Asian Futures:

- Australia’s ASX 200 futures are down 0 points (0%), the cash market is currently estimated to open at 7,415.50

- Japan's Nikkei 225 futures are down -180 points (-0.62%), the cash market is currently estimated to open at 28,624.85

- Hong Kong's Hang Seng futures are down -102 points (-0.39%), the cash market is currently estimated to open at 26,024.93

- China's A50 Index futures are down -48 points (-0.3%), the cash market is currently estimated to open at 16,141.35

European Friday close:

- UK's FTSE 100 index rose 14.25 points (0.2%) to close at 7,204.55

- Europe's Euro STOXX 50 index rose 33.08 points (0.8%) to close at 4,188.81

- Germany's DAX index rose 70.42 points (0.46%) to close at 15,542.98

- France's CAC 40 index rose 47.52 points (0.71%) to close at 6,733.69

US Friday close:

- The Dow Jones rose 73.92 points (0.21%) to close at 35,677.02

- The S&P 500 fell -4.88 points (-0.11%) to close at 4,544.90

- The Nasdaq 100 fell -134.525 points (-0.87%) to close at 15,355.07

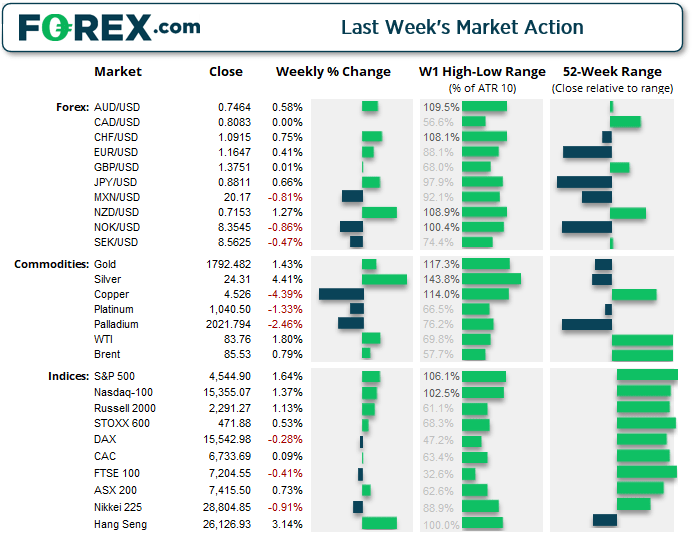

Indices:

Speaking at a virtual event on Friday, Jerome Powell said "I do think it's time to taper; I don't think it's time to raise rates”, pointing to weakness at the labour market (which still has 5 million fewer jobs than before the pandemic). Rates will remain near-zero until employment has been replenished, and it’s “very possible” that could be achieved next year.

The S&P 500 hit an intraday record high although fell to a 2-day low after the comments, before closing the day flat with a Rikshaw Man Doji. The E-mini futures contract found resistance at its record high and formed a bearish engulfing candle on the four-hour chart. Furthermore, a bearish engulfing candle formed the US 10-year treasury yield daily chart.

The ASX 200 is holding above trend support on the daily chart and spent the last 3 days of last week closing around the similar price of 7415. We’re now looking for an upside break from its current period of consolidation.

The Hang Seng trades in a similar pattern, with 3 days of consolidation potentially building a base above 25,800 gap support. Next resistance is the 26,500 high and 200-day eMA within the 26,700 – 27,860 resistance zone.

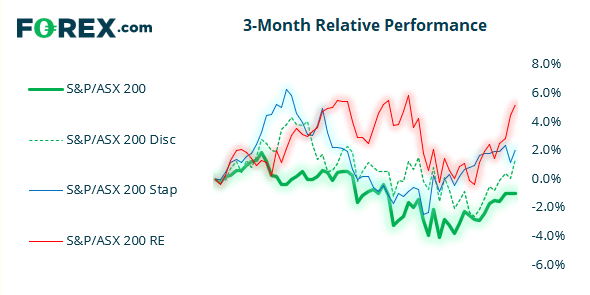

ASX 200 Market Internals

ASX 200: 7415.5 (0.00%), 24 October 2021

- Consumer Discretionary (1.35%) was the strongest sector and Energy (-2.08%) was the weakest

- 6 out of the 11 sectors closed higher

- 105 (52.50%) stocks advanced, 80 (40.00%) stocks declined

- 67% of stocks closed above their 200-day average

- 61.5% of stocks closed above their 50-day average

- 67.5% of stocks closed above their 20-day average

Outperformers:

- + 4.00%-Healius Ltd(HLS.AX)

- + 3.17%-Wesfarmers Ltd(WES.AX)

- + 2.93%-Auckland International Airport Ltd(AIA.AX)

Underperformers:

- -8.06%-Lynas Rare Earths Ltd(LYC.AX)

- -6.17%-Aurizon Holdings Ltd(AZJ.AX)

- -4.02%-Mineral Resources Ltd(MIN.AX)

Forex: Eyes on the Turkish Lira after President Erdogan strikes again

The US dollar index (DXY) closed lower for a third week, although it’s trying to build a base above the March high near 93.50. A break above Frida’s high also clears the 20-day eMA and suggest a corrective bonce is underway.

NZD/CAD formed a bullish pinbar on the daily chart, after a wo-day pullback. We’re looking for prices to now hold above 0.8790 and move higher in line with its rally from this month’s low. AUD/CAD is trying to build a base above 0.9200 following its bullish breakout of an inverted head and shoulders pattern last week.

The Turkish Lira continued to plummet last week after their Central bank cut interest rates by 200 bps. And it is expected to weaken further following reports that President Erdogan had ordered the expulsion of 10 Western diplomats (including US and NZ) as they had signed a joint declaration demanding the release of political prisoner Osman Kavala. USD/TRY is currently up 0.05% and probing last week’s record high.

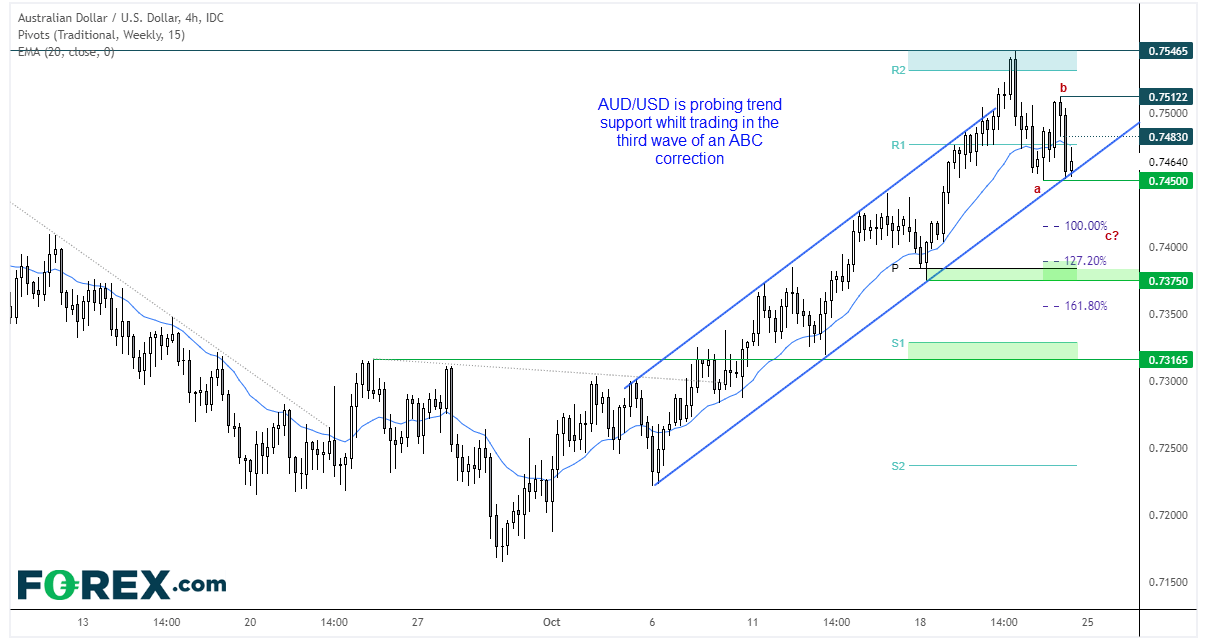

AUD/USD is probing trend support following a volatile shakeout below 0.7550. Prices are in wave 3 of an ABC correction which could potentially fall to 0.7415 if ‘wave equality’ occurs (where the length of wave A = B), or somewhere around the monthly Pivot point should its decline extend.

Given the strength of the bearish candle on Friday then perhaps monthly R1 can cap as resistance before a break beneath 0.7450 hints at its next leg lower.

The economic calendar is practically, non-existent for today’s Asian session, and New Zealand exchanges are closed due to a public holiday.

Commodities:

Gold spiked above 1800 and reached a high of 1.8% on Friday, yet gains were short-lived following Powell’s comments and it closed at 1792 to formed a bearish pinbar on the daily chart. We remain neutral on the yellow metal and await the market to tip its hand.

Silver suffered a similar fate after its spike found resistance at the September high, yet its bullish structure on the daily chart remains the more convincing of the two metals.

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.