This is an excerpt from our full 2025 AUD/USD Outlook report, one of nine detailed reports about what to expect in the coming year.

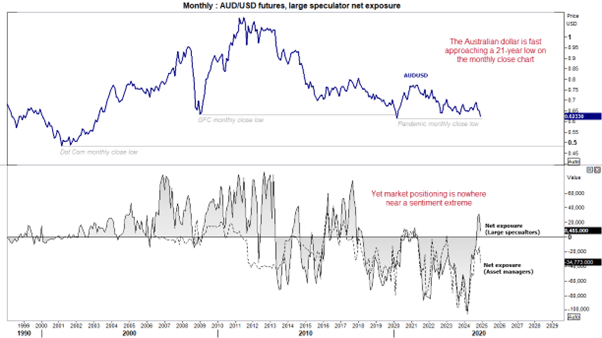

Market positioning for AUD/USD

Throughout 2024 I was running with my conviction that the 2020 low was significant. Yet recent developments has turned that on its head. Prices are quickly making their way to down to the pandemic low on the monthly close chart, which if broken takes the Aussie down to a 21-year low. While this could signal a sentiment extreme over the near-term, market positioning is not.

Large speculators remain net-long, even if by a mere 8.5k contracts. Asset managers have remained net-short since January, but not by an extreme amount. And this leaves plenty of downside potential for AUD/USD as we head into 2025.

Gross shorts have risen among both sets of traders over the past two weeks, and this is a trend that seems likely to continue while longs are also reduced. In a nutshell, AUD/USD could be trading in the 50s next year.

Source: RBA

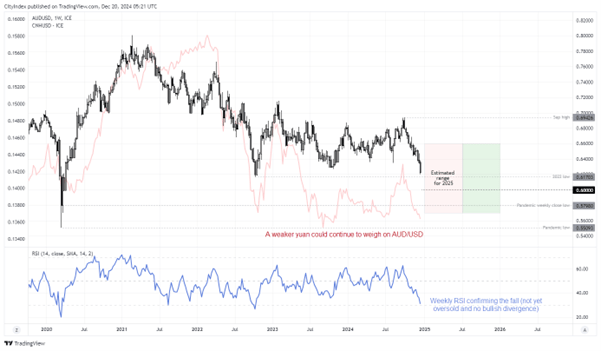

Technical analysis for AUD/USD

The -11% fall from the September high has been direct enough to assume prices will eventually break beneath the 2022 low and test 60c. The weekly RSI (14) is also confirming the dip lower without any signs of a bullish divergence, and is yet to test the oversold zone.

We might get a sympathy bounce around the November low before an initial break of 60c. But given it required a pandemic to send the Aussie down into the 50s and it still didn’t stay there for long, there could be some support in the upper 50s and above the pandemic low.

The bias is to fade into rallies in the first half of the year, while the RBA eases and Beijing allow the yuan to slide. Yet things could improve in H2 as trade negotiations are made and sentiment for commodity currencies improves.

Given we could be in for a turbulent year for global markets, I have allowed for a ~16% range between 57c – 66c.

Source: TradingView

This is an excerpt from our full 2025 AUD/USD Outlook report, one of nine detailed reports about what to expect in the coming year.