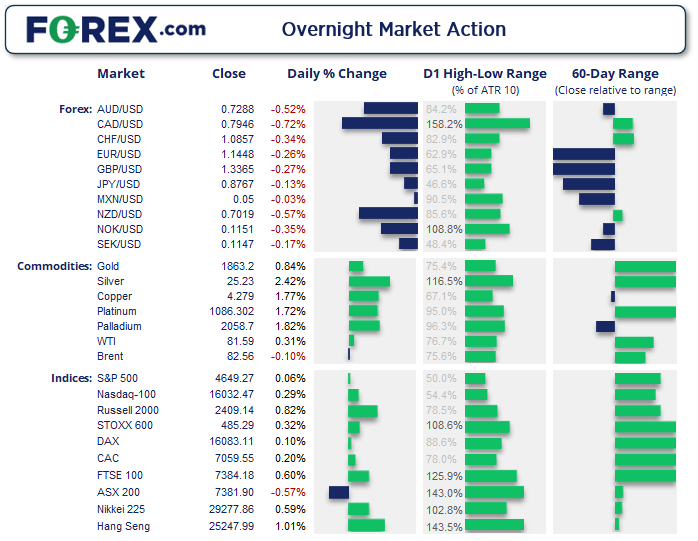

Asian Futures:

- Australia's ASX 200 futures are up 32 points (0.43%), the cash market is currently estimated to open at 7,413.90

- Japan's Nikkei 225 futures are up 110 points (0.38%), the cash market is currently estimated to open at 29,387.86

- Hong Kong's Hang Seng futures are up 219 points (0.87%), the cash market is currently estimated to open at 25,466.99

- China's A50 Index futures are up 79 points (0.5%), the cash market is currently estimated to open at 15,758.04

UK and Europe:

- UK's FTSE 100 index rose 44.03 points (0.6%) to close at 7,384.18

- Europe'sEuro STOXX 50 index rose 9.18 points (0.21%) to close at 4,358.00

- Germany's DAX index rose 15.28 points (0.1%) to close at 16,083.11

- France's CAC 40 index rose 14.39 points (0.2%) to close at 7,059.55

Thursday US Close:

- The Dow Jones Industrial fell -158.71 points (-0.44%) to close at 35,921.23

- The S&P 500 index rose 2.56 points (0.06%) to close at 4,649.27

- The Nasdaq 100 index rose 46.901 points (0.29%) to close at 16,032.47

Indices:

Wall Street recouped a slither of Wednesday’s inflation-induced sell-off, with the S&P 500 rising just 0.06% although the Nasdaq posted a slightly more impressive 0.3% gain. The VIX (volatility index) fell back below 18 and within its 18-bar range prior to Wednesday’s breakout.

The Nikkei 200 has nearly closed its post-election gap. A bullish engulfing candle formed just above 29k, making it a pivotal level to monitor today and perhaps next week if it can last the weekend.

The ASX 200 closed below 7400 and filled the liquidity gap below 7382, before mean reverting and closing one point above that level. Once again, 7400 – 7411 remains a pivotal zone for intraday traders.

ASX 200 Market Internals:

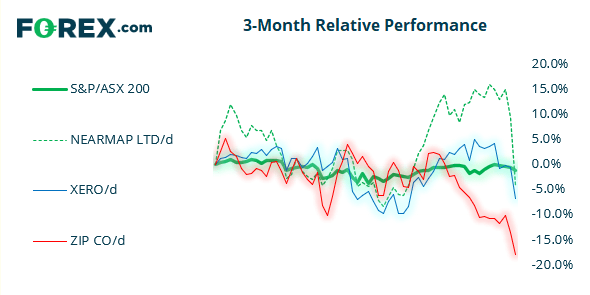

ASX 200: 7381.9 (-0.57%), 11 November 2021

- Materials (2.27%) was the strongest sector and Information Technology (-2.54%) was the weakest

- 2 out of the 11 sectors closed higher

- 9 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 57 (28.50%) stocks advanced, 139 (69.50%) stocks declined

- 63% of stocks closed above their 200-day average

- 51.5% of stocks closed above their 50-day average

- 43.5% of stocks closed above their 20-day average

Outperformers:

- + 9.64%-Chalice Mining Ltd(CHN.AX)

- + 8.19%-Fortescue Metals Group Ltd(FMG.AX)

- + 6.47%-Regis Resources Ltd(RRL.AX)

Underperformers:

- -12.33%-Nearmap Ltd(NEA.AX)

- -6.22%-Xero Ltd(XRO.AX)

- -5.16%-Zip Co Ltd(Z1P.AX)

Forex:

USD retained its dominance to see the US dollar index (DXY) rise another 0.33% to a 16-month high and trade above 95 for the first time since July 2020. USD/CAD was the best performer and broke firmly above 1.25 to trigger our bullish bias and stopped just shy of 1.26. The bias remains bullish above 1.25 with next target around the 1.2648 high, with 1.255 and 1.2520 making viable intraday support levels.

The Bank of Mexico raises interest rates for a fourth consecutive meeting by 25 bps, taking their base rate to 5%. Members voted 4-1 in favour of the hike and in response to inflation which has risen to 6.24% y/y as of October. The bank has a target at 3% and are expected to increase two more times until they reach 6%. USD/MXN rose 1% to a 6-day high of 20.7.

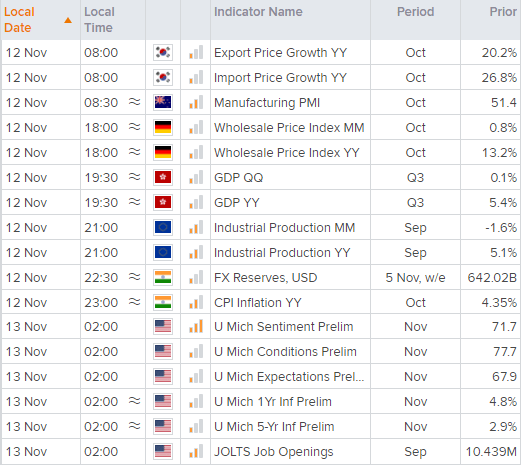

South Korean export prices rose at their fastest rate since 2008. This is yet another data set which points towards transitory inflation not being as transitory as some would like. And with South Korean data being a bellwether for global growth, this simply piles on the pressure for importers – so we doubt the ‘prices paid’ component of Wester PMI’s will be dropping any time soon.

Commodities:

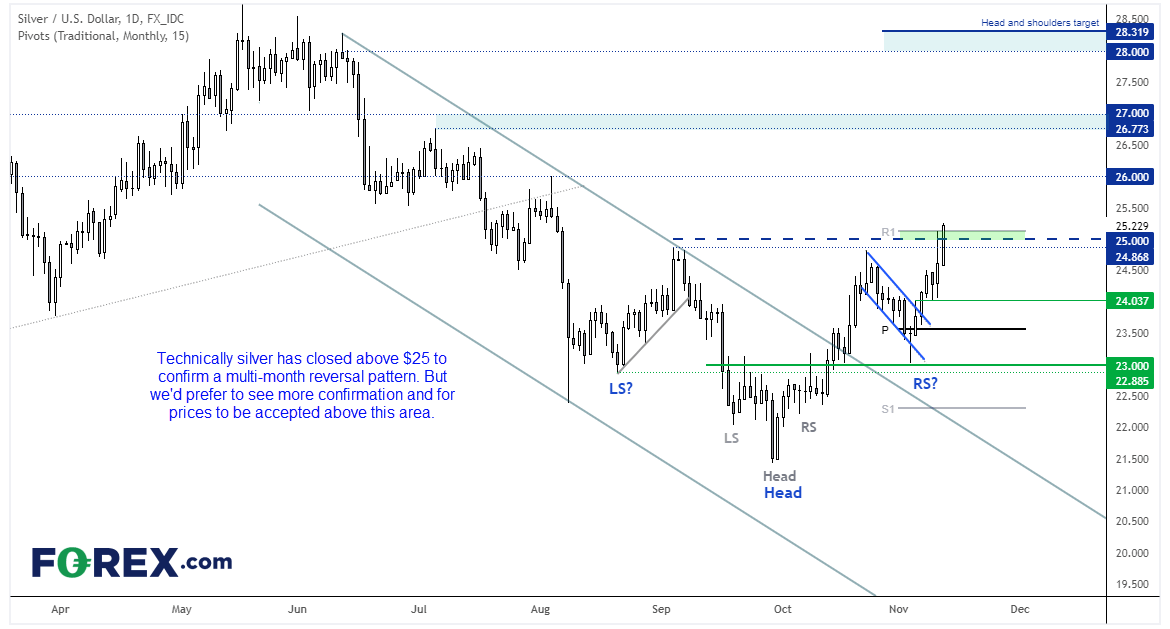

Silver closed above $25 for the firt time since August. Technically this now confirms the inverted head and shoulders reversal pattern which projects a target above $28. But, given it is a multi-month pattern, patience can be utilised. And we’d need to see more than a 23c breakout to be sure the longer-term reversal is in play. One to watch regardless.

Gold remains buoyant and printed and bullish inside day just below Wednesday’s high. 1870.50 is the next level for bulls to conquer, although whether it can manage it ahead of the weekend remains to be seen.

Choppy trade on oil saw WTI make a dash for, yet not quite reach, $80. Still, prices remains below our intraday 82.60 resistance zone, even if it did close flat for the session.

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.