This week the critical issues in Australia will be how investors respond to the uncertainty created by Omicron and headlines on Wednesday that will confirm the Australian economy shrunk in the third quarter of 2021.

The news that the economy shrunk in Q3 should not come as too much of a surprise after extended lockdowns in NSW, Vic, and ACT. For the record, the market is looking -2.7% fall in the Q3 - not as bad as initially feared after the release of stronger than expected Capex and Construction works surveys last week.

Now, to the arrival of Omicron last week, which followed a series of worsening Covid headlines from out of Europe. Recently a friend of mine pointed me in the direction of a podcast called The Future of Vaccines with the CEO of Moderna, Stéphane Bancel. Given last week's developments, it's well worth a listen. The link is here for those that are interested.

Omicron carries many mutations in its spike protein, raising concerns that existing vaccines may be less effective and has higher transmissibility. However, thanks to the platform of mRNA technology, and as outlined in the podcast, a vaccine for Omicron will likely be available within months.

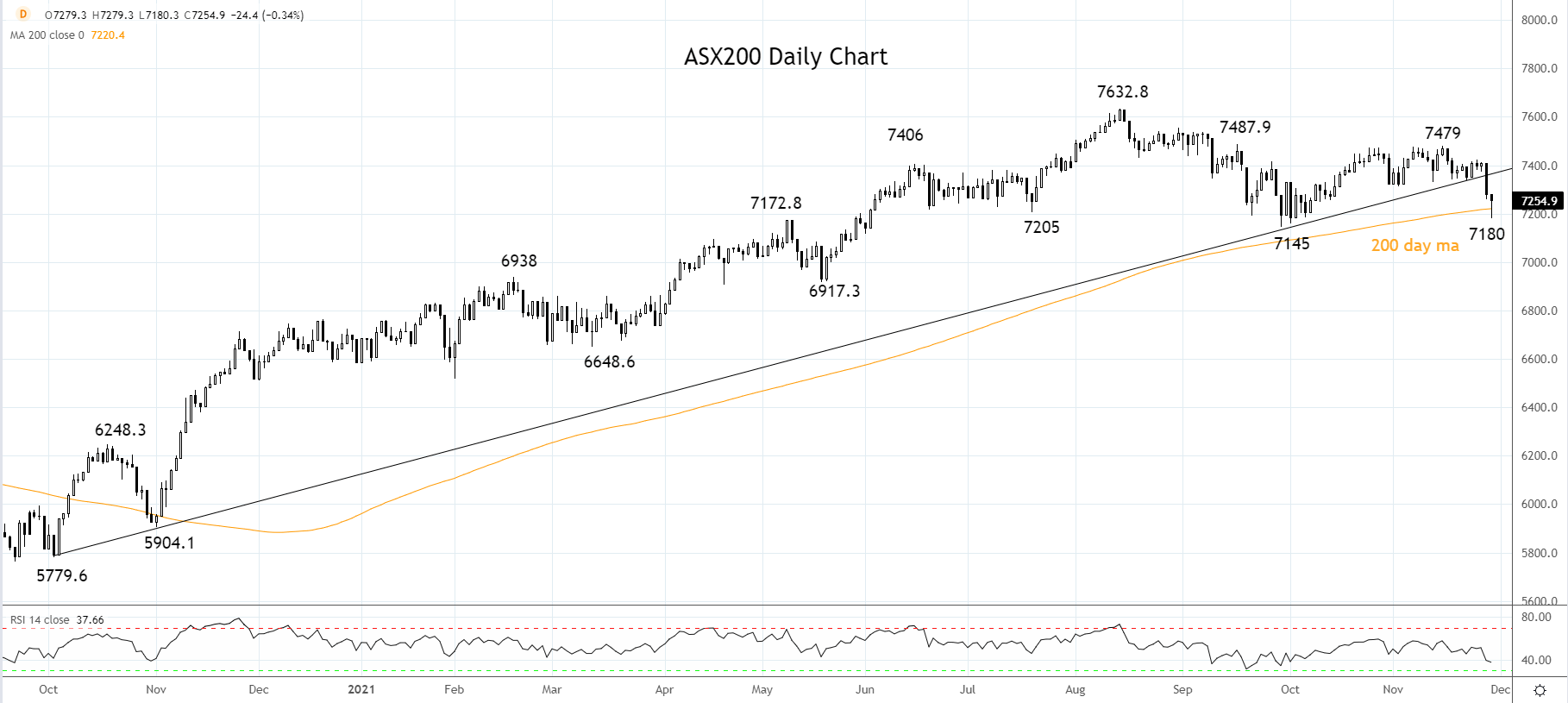

Providing hospitalisations and fatalities don’t rise significantly in the meantime, it is likely that as the panic subsides and calmer heads prevail, the market will recover lost ground. Evidence of this is already demonstrated today by the ASX200 trading at 7261, just 18 points lower from Friday's close at 7279.

From here, while it's impossible to rule out a test of the psychologically important 7000 region, the ASX200’s rapid rebound today above the 200 day moving average at 7220 today has been impressive.

Nonetheless, to increase conviction that the Omicron correction is complete and the uptrend has resumed, the ASX200 must reclaim Friday's breakdown level at 7350ish.

Source Tradingview. The figures stated areas of November 29th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.