The bulk of the last week’s gains coming from the Energy (+4.6%) and Financial (3.3%) sectors, supported by the Materials sector as the price of iron ore rebounded following the return of Chinese markets from the “Golden Week” holiday period.

However, some uncertainty has returned this morning after an unexpectedly soft U.S. jobs number on Friday that threatens to spill into earnings season.

Along with ongoing questions around energy markets, the stress in China’s financial system, unsolved U.S. fiscal issues, slowing growth, and Fed tightening.

In response to some of these issues, influential U.S. bank Goldman Sachs over the weekend, cut their forecasts for U.S. growth this year and in 2022, blaming a delayed recovery in consumer spending.

In Australia this week, we get a look at how this morning’s exit from lockdown and the formal tightening of macroprudential policy by APRA last week has affected Business and Consumer confidence in Australia.

The NAB business conditions and confidence survey for September (tomorrow 11.30 am Sydney time) are expected to improve, as is consumer confidence (Wednesday 10.30 am Sydney time) due to rising vaccination rates and reopening roadmaps.

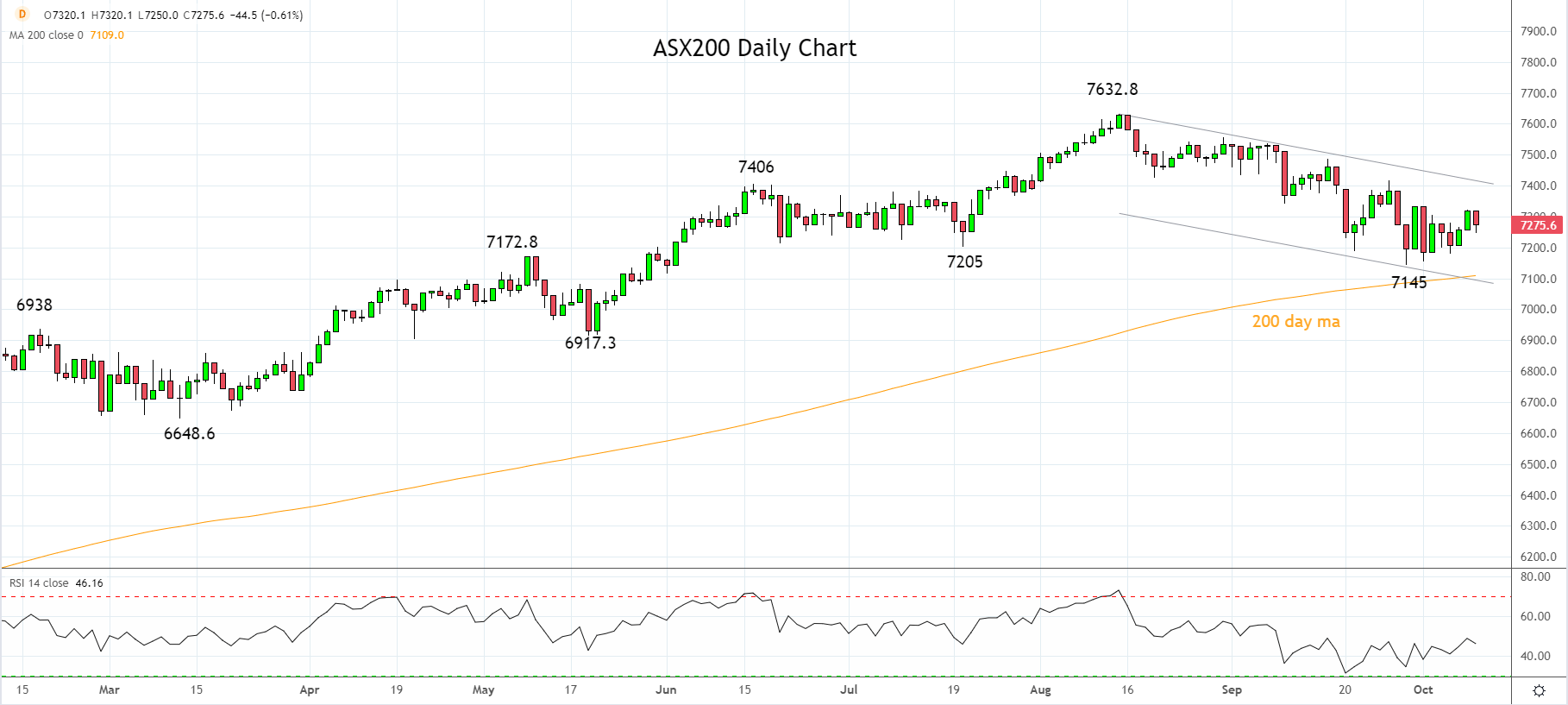

The decline from the August 7632.8 high is viewed as a correction, not a change of trend. However, a recovery back above trend channel resistance at 7420ish is needed to indicate the correction is complete and the uptrend has resumed.

Until then, a retest of the support provided by the September 7145 low, reinforced by the 100 day moving average at 7110, remains possible.

Source Tradingview. The figures stated areas of October 11th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation