Asian Futures:

- Australia’s ASX 200 futures are down -45 points (-0.608%), the cash market is currently estimated to open at 7,351.50

- Japan's Nikkei 225 futures are down -170 points (-0.57%), the cash market is currently estimated to open at 29,575.87

- Hong Kong's Hang Seng futures are down -97 points (-0.39%), the cash market is currently estimated to open at 24,952.97

- China's A50 Index futures are down -22 points (-0.14%), the cash market is currently estimated to open at 15,598.39

European Friday close:

- UK's FTSE 100 index fell -32.39 points (-0.45%) to close at 7223.57

- Europe's Euro STOXX 50 index fell -27.23 points (-0.62%) to close at 4356.47

- Germany's DAX index fell -61.76 points (-0.38%) to close at 16159.97

- France's CAC 40 index fell -29.69 points (-0.42%) to close at 7112.29

US Friday close:

- The Dow Jones fell -268.92 points (-0.75%) to close at 35,601.98

- The S&P 500 fell -6.58 points (-0.14%) to close at 4,697.96

- The Nasdaq 100 rose 90.369 points (0.55%) to close at 16,573.34

US indices diverge

A quick look at the benchmark indices for industrial, technology stocks and the broader barometer of large caps (S&P 500) shows that they’re all pointing different direction. The Nasdaq 100 hit a record high last week, the S&P 500 rose for the week yet staled below its previous record high whilst the Dow Jones fell.

No sign of a Fed chair announcement yet

China are expected to keep their one-year loan prime rate (LPR) at 3.85% for a nineteenth month today at 12:30 AEDT. Biden’s teased markets last Tuesday that he would announce his nomination for the Fed Chair “in about four days” on Tuesday. Six days later we are yet to find out, although a Whitehouse spokesman has now said the decision will be made by thanksgiving, on Thursday.

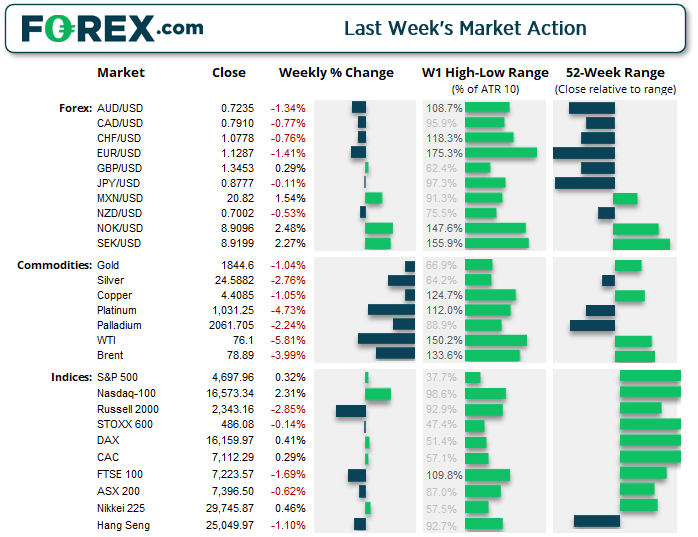

GBP was the strongest major, EUR and AUD were the weakest

The British pound was the strongest currency last week, thanks to strong inflation data, decent employment figures and a growing expectation of a hike at BOE’s next meeting. The US dollar and Japanese yen were hot on its heels, whilst the euro Australian dollar were the weakest major pairs.

AUD/USD closed below trend support from the 2021 low. Whilst prices remain below 0.7300 then the bias is for a move to the 0.7117 low.

AUD/JPY came within pips of re-testing the September high in line with our bearish bias. A bearish engulfing candle formed on Friday in line with its trend although we suspect there could be a period of consolidation or pullback from Friday’s low before the key support level breaks down.

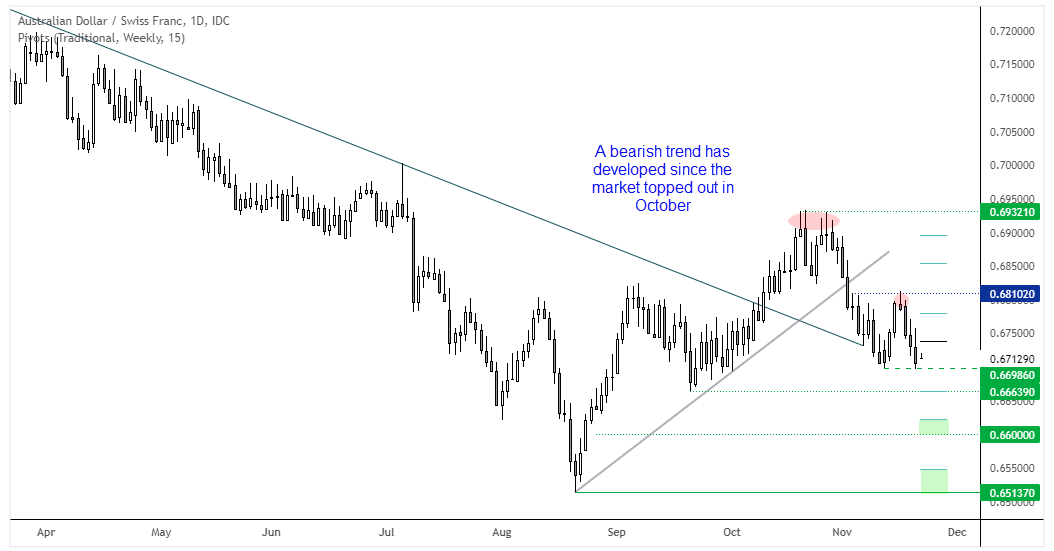

AUD/CHF probed its November low on Friday and its trend suggests there could be further downside. The market topped out in October and saw a firm close below trend support, and a break of Friday’s low assumes bearish continuation. The first support level (and potential target) is the 0.6664 low by the weekly S1 pivot, then the support zone around 0.6600.

Metals pullback

Momentum for gold and silver is turning lower after their break to new highs stalled at key resistance levels. Yet the moves do not look particularly bearish so are suspected to be corrective in nature at present. Or silver we’ll look for prices to hold above the September trendline or the 24.07 area, with the first support level for gold sitting around 1834 where the July, August and September highs reside.

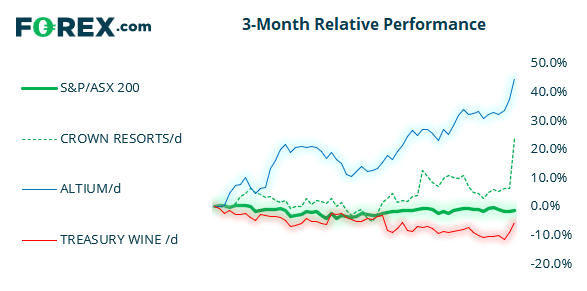

ASX 200: Will it, won’t it?

We saw two failed attempts to break the September trend support last week, yet its rebound lacked conviction and prices remained below 7400. Unless we see a strong rally soon, the two-day pullback from last week’s lows suggests bears retain control so we are on guard for another leg lower.

ASX 200: 7396.5 (0.23%), 20 November 2021

- Healthcare (0.9%) was the strongest sector and Industrials (-0.61%) was the weakest

- 6 out of the 11 sectors closed higher

- 5 out of the 11 sectors outperformed the index

- 105 (52.50%) stocks advanced, 88 (44.00%) stocks declined

- 64% of stocks closed above their 200-day average

- 58% of stocks closed above their 50-day average

- 54% of stocks closed above their 20-day average

Outperformers:

- + 16.57%-Crown Resorts Ltd(CWN.AX)

- + 5.16%-Altium Ltd(ALU.AX)

- + 4.07%-Treasury Wine Estates Ltd(TWE.AX)

Underperformers:

- -4.92%-Nanosonics Ltd(NAN.AX)

- -3.91%-ALS Ltd(ALQ.AX)

- -3.8%-Orocobre Ltd(ORE.AX)

Up Next (Times in AEST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.