Australian equities now face competition when it comes to capital flows with yields on 10-year Australian Commonwealth Government Bond yields surpassing those for ASX 200 12-months forward earnings for the first time since the Global Financial Crisis (GFC).

Australian stocks vulnerable to earnings disappointment

According to the Morgan Stanley Australian equity strategy team, increased competition not only presents headwinds for the broader index, but especially for individual stocks. Even with recent declines, seeing the ASX 200 give back around 80% of the gains achieved from July’s lows, it says the index forward earnings yield sits at 4.2%, towards the bottom of the range its oscillated in for much of the past two decades. In other words, at the aggregate level, the Australian market is not looking particularly cheap.

Given the continued rise in government bond yields, Morgan Stanley warns that earnings execution, rather than multiple expansion, should be more important to near-term stock returns.

Cautious RBA contributing to valuation headwinds

And while higher risk-free rates are challenging valuations for stocks in the near-term, the investment bank says the Reserve Bank of Australia’s (RBA) cautious approach to monetary policy tightening, leaving Australia’s cash rate well below policy rates in other developed markets, is contributing to the uplift in Australian bond yields, potentially adding to valuation pressures for stocks longer-term.

“The RBA has acknowledged this directly, stating it is setting policy less restrictive and allowing a slower path of inflation back to target, relative to other central banks,” it says. “The rub, however, is that this reduces the scope for a pivot to policy easing – and indeed the higher bond yield reflects this.”

Australian overnight index swaps currently have around 50 basis points of rate cuts priced in, the smallest amount in the history of RBA easing cycles.

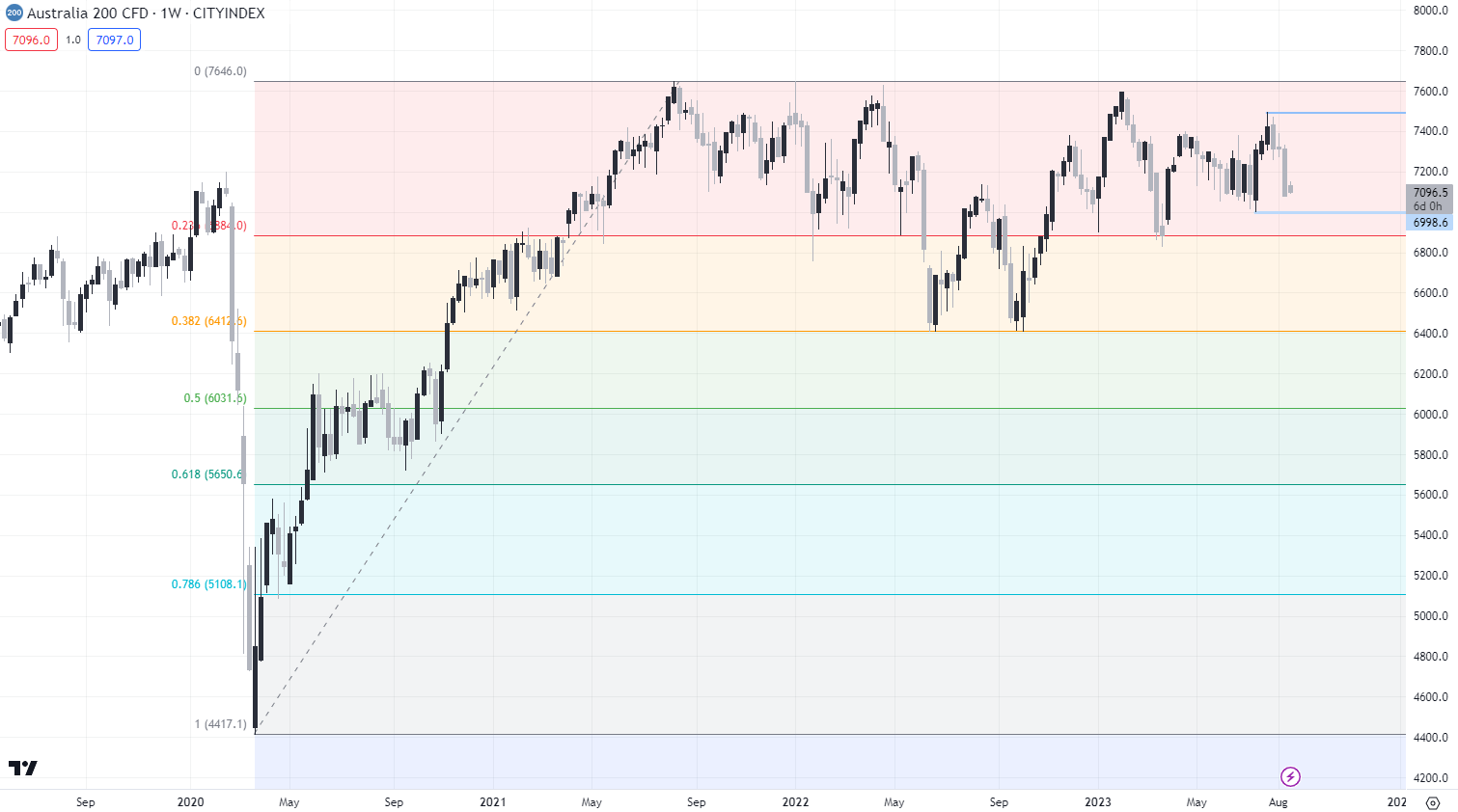

AU 200 trades near the bottom of its recent range

The AU 200 sits towards the bottom of its recent trading range, continuing to find support on dips below 7100. Should that level go, downside support may be found at 7000 and again around 5884, the 23.6% Fibonacci retracement from the pandemic lows to highs. On the topside, 7500 has been a level the index has struggled to overcome convincingly on multiple occasions over the past two years.

-- Written by David Scutt

Follow David on Twitter @scutty