UK and Europe:

- UK's FTSE 100 index fell -29.29 points (-0.39%) to close at 7484.33

- Europe's Euro STOXX 50 index fell -88.57 points (-2.17%) to close at 3985.71

- Germany's DAX index fell -311.39 points (-2.07%) to close at 14731.12

- France's CAC 40 index fell -141.29 points (-2.04%) to close at 6788.34

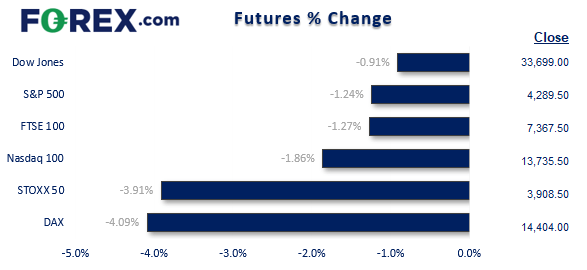

US Futures:

- S&P 500 E-minis are index down -54 points (-1.24%)

- Nasdaq 100 E-minis are index down -260.5 points (-1.86%)

- Dow Jones E-minis are index down -308 points (-0.91%)

Asian Futures:

- Australia’s ASX 200 futures fell -72 points (-1.006%), the cash market is currently estimated to open at 7161.6

- Japan's Nikkei 225 futures are down -420 points (-1.56%), the cash market is currently estimated to open at 26490.87

- Hong Kong's Hang Seng futures are down -206 points (-0.85%), the cash market is currently estimated to open at 23964.07

The Kremlin announced Putin’s plans to sign a decree which will recognise two breakaway regions in Ukraine. Given this could be a taken as a pretext for Russia to invade, and the Biden-Putin summit hinged up an invasion not occurring, this more than likely irks world leaders and goads Biden to withdraw from the summit. And we also have further ‘claims’ from Russia that Ukrainian rebels have tried to enter Russia in armed vehicles. In short, a summit looks like a long shot, to say the least. Classic risk-off moves ensued which saw US futures fall alongside bond yields as investors moved into the safety of bonds, gold and the Swiss franc.

CHF was the strongest major currency, even outperforming then yen. The Russian ruble failed to see a bright side with the prospects of sanctions hitting Russia should they annexe the Ukraine. The ruble fell around -3% against the US dollar during a 2-standard deviation day, which is only the second time that has happened since March 2020.

EUR/JPY rolled over from 130.70 resistance and remained within its bearish channel. It found support at the monthly pivot point and 200-day eMA which is likely to hold as support unless Russia-Ukraine tensions continue to escalate.

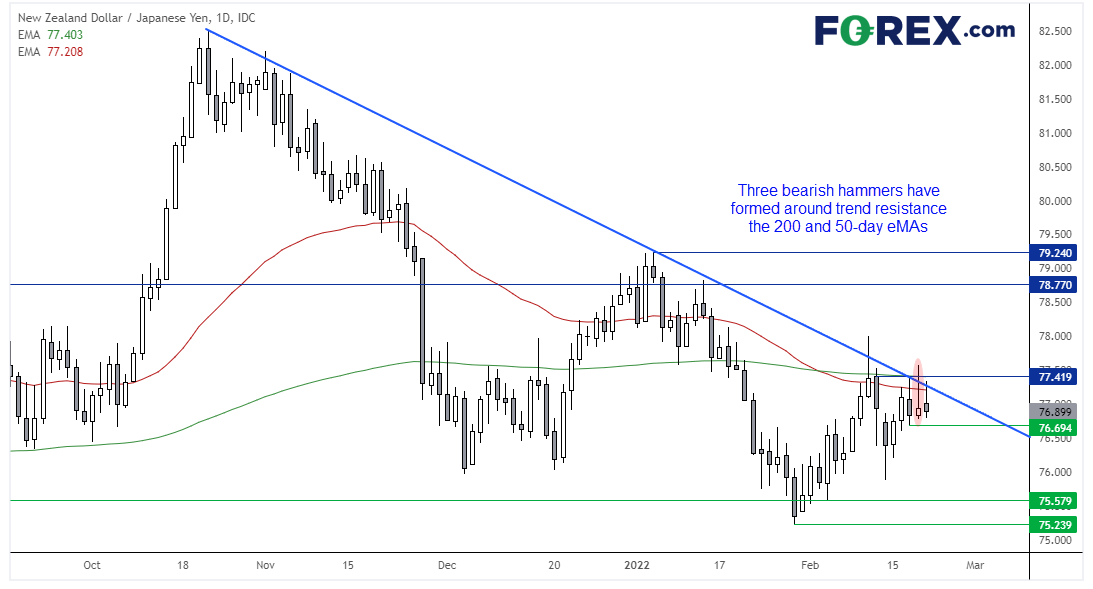

Another yen pair we are tracking closely is NZD/JPY. We can see on the daily chart that three bearish hammers have formed around trend resistance, the 200-day eMA and 50-day eMA. A break below 76.94 confirms the reversal candles and such and brings 76.0 and 75.58 into focus for bears.

Everything you should know about the Japanese yen

Gold and oil rose with tensions

WTI rose on the fumes of war and wasted no time reclaiming the $90 handle. Energy stocks are likely to benefit today in Asia, as will gold miners now gold closed above 1900 for the first time since June. Gold is less than a day’s trade away from the June 2021 high, and Putin seems to be doing all he can to make sure that level is tested – if not broken as soon as possible.

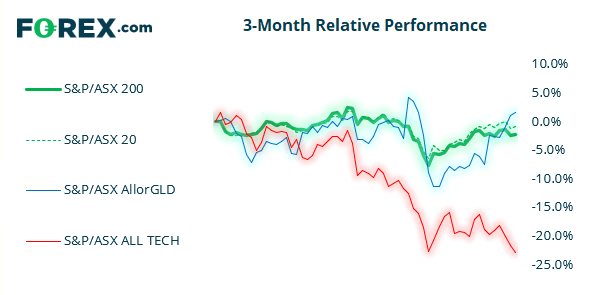

ASX 200: Best of a bad bunch?

We suspect the ASX 200 will remain in its choppy range between 7150 – 7300 for the foreseeable future. It was the only major benchmark to close (marginally) higher last week despite turbulence from Russia, as the financials and materials sectors continue to prop up the broader market. Of course, we expect a bad start today with futures markets pointing lower. But with the financials sector looking ripe for a bullish breakout (which accounts for over a quarter of the index) then we’d do well to remember Australia’s stock market is not the best proxy for sentiment over in the Ukraine right now.ASX 200:

ASX 200: 7233.6 (0.16%), 18 February 2022

- Materials (0.16%) was the strongest sector and Utilities (3.71%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 93 (46.50%) stocks advanced, 94 (47.00%) stocks declined

Outperformers:

- +11.13% - A2 Milk Company Ltd (A2M.AX)

- +10.61% - AGL Energy Ltd (AGL.AX)

- +10.29% - Endeavour Group Ltd (EDV.AX)

Underperformers:

- -9.49% - Super Retail Group Ltd (SUL.AX)

- -7.78% - Zip Co Ltd (Z1P.AX)

- -6.67% - Imugene Ltd (IMU.AX)

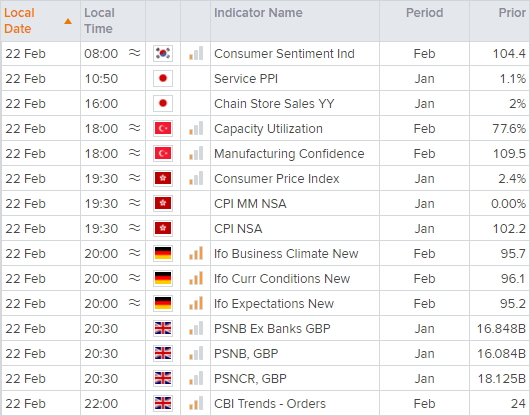

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.