Forex trading

-

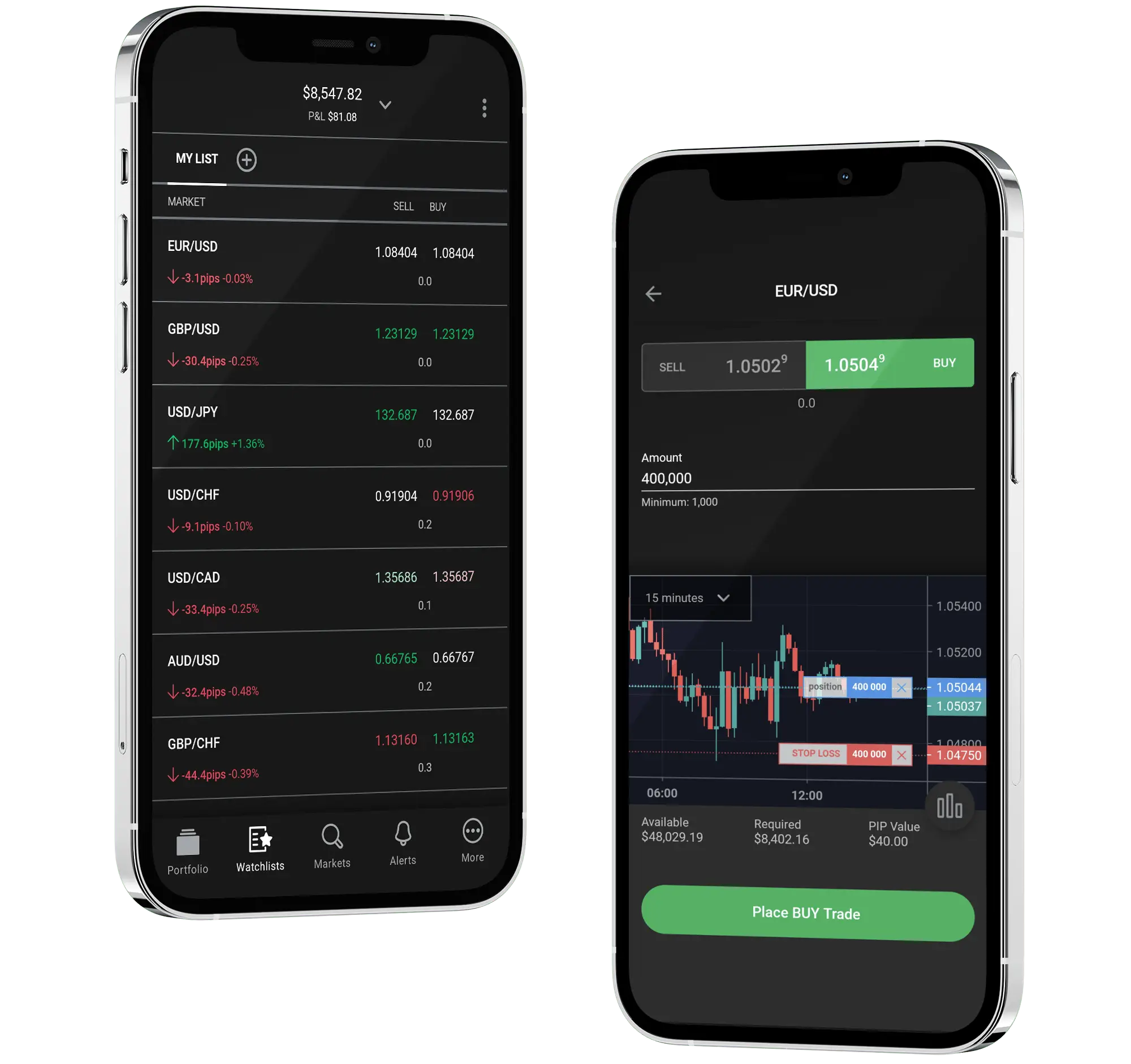

Major pairs like EUR/USD as low as 0.0 with our RAW Spread Account - with low commission

-

Super-fast and reliable forex trade executions

-

Powerful, purpose-built forex currency trading platforms

Forex explained

-

A quick snapshot of FX

Forex trading is the act of speculating on the movement of exchange prices by buying one currency while simultaneously selling another. -

There’s no larger market

With an average turnover in excess of $7.5 trillion a day*, currency prices are constantly fluctuating – creating endless trading opportunities in the world's most traded market.

*According to BIS -

Forex never sleeps

As a globally traded market, the foreign exchange market is open 24 hours a day, five days a week (Sunday 5PM to Friday 5PM).

Market-leading FX pricing

Standard spread pricing, no commissions

USD/RUB and EUR/RUB are currently unavailable for trading. See Ruble update.

Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. Typical spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker.

Award-winning FX trading apps

-

TradingView Charts80+ indicators, 11 chart types and 14 timeframes

-

Performance AnalyticsAnalyze your decision-making with the latest behavioural science technology

-

Total ControlCustomize your notifications and alerts to stay on top of the markets

-

Trading ResearchAccess integrated market analysis, Reuters news & a full economic calendar

Forex trading accounts

Standard Account

Ideal for traders who want a traditional currency trading experience.

No commissions, traditional competitive

spread pricing.

RAW Spread Account

For traders who are seeking ultra-tight spreads with low commissions.

Spreads as low as 0.0 with low fixed commissions of $5 USD per $100k USD traded.

Daily Forex moves and news

Latest Forex news and analysis

Lower your trading costs by up to 15%

Earn cash rebates and access other exclusive benefits with the Active Trader program.

-

Functional BenefitsMulti-asset rebates on FX, Indices, Commodities, Metals, cryptocurrencies and Equities, up to $50 per million traded and get bank fees on wire transfers reimbursed.

-

White Glove ServiceTake advantage of one-on-one guidance from our relationship managers to develop and maintain a strong trading strategy.

-

Red Carpet RolloutVIP access gets you invited to exclusive events and previews of our products.

Frequently asked questions

When is the forex market open for trading?

The forex market is open for trading 24 hours a day from 9 PM UTC on Sunday to 9 PM UTC on Friday. That means with FX, you can build your trading strategy around your schedule, instead of having to conform to when a stock exchange is open.

However, there are times when the market is much more active, and times when it is comparatively dormant.

Where is forex traded?

Forex is traded via a global network of banks in what’s known as an over-the-counter market – unlike stocks and commodities, which are bought and sold on exchanges. Because of this, you can trade forex 24 hours a day during market hours.

FX trading is split across four main ‘hubs’ in London, Tokyo, New York and Sydney. When banks in one of these areas close, those in another open, which is what facilitates round-the-clock trading.

However, there’s no physical location where these banks and individuals trade with each other. Instead, it is entirely online.

Why do people trade currencies?

People trade currencies for lots of different reasons. You’ve probably traded a currency if you’ve ever bought goods overseas, for example, or gone on a vacation in another country. However, the vast majority of FX trading is done for profit.

Currencies are constantly moving in value against each other. On any given day, the pound might be rising against the dollar, while the euro falls against the Swiss franc. Forex traders buy and sell currency pairs to try and take advantage of this volatility and earn a return.

For instance, if the pound is rising against the dollar, you might buy GBP/USD. When you buy this pair, you’re buying pound sterling (GBP) by selling the US dollar (USD). Then, if the pound continues to outpace the dollar, you can sell the pair to exchange your GBP back for USD and keep the difference as profit.

As a wholly owned subsidiary of a NASDAQ-traded company, we possess the solid foundations and financial strength to innovate and push the industry forward.

*Refers to trade executions for GAIN Global Markets Inc. Please note that multiple factors may impact execution speed, including but not limited; market conditions, platform type, network connectivity, trading strategies, and account type. Forex.com’s execution statistics represent GAIN Global Markets Inc. orders executed on FOREX.com's platforms during market hours between September 30, 2024, 5:00 pm ET, and October 31, 2024, 5:00 pm ET and excludes trades/orders entered on the MetaTrader platform.

Market volatility, volume, and system availability may delay trade executions. Price can change quickly in fast market conditions, resulting in an execution price different from the price available at the time order is submitted. Price improvement is not guaranteed and will not occur in all situations.

Excludes trades that received non-standard order processing and orders that failed to trigger

FOREX.com is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.