Wednesday US cash market close:

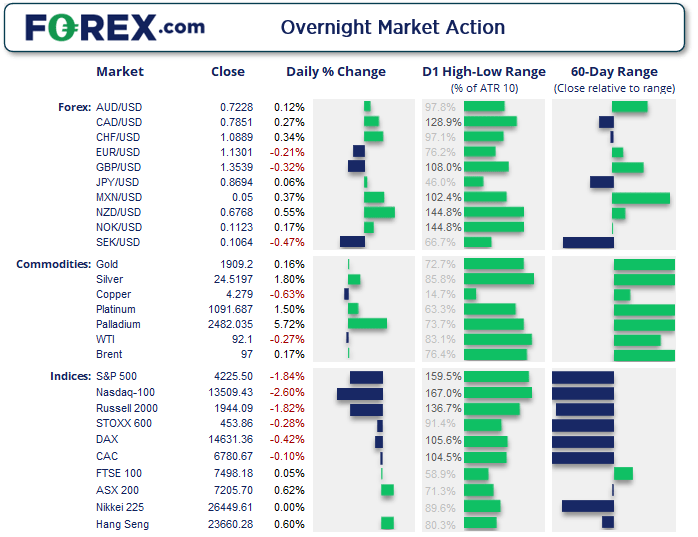

- The Dow Jones Industrial fell -464.85 points (-1.38%) to close at 33,131.76

- The S&P 500 index fell -79.26 points (-1.85%) to close at 4,225.50

- The Nasdaq 100 index fell -361.095 points (-2.6%) to close at 13,509.43

Asian futures:

- Australia's ASX 200 futures are down 0 points (-1.1%), the cash market is currently estimated to open at 7,205.70

- Japan's Nikkei 225 futures are up 220 points (0.83%), the cash market is currently estimated to open at 26,669.61

- Hong Kong's Hang Seng futures are down -276 points (-1.17%), the cash market is currently estimated to open at 23,384.28

- China's A50 Index futures are down -90 points (-0.6%), the cash market is currently estimated to open at 14,822.12

Wall Street’s sell-off intensified with a sea of red hitting trader’s screens and selling into the close. The S&P 500 fell to its lowest level since June and closed at the low of the day. The Dow Jones entered a technical correction by closing -10% below its record high. Perhaps unsurprisingly, Asian futures point lower which points to a weak open for the ASX.

ASX 200:

The ASX 200 has done well to hold up this week, but it’s not excelling neither. Its modest gain scraped a close above 7200 but is likely to face further headwinds today with Wall Street trading and ASX futures pointing lower. And whilst the technology sector enjoyed its best day in 9 with a 2% rally, they may be old hat again today with the Nasdaq plunging to a 9-month low. If financials, materials and healthcare sectors continue hold up (which account for around 60% of the index) then there’ll be no Armageddon on the ASX. But investors would be wise to remain nimble and keep expectations for a sustainable rally in check.

Read our ASX 200 trading guideThis image will only appear on cityindex websites!

ASX 200: 7205.7 (0.62%), 23 February 2022

- Information Technology (2.17%) was the strongest sector and Utilities (-0.7%) was the weakest

- 9 out of the 11 sectors closed higher

- 2 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 137 (68.50%) stocks advanced, 51 (25.50%) stocks declined

Outperformers:

- +13.93% - PEXA Group Ltd (PXA.AX)

- +9.09% - Paladin Energy Ltd (PDN.AX)

- +9.03% - AVZ Minerals Ltd (AVZ.AX)

Underperformers:

- -14.02% - Domino's Pizza Enterprises Ltd (DMP.AX)

- -5.29% - Zimplats Holdings Ltd (ZIM.AX)

- -5.23% - JB Hi-Fi Ltd (JBH.AX)

NZD and RUB is where the action is

The Russian rouble came back under attack and fell to its lowest level in 23-months. With sanctions hitting Russia left right and centre, investors are really questioning if they want their money parked in the country and which, if any, stocks they want to be holding. USD/RUB rose to a high of 81.80 before pulling back to 81.04.

As for FX majors, NZD retained its top spot after yesterday’s hawkish hike from RBNZ. The Australian dollar has had a great run but it has (or is close to) hitting resistance against CAD, CHF, EUR and JPY. Capex data is out at 11:30 AEDT, although it is debatable as to how much of a market mover it will be.

The yen has lost its safe-haven appeal as the rout appears confined to equities and the Russian rouble. We’re keeping an eye on a potential long for USD/JPY as its trying to carve out a low around 114.50. Support has been found near the 61.8% Fibonacci level and 50-day eMA and a bullish engulfing formed. Our bias is bullish above the 114.50 low although tighter risk-management could be considered using the 114.70 low or 50-day eMA. A break above Tuesday’s high assumes bullish continuation and brings 115.50 into focus for bulls, ahead of 116.0.

Gold: Smudged, but not scratched

Gold continues to meander around $1900. We thought it was beginning to lose its shine this time yesterday, but it now looks like more of a smudge. There’s no compelling reason to short it with geopolitical tensions lurking in the corner, but some investors are likely avoiding buying at these levels after a 7.5% rally into resistance, without a fresh catalyst to drive it above the 1916 – 1920 region.

Oil slides sideways

Oil doesn’t quite know that to do with itself. It’s closed around 91.90 these past two days with failed attempts to hold onto intraday rallies and selloffs. Like gold it’s had a great run but, until momentum tips its hand, it’s a pass for us over the near-term.

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.