Asian Futures:

- Australia's ASX 200 futures are down -22 points (-0.3%), the cash market is currently estimated to open at 7,342.80

- Japan's Nikkei 225 futures are up 240 points (0.84%), the cash market is currently estimated to open at 28,802.21

- Hong Kong's Hang Seng futures are up 98 points (0.42%), the cash market is currently estimated to open at 23,200.33

- China's A50 Index futures are up 66 points (0.42%), the cash market is currently estimated to open at 15,830.23

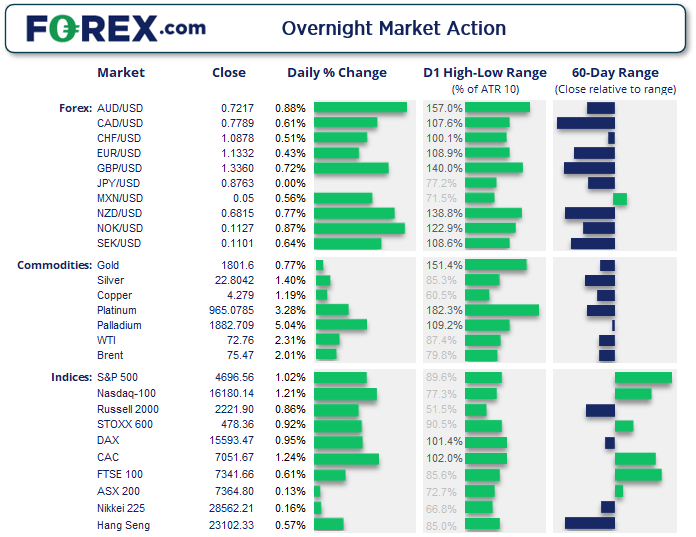

UK and Europe:

- UK's FTSE 100 index rose 44.25 points (0.61%) to close at 7,341.66

- Europe's Euro STOXX 50 index rose 42.07 points (1.01%) to close at 4,217.06

- Germany's DAX index rose 146.03 points (0.95%) to close at 15,593.47

- France's CAC 40 index rose 86.68 points (1.24%) to close at 7,051.67

Wednesday US Close:

- The Dow Jones Industrial rose 261.19 points (0.74%) to close at 35,753.89

- The S&P 500 index rose 47.33 points (1.02%) to close at 4,696.56

- The Nasdaq 100 index rose 193.86 points (1.21%) to close at 16,180.14

All major US benchmarks posted gains by the close with the Nasdaq 100 leading with a 1.2% (or 2.4% week to date). The S&P 500 rose 1% and the Dow was up 0.7%. Biotech stocks bucked the trend with a -0.37% decline but, overall, it was a day of green for Wall Street on the last full day of trading ahead of the Christmas break.

Antipodean currencies lead the pack higher

AUD and NZD were the strongest majors overnight and both rose around 0.8% against the US dollar. JPY was the only major to close lower against the dollar, and by a mere -0.1% and even GBP managed to rise 0.75% by the close. And that was despite GDP being revised lower in Q3 and the UK potentially heading into a fourth lockdown after Christmas.

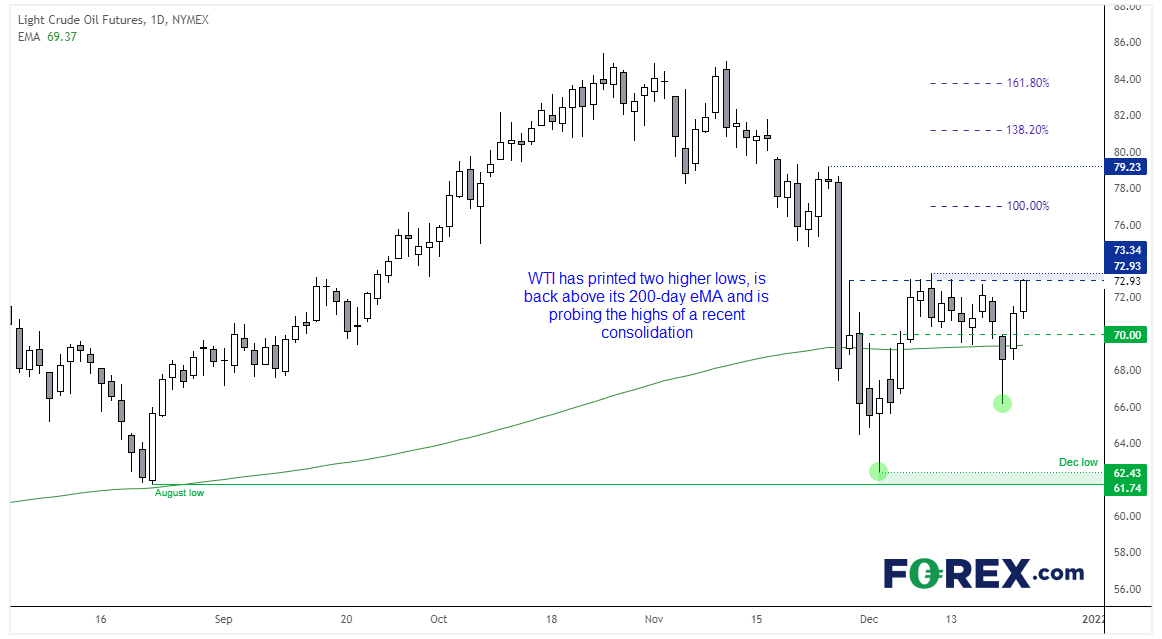

WTI set to breakout?

Crude oil inventories were lower than expected yesterday, allowing oil prices to rally for a second consecutive day. Whilst the threat of Omicron should remain at the back of our minds, some signs of optimism are appearing in some headlines and, as markets are forward looking, there’s a tone of optimism of oil pricing.

WTI rallied to a 7day high and closed above its 200-day eMA for a second consecutive day. Given the strength of momentum these past 48-hours, it increases the odds that 62.43 was an important structural low and we could be heading back into a bullish trend on the daily chart. Still, if we assume this is part of a 3-wave countertrend move then wave equality land around $77.0, and a break above 73.0 could be used to confirm a breakout.

How to start oil trading

Metals rally into the close

Gold broke its 3-day losing streak to form a swing low around the mid-way point of last Thursday’s bullish candle, as part of a classic pullback / swing trade. Silver closed to a 3-week high in line with our bullish bias outlined in this week’s silver video. After falling -16% from November’s high and failing to break the September low, the odds were stacked towards such a corrective bounce in our view.

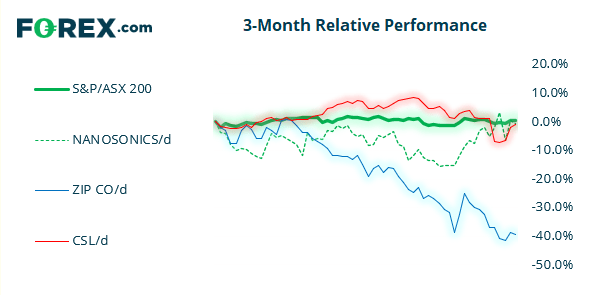

ASX 200 Market Internals:

ASX 200: 7364.8 (0.13%), 22 December 2021

- Information Technology (2.6%) was the strongest sector and Real Estate (-0.99%) was the weakest

- 7 out of the 11 sectors closed higher

- 6 out of the 11 sectors outperformed the index

- 110 (54.73%) stocks advanced, 83 (41.29%) stocks declined

- 60.7% of stocks closed above their 200-day average

- 47.26% of stocks closed above their 50-day average

- 59.7% of stocks closed above their 20-day average

Outperformers:

- + 5.41% - Pilbara Minerals Ltd (PLS.AX)

- + 4.84% - Afterpay Ltd (APT.AX)

- + 4.04% - Polynovo Ltd (PNV.AX)

Underperformers:

- - 37.0% - Charter Hall Group (CHC.AX)

- - 7.54% - Ansell Ltd (ANN.AX)

- - 3.65% - Brickworks Ltd (BKW.AX)

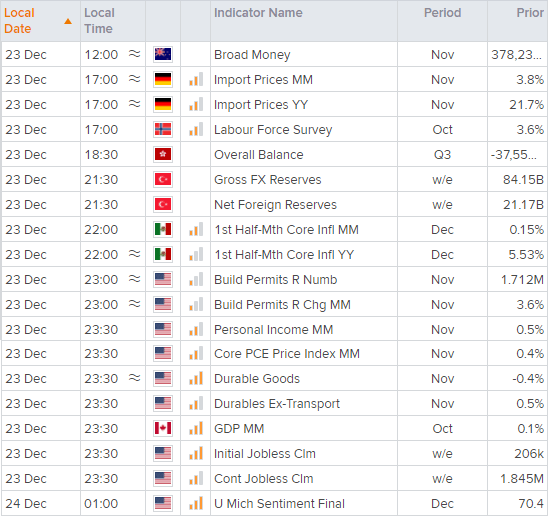

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.