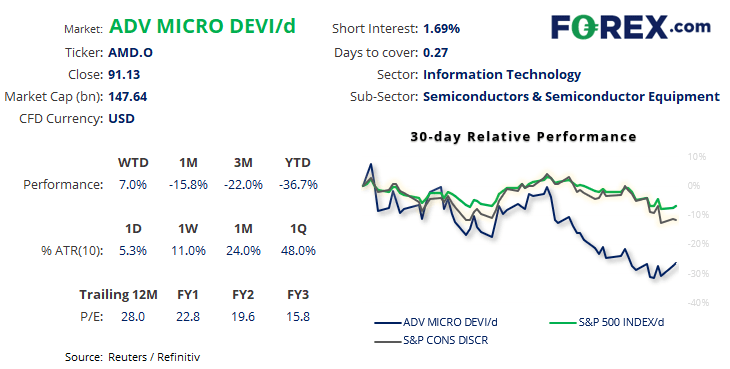

Advanced Micro Devices Inc (AMD) delivered stronger than expected earnings in Q1 of $1.13 per share versus $0.91 expected. Revenues rose 70.9% y/y, or $5.89 billion compared with $5.52 billion forecast. Earnings per share (EPS) rose 56c in the firt quarter and report a net income of $786 million in Q1. Overall, the stock retains a buy recommendation from the 43 analysts polled by Reuters; 25 have a ‘strong buy’ or ‘buy’ recommendation, 17 have a ‘hold’ and 1 as a ‘sell’ or ‘strong sell’.

However, these buy recommendations are yet to bear any fruit with the stock having fallen around -48% from its record high, although there has been a minor attempt to lift the stock from its lows.

We can see on the daily chart that AMD remains in a strong downtrend as it has been dragged down by the technology sector. The past two days have been rising and above average to suggest some accumulation is taking place, yet in the grand scheme of things it is a minor bounce at best. The monthly pivot point and 20-day eMA are capping as resistance, so we are looking to fade into rallies below 95.0 and initially target the 84.24 lows. Whereas a break beneath 84.00 brings the monthly S1 pivot into focus around 76.0.

Nasdaq flirts with a break of 13k

The Nasdaq 100 remains in a clear downtrend on the daily chart, although it is trying to rebound from 13k after a false break beneath it. 13k is an important level to monitor as it is near a 38.2% Fibonacci ratio between the March 2020 low and 2021 record high. It also its near the May 2021 lows and of course it is a round number.

But notice how daily trading volumes were above average and increasing as prices fell down towards and through 13k, yet volumes since the supposed rebound are very light. This currently suggests the Nasdaq is within a countertrend bounce, so we prefer to fade into minor rallies. For us to be more confident that an important swing low has been achieved, we would want to see at least one strong bullish daily candle with above-average volume. Until then, a break beneath 12,720 assumes bearish continuation and brings the support zone around 12k into focus.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.