It was not a bad year for the ASX 200 with its 7.4% gain, this is less than half of its low-to-high range of over 15%. Price action on the monthly chart also shows a few twists and turns along the way, even if it managed to hold above its 20-month EMA and close firmly above its 10-mont EMA. However, December’s bearish engulfing month for December at its record high stands out, and this has me on guard for another dip lower.

ASX 200 futures (SPI 200) technical analysis

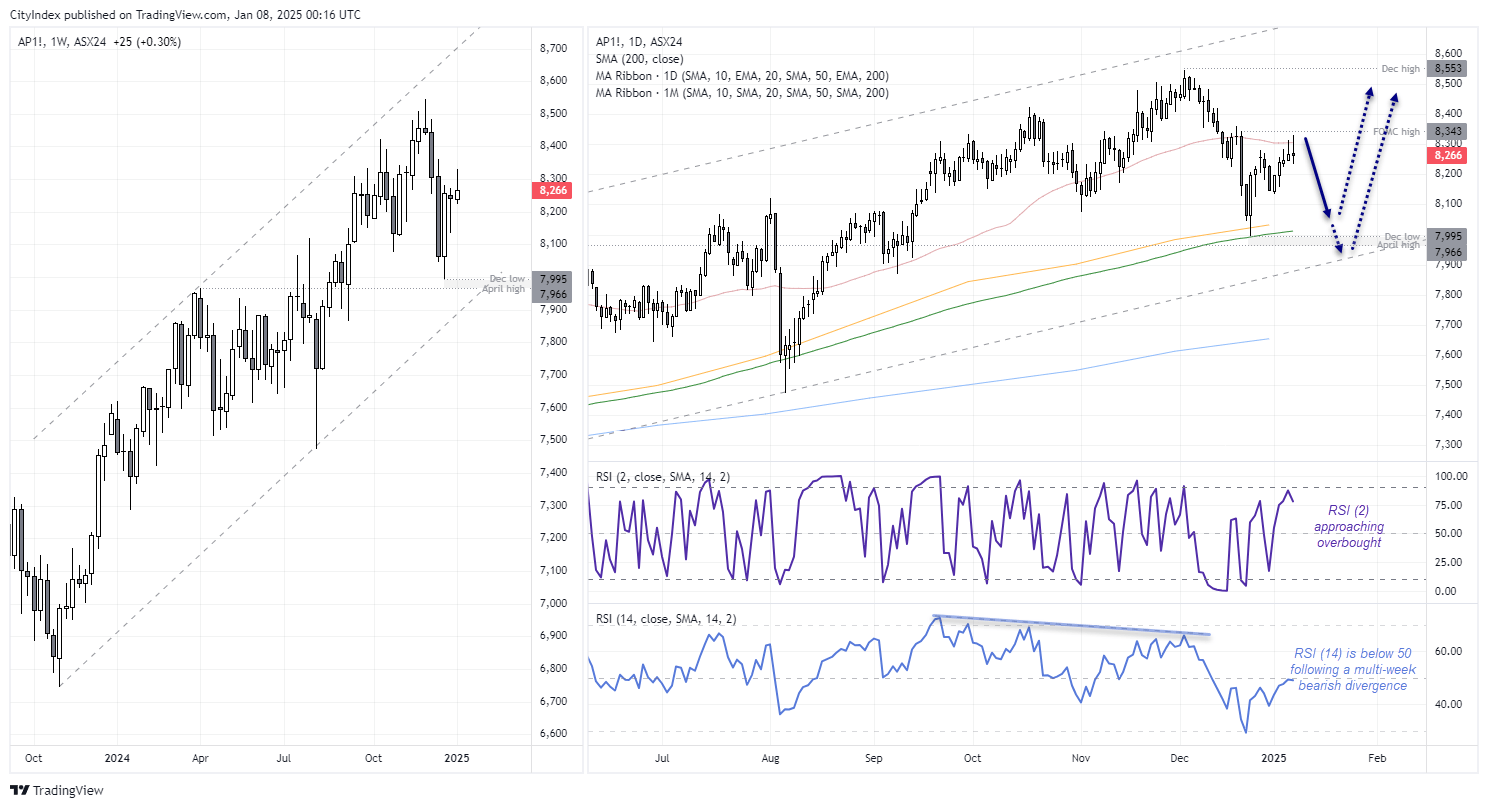

The weekly chart shows the ASX 200 trades within a strong bullish channel, although it could still allow for some further downside and retest of its lower trendline before the bullish trend resumes. The April high and December low land between 7699 – 7995 for potential support, should losses arrive hard and fast.

The daily chart shows a 3-wave move from the December low, although the third leg is losing bullish momentum. Two small shooting stars have also formed, and if prices are to close around current levels today then we’ll have a third. Also note that prices are struggling to hold above the 50-day SMA or retest the FOMC high. And given the multi-week bearish RSI (14) divergence and the fact that the daily RSI (2) is approaching overbought only adds to the case for a swing high to form.

Bears could seek to fade into moves towards the FOMC high with a view to initially target the 8100 handle and 200-day SMA near the 8000 handle. Although a potentially supporting factor for bears to mull over is that Wall Street indices are holding above their post-FOMC lows from December 18th.

For now, I suspect we’re in for at least a cheeky swing lower. But buyers could be lurking around the 200-day SMA or lower trendline. And as a Trump presidency favours a higher Wall Street, the ASX 200 could eventually rally higher as well.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge