It appears that the PBOC couldn’t keep the Yuan down any longer and may have “let it go” to take out stops below the market. USD/CNH started the day at 6.4289, however the pair has reached lows not seen since early June near 6.3742. Will the PBOC the Yuan remain this strong, or have China’s problems finally caught up? Below are some ongoing Chinese related themes which the PBOC must consider:

Evergrande

The Evergrande saga is spilling over into the rest of the housing and property market, as other property developer firms have been downgraded by ratings agencies. Evergrande was able to make an interest payment in Yuan on Tuesday, however that alone isn’t comforting to markets. And although the PBOC said that the Evergrande fallout can be contained, China is issuing a $4 billion bond offering, which is sending China’s junk bond yields to its highest level since 2011. Watch for more nervousness over the coming week regarding a continued PBOC bailout.

Crackdowns

Making matters worse in the property markets have been the crackdowns on the property and construction sectors. However, the governments involvement lately isn’t just restricted to the property markets as cryptocurrency, gaming, technology, and education sectors have all been hit. Cryptos have been banned. Gaming and the internet have been restricted for children until certain ages. Private tutoring businesses have been placed under heavy restrictions. These restrictions may be helping increase the effects of the economic slowdown.

Economic Data

China’s Q3 data may be putting fear of a slowdown into traders of the offshore Yuan. China’s GDP for Q3 was 4.9% vs 5.2% expected and 7.9% in Q2. Industrial Production was also worse than expected for September, coming in at 3.1% vs 4.5% expected and 5.3% in August. Was this weak data an indication of a further slowdown to come in China’s economy? The one bright spot was retail sales, which was 4.4% for September vs 3.3% expected and 2.5% in August. NBS Manufacturing PMI and Non-Manufacturing PMI will have to be watched to October 31st to see if the slowdown is continuing.

Taiwan (and now Japan?)

China continues to fly military jets over Taiwan as a show of force, with over 150 aircraft flown over Taiwan on China’s National Day. The US had already sent military to Taiwan to help train forces. In addition, the US had admitted to having a military presence in Taiwan for over 1 year. And just yesterday, China and Russia had conducted joint operations by sending navel vessels through the Tsugaru Strait (international waters), which separates mainland China from its northern island, Hokkaido. One has to consider if China is trying to test the US to see if they will send more forces into the area.

China/US Relations

Way back in December 2019, President Donald Trump came to an agreement with China over a trade deal, which would be done in Phases. Thus far, they have only gotten to Phase 1, and the US has said that China has failed to hold up its end of the deal, which will initiate a further review. However, relations had already been souring between the two nations. Although many have tried, no one can determine who is to blame for the initial outbreak of the coronavirus. There are also issues of data breaches involving some Chinese firms, such as TikTok and Huawei, which have caused the US go as far as possibly kicking some firms off stock exchanges.

Trade USD/CNH now: Login or open a new account!

Energy crisis

China has been forced to restrict electricity and energy to some areas of the country, causing closures at factories as energy prices continue to soar, particularly in coal. Thermal coal futures have more than doubled since August (although they were limit down today) This only adds to the supply chain issues and inflation concerns. As a result, despite attempting to reduce its use of Coal, China is now forced to ramp up production to lower prices and keep the power on.

USD/CNH

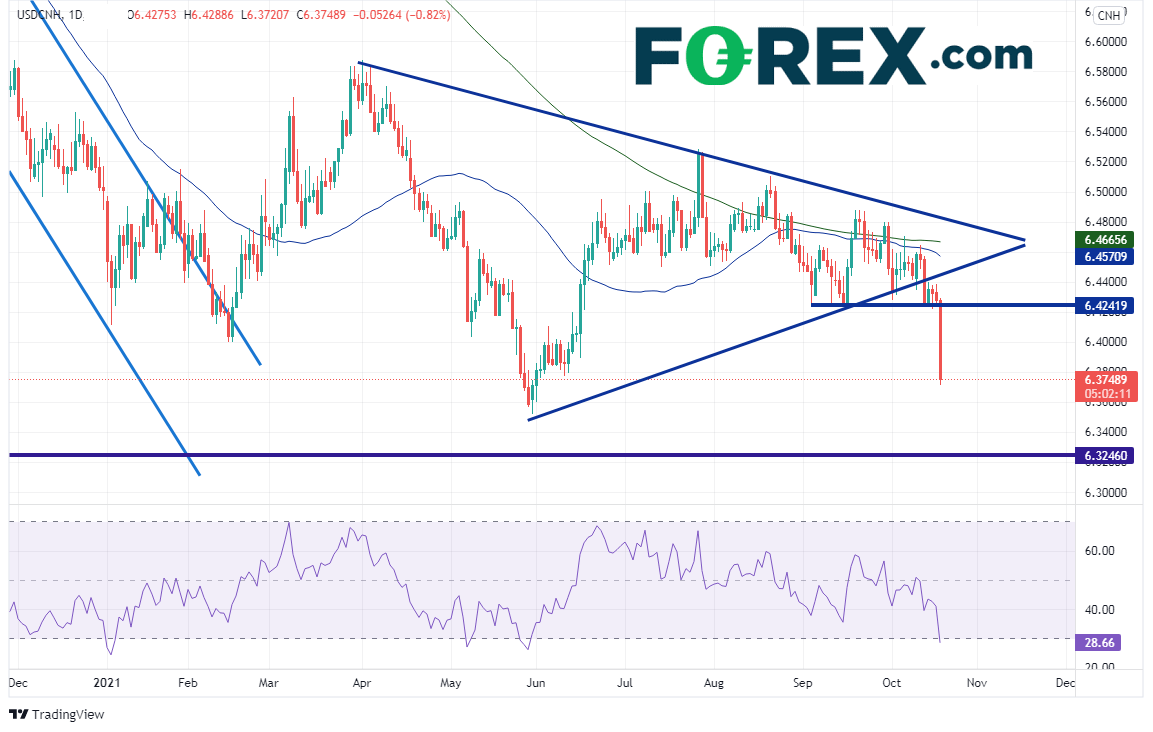

USD/CNH had been moving lower in an orderly channel since May 2020 from 7.1987 to a low of 6.4116 on January 5th, 2021, before trading sideways out of the channel. The pair formed a symmetrical triangle for all of 2021 between 6.3524 and 6.5876, before breaking lower out of the triangle on October 13th. However today, as price fell below horizontal support from within the channel near 6.4242, stops were triggered and sent the pair tumbling to a low of 6.3721!

Source: Tradingview, Stone X

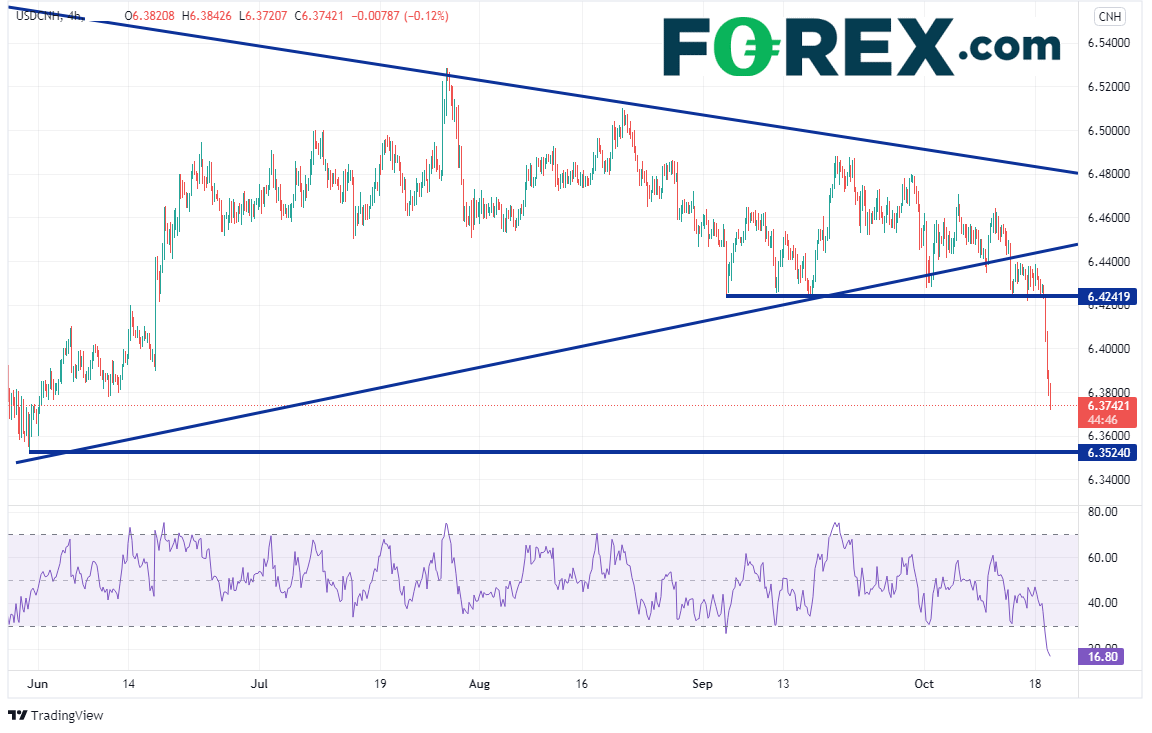

On a 240-minute chart, the dramatic fall in USD/CNH is attempting to reach the May 31st lows of 6.3524. This was the lowest the pair has been since May 2018. Notice that the RSI is below 20 at 16.80, which is extreme oversold conditions. Resistance isn’t until the breakdown level from prior support at 6.4242.

Source: Tradingview, Stone X

Some may attribute the large selloff in USD/CNH to the pullback in the US Dollar. However, the DXY has bounced nearly 50% from today’s lows, while USD/CNH is still near the lows. With all of the problems China is facing recently, has the PBOC thrown in the towel and let the Yuan appreciate (at least for today)? However, with extreme oversold conditions and near-term support (prior lows) watch for a possible bounce sooner than later!

Learn more about forex trading opportunities.