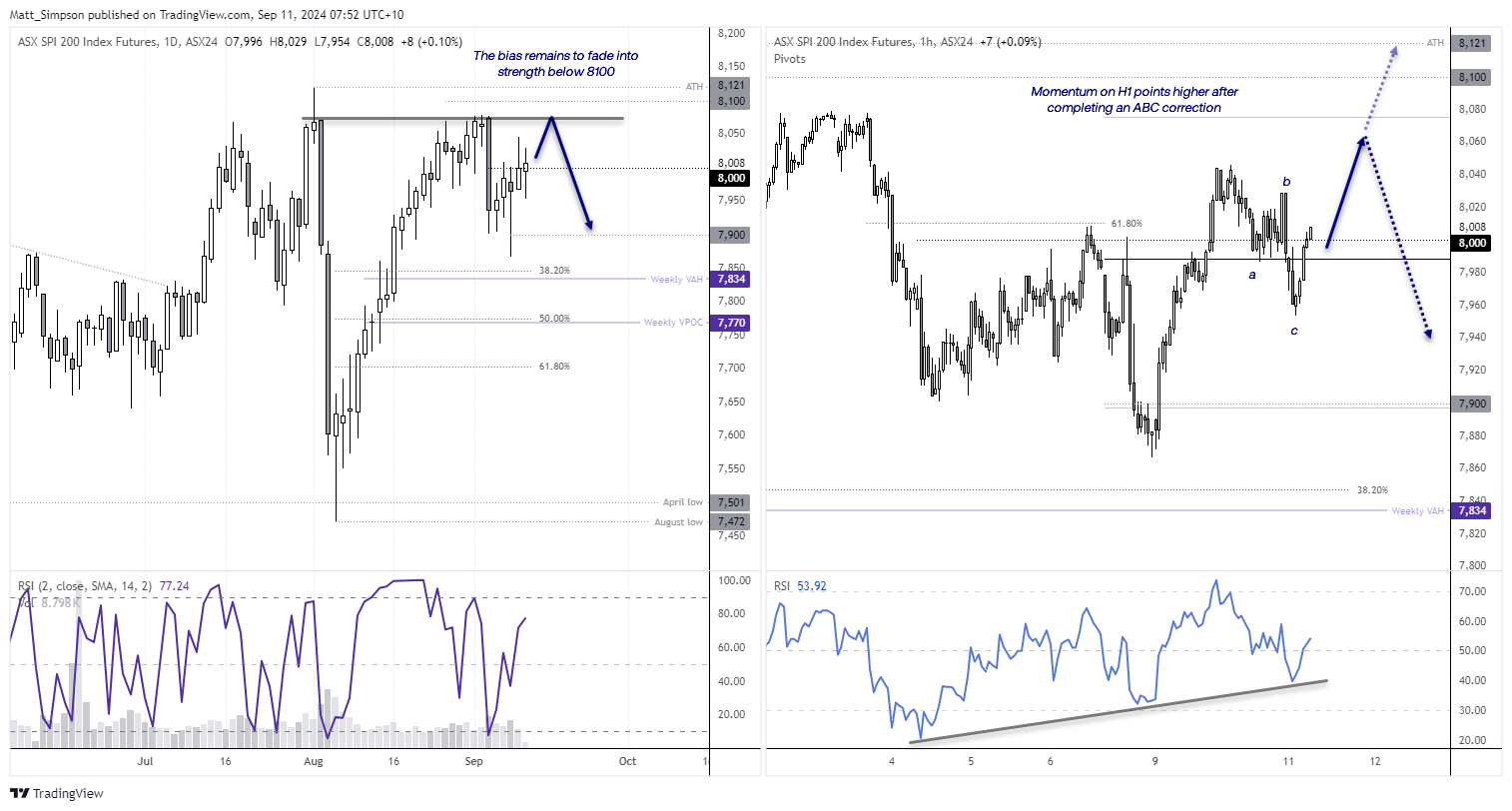

ASX 200 futures (SPI 200) technical analysis:

There has been very little trading activity above 8070 on ASX futures, given each time it tried to break above resulted in a swift reversal lower. Prices are now creeping back towards that level and now meandering around 8000 heading into the US inflation report, whose presence could suppress volatility today. Yet with Wall Street indices creeping higher, perhaps there’s a little more bullish fumes in the tank today.

Note the momentum has turned higher on the 1-hour chart having completed an ABC correction, which could point to cautious gains in today’s ASX session. But given the history around these levels, the bias remains to fade into strength below 8100.

Keep in mind that volatility can pick up in the minutes ahead of US CPI (22:30 AEST), so risk needs to be managed accordingly or traders could step aside until after the event.

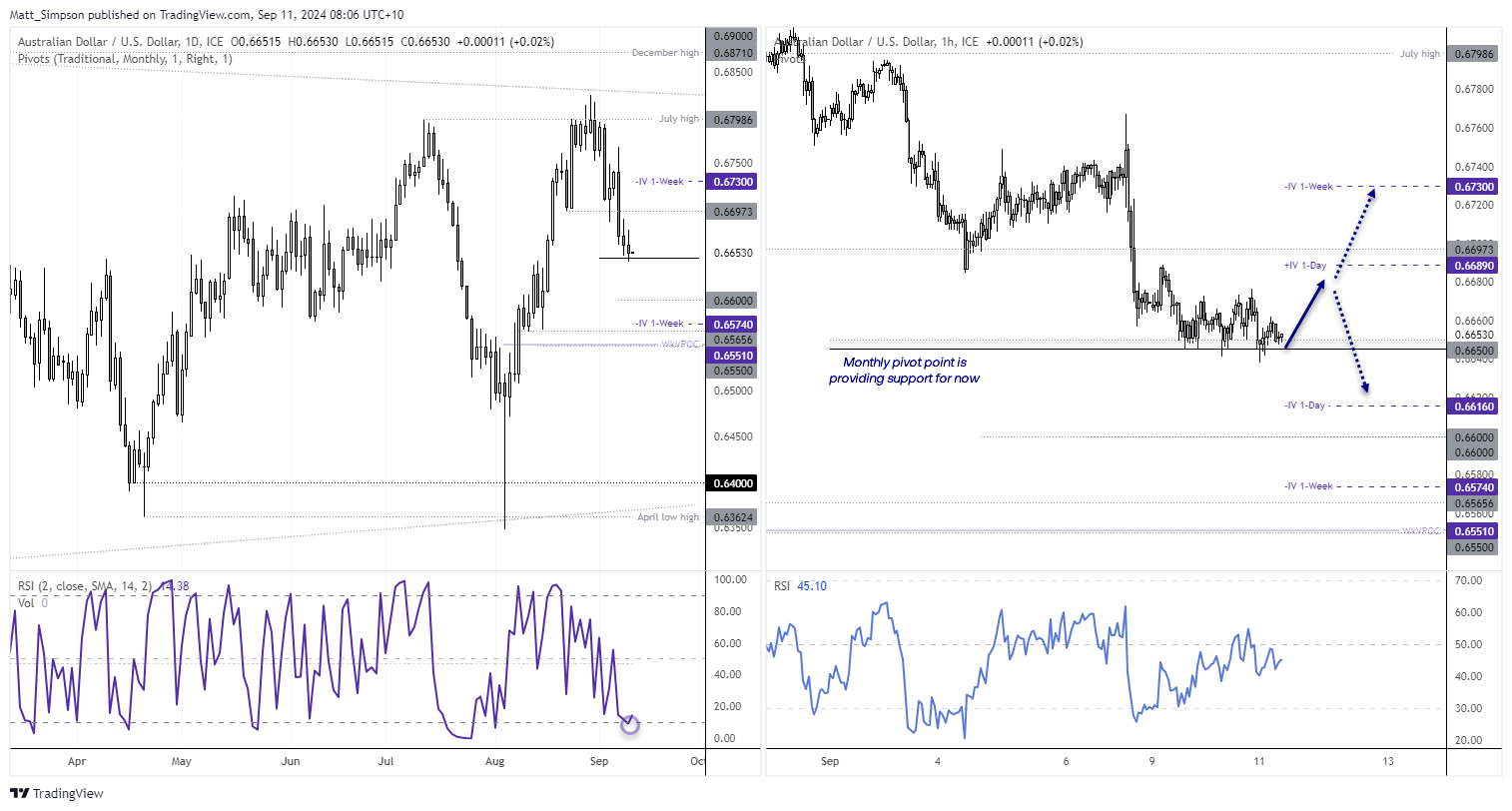

AUD/USD technical analysis:

The reality is that US CPI will likely dictate which direction AUD/USD closes today. However, note that support for AUD/USD has been found around the monthly pivot point, the daily RSI (2) dipped into oversold and bearish volatility on that timeframe is waning. We might get a cheeky bounce higher today, but anything more would require a weak US inflation report. Therefore I have no real bias beyond a potential cheeky bounce, but have provided implied volatility bands from options markets to gauge the market’s estimate of incoming volatility.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge