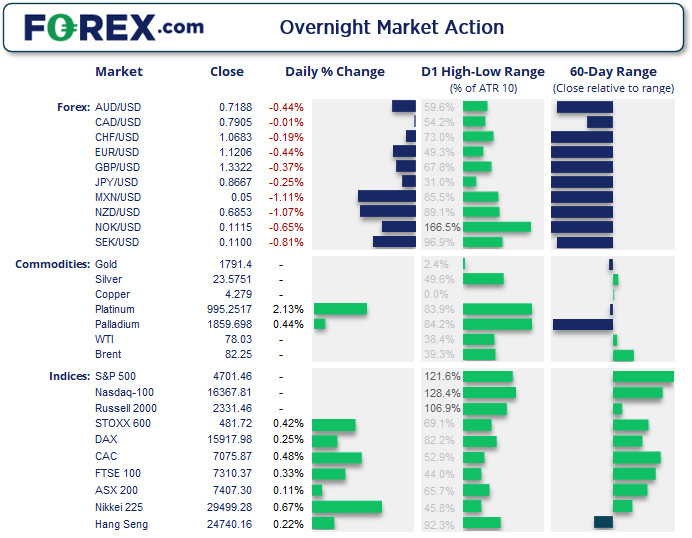

Asian Futures:

- Australia’s ASX 200 futures rose 4 points (0.054%), the cash market is currently estimated to open at 7411.3

- Japan's Nikkei 225 futures are down -10 points (-0.03%), the cash market is currently estimated to open at 29489.28

- Hong Kong's Hang Seng futures are down -74 points (-0.3%), the cash market is currently estimated to open at 24666.16

European Friday close:

- UK's FTSE 100 index rose 24.05 points (0.33%) to close at 7310.37

- Europe's Euro STOXX 50 index rose 16.99 points (0.4%) to close at 4293.24

- Germany's DAX index rose 39.59 points (0.25%) to close at 15917.98

- France's CAC 40 index rose 33.64 points (0.48%) to close at 7075.87

US Futures:

- S&P 500 E-minis are index up 6.5 points (0.14%)

- Nasdaq 100 E-minis are index up 38.5 points (0.24%)

- Dow Jones E-minis are index up 32 points (0.09%)

A test of 29k for Nikkei seems feasible whilst 30k caps gains

The Nikkei 225 stabilised yesterday after a seemingly unexplained drop on Wednesday, which also broken the October trend support line. The index had struggle to test 30k following the elections and the election gap has now been closed so we see the potential for 29k support to be tested without a fresh bullish catalyst.

Europe to vaccinate children

Facing a fresh wave of new COVID-19 cases, booster shots are being rolled out across Europe with plans to vaccinate children also being discussed. Around a million new infections are being reported every 48 hours and concerns remain that at least some counties will follow Austria’s decision for a sudden lockdown.

European bourses have stabilised since falling from the November highs, although we still suspect a bounce is due. The DAX is likely to find resistance around 16k, so we prefer the STOXX 50 for potential longs over the near-term whilst prices hold above Wednesday’s low.NZD remains the weakest major post-RBNZ

NZD was the weakest currency again, as traders continued to unwind positions as they expected a more aggressive hike path than the one presented at RBNZ’s meeting this week.

NZD/USD probed the September low and yesterday after its high met resistance at the broken trendline from the September low. AUD/NZD reached 1.0500 after Wednesday’s trendline break, with next targets being 1.0540 and the highs around 1.0600. But we suspect prices may pause for breath or retrace, so would consider dips above the 1.0400 – 1.0433 zone.

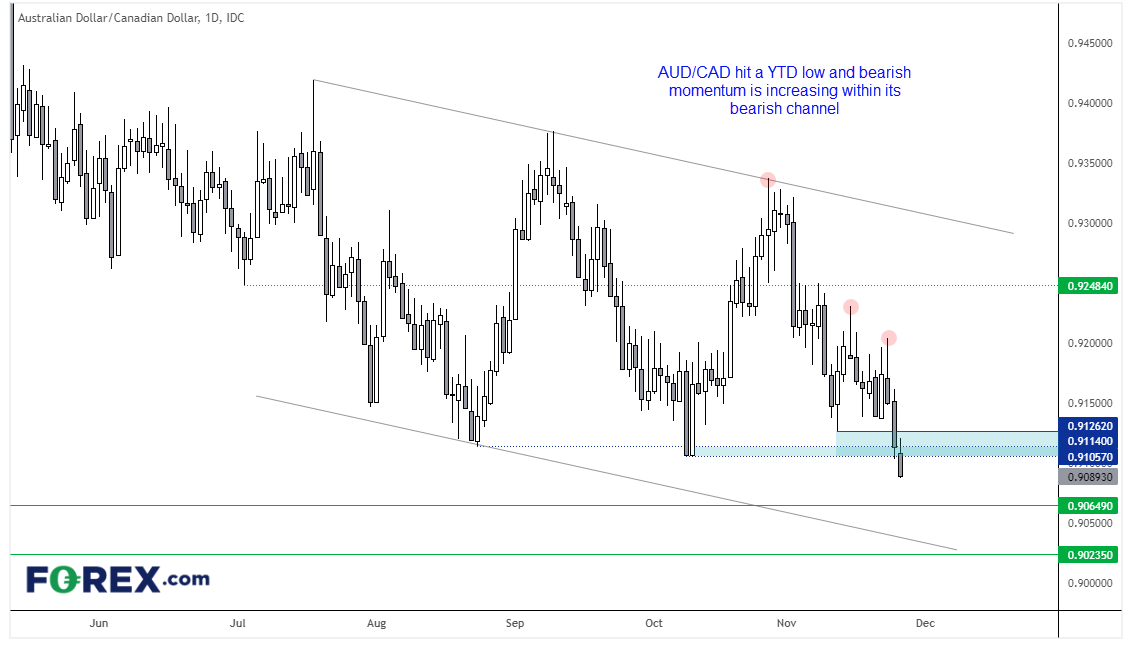

AUD/CAD fell to a YTD low

To be more specific, AUD/CAD fell to its lowest level since May 2020. Whilst BOC have walked back some of their earlier hawkish comments, they still remain the more hawkish central bank compared with RBA. Combined with the higher base rate it is applying downside pressure on the AUD/CAD cross.

AUD/CAD trades within a downwards channel, and recent lower highs shows us that bearish momentum is increasing within that channel. Furthermore, it closed beneath two key swing lows and last night’s high respected the resistance zone. Our bias remains bearish below 0.9126 with immediate support at 0.9064 being a likely target, and the lower trend channel or 0.9023 support level be used assuming prices continue lower.

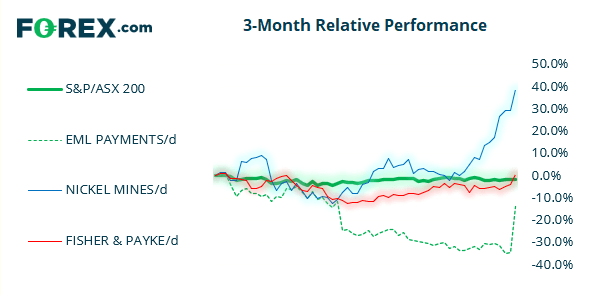

ASX 200 Market Internals:

US futures were higher overnight and cash markets closed higher ahead of Thanksgiving. So perhaps the ASX can take a positive lead form this. But whilst prices continue to chop around 7400 it is difficult to become attached to a daily directional bias.

ASX 200: 7407.3 (0.11%), 25 November 2021

- Information Technology (2.4%) was the strongest sector and Financials (-0.9%) was the weakest

- 7 out of the 11 sectors closed higher

- 7 out of the 11 sectors outperformed the index

- 108 (54.00%) stocks advanced, 79 (39.50%) stocks declined

- 62% of stocks closed above their 200-day average

- 49% of stocks closed above their 50-day average

- 45% of stocks closed above their 20-day average

Outperformers:

- + 31.2% - EML Payments Ltd (EML.AX)

- + 7.2% - Nickel Mines Ltd (NIC.AX)

- + 4.6% - Fisher & Paykel Healthcare Corporation Ltd (FPH.AX)

Underperformers:

- -5.00% - AMP Ltd (AMP.AX)

- -4.28% - Kogan.com Ltd (KGN.AX)

- -3.37% - Bendigo and Adelaide Bank Ltd (BEN.AX)

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.