FY 2025 USD/JPY Outlook

USD/JPY enters 2025 at a crossroads. Rising US yields, hawkish Fed pivot, and expansionary fiscal policies could fuel more dollar strength, but BoJ moves and carry trade vulnerabilities may keep yen downside in check. The year ahead promises to be an eventful one.

USD/JPY 2025 Outlook: Rising Yields, Inflation Fears, and Potential for BoJ Intervention

- US Treasury yields and Fed policy will be key drivers for USD/JPY in 2025

- Diverging economic performance between the US and Japan creates backdrop for ongoing volatility.

- Trump’s fiscal policies, including potential tax cuts and tariffs, could influence inflation expectations and the dollar.

- BoJ’s moves, including potential rate hikes and intervention, carry sizeable reversal risks

- Carry trades flows vulnerable to expensive asset valuations, narrowing yield differentials

The high-flying USD/JPY struck turbulence in the September quarter, pulling back sharply from multi-decade highs. The question now is whether there’s more to come. This guide looks at key drivers, event risk, market pricing and the technical factors traders should be aware of entering the final three months of the year

Summary

2024 was a wild year for USD/JPY, with shifting interest rate dynamics and Donald Trump’s re-election as US President driving significant market moves.

This report explores the critical factors behind the price action, including relative economic performance, policy responses from the Fed and BoJ, along with the importance of continued buoyancy in asset valuations.

Key insights include:

- How correlation between USD/JPY and US Treasury yields shaped market moves, with longer-dated yields taking the lead

- The role of carry trade flows and Japanese monetary policy in influencing short-term yen fluctuations

- A technical and fundamental outlook on US Treasury yields and their implications for USD/JPY in 2025

The analysis offers a comprehensive view of USD/JPY’s drivers and scenarios for potential outcomes, providing traders and investors with actionable insights for the year ahead.

US exceptionalism on full display

2024 was the year when the US economy simply wouldn’t quit, roaring back to life just as it seemed activity was rolling over, maintaining its streak of exceptional performance relative to other developed nations, including Japan.

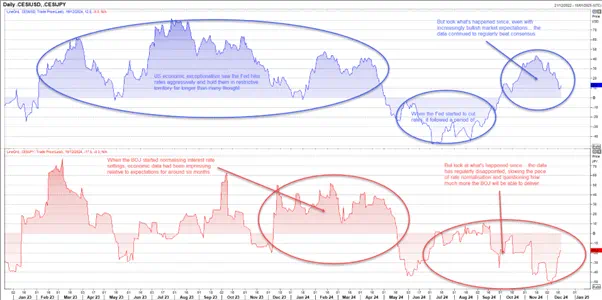

You can see the divergence in the first chart, which shows Citi’s economic surprise indices, a measurement of how economic data performs relative to expectations. A reading above 0 indicates more data than not has topped consensus, with the distance from 0 reflecting the aggregate proportion of surprises.

Source: Refinitiv

Japanese data, shown in red, undershot consensus for large periods in the second half of 2024, coinciding with the BoJ’s move to normalise monetary policy by abandoning yield curve control and lifting overnight rates out of negative territory. In contrast, US economic data, shown in blue, delivered persistent upside surprises over the past two years, apart from a brief dip in mid-2024.

This relative economic divergence, and the subsequent reaction functions from the Fed and BoJ, explains much of the price action seen in USD/JPY in 2024, as the following section outlines.

Comeback’s spark major rates reversal

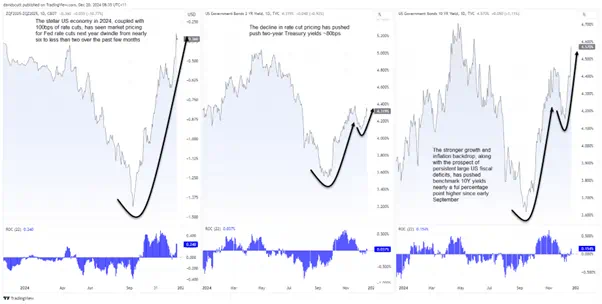

With US economic data roaring back to life last quarter, it sparked a major recalibration of expectations on how much the Federal Reserve will need to cut interest rates in 2025. Futures shifted from pricing nearly six cuts to fewer than two, contributing to US two-year Treasury yields reversing sharply higher toward levels seen immediately after the US Presidential election.

That event is worth noting as President-elect Donald Trump’s policy mix has been a significant factor behind the sharp rise in longer-dated US Treasury yields, boosting growth expectations and bringing future fiscal deficits into focus. Combined with proposed mass deportations of undocumented workers and one-off impacts from planned import tariffs, perceived inflation risks are skewing higher, including from rising wages

Source: TradingView

The point cannot be reinforced enough: while it will be easy for the Trump Administration to introduce tax cuts and tariffs, delivering offsetting measures to counteract the inflationary impact – such as boosting productive capacity and achieving public sector synergies – will be far more challenging, especially without the threat of industrial action. Such measures could take years to implement.

Key US data to watch

The byproduct of government policy will shape future economic outcomes. For USD/JPY, the key data points to monitor are nonfarm payrolls and core consumer price inflation. While the core PCE deflator is the Fed’s preferred inflation measure, CPI often moves markets more as it includes many components that feed into the PCE measure.

While they don’t carry the same potential to spark volatility, GDP, jobless claims, consumer spending and incomes, along with wage measures such as the Employment Cost Index, are other reports traders should watch. Treasury auctions, given their implications for yields, may also become increasingly influential next year.

The policy mix and trajectory for US economic data will be highly influential on the US interest rate curve in 2025. As the next section explains, it’s also critical for USD/JPY.

Long bonds provide strong leads

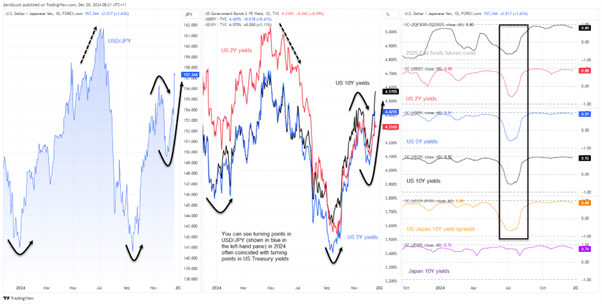

The following chart is divided into three panes: USD/JPY on the left, US two, five, and 10-year Treasury yields in the centre, and the rolling daily correlation between the currency pair and various interest rate variables over the past quarter on the right.

Source: TradingView

Where US Treasury yields moved last year, USD/JPY almost always followed. This is visually evident and confirmed by the correlation coefficient analysis, showing especially tight relationships with US five and 10-year Treasury yields.

Correlation coefficient scores measure the strength and direction of a relationship between two variables, ranging from -1 to +1. A score near +1 signals a strong positive link, where one rises as the other moves up. A reading closer to -1 shows a strong inverse relationship, while zero indicates no correlation.

While correlation does not imply causation, in this instance, US yields in the belly and back end of the Treasury curve drove USD/JPY moves for much of the year.

US short-end rates and interest rate spreads between the US and Japan were also correlated with USD/JPY, albeit less so than longer-term yields.

There was a weak positive relationship with Japanese 10-year yields, but that likely reflects the impact of US Treasury yield fluctuations on global borrowing costs. All else being equal, one would expect an inverse correlation if there were a meaningful fundamental relationship.

Japanese events an important short-term driver

That’s not to say Japanese data and interest rates don’t matter for USD/JPY. They do, but typically only for short periods when they threaten to disrupt carry trade flows. These flows rely on borrowing yen cheaply and swapping it into higher-yielding currencies. Higher Japanese interest rates can discourage carry trades both on a relative return and FX basis, resulting in capital being repatriated into the yen. When that occurs, it has the potential to deliver powerful USD/JPY downside.

Even though US longer-term rates were highly influential for much of 2024, that doesn’t mean they will always be influential. Market drivers can and do change, as indicated by the black box and dotted black arrows in the chart above.

Monitoring for turning points

After essentially moving in lockstep with US yields early in 2024, the strong relationship abruptly disintegrated mid-year. During this period, USD/JPY was more correlated with riskier asset classes such as stocks, suggesting carry trade flows were pushing the pair higher. Declining US yields were ignored as USD/JPY rose, but as the BoJ continued to lift rates and US economic growth faltered, it sparked an aggressive USD/JPY unwind.

This doesn’t mean it will happen again, but if USD/JPY disconnects from US Treasury yields next year, it may signal an eventual reversal.

Rate futures useful for assessing setups

Given the impact US 10-year Treasury yields had on USD/JPY last year, it’s worth assessing directional risks for yields moving forward. US 10-year Treasury note futures, one of the most liquid contracts globally, is useful for this purpose.

The signals can be used to anticipate price shifts like any other market, offering a mechanism to gauge directional risks for prices – and yields – from both a fundamental and technical perspective.

Source: TradingView

USD/JPY bulls would have enjoyed the late-2024 price action, with futures breaking out of the rising wedge pattern they had been trading in over the past year to the downside. With MACD and RSI (14) providing bearish signals on the weekly timeframe, it suggests the break may stick, opening the door for a potential retest of the October 2023 lows. Given Treasury prices move inversely to yields, the bearish price action points to upside risks for 10-year yields.

As the USD/JPY chart below reveals, the bearish break is helping fuel USD/JPY upside.

USD/JPY scenario analysis

Source: TradingView

Rather than offering an official forecast for where USD/JPY will end in 2025, it’s more useful to examine scenarios that could lead to upside, sideways range trade, or a downside reversal from current levels. Price and momentum indicators were trending higher in late December when this report was written, suggesting a bias to buy dips and favour bullish breaks if those trends persist.

As things stand, a retest of the multi-decade high of 161.95 looks probable from a technical perspective.

From a fundamental perspective, for such an outcome to materialise, Fed rate cut pricing would likely need to dwindle further, with a shift from pricing cuts to hikes offering a far more powerful force. However, if the US inflation threat discussed earlier does not materialise, it may be difficult for USD/JPY to push meaningfully higher. And if US unemployment rises sharply, it could spark a material downside move, exacerbated by increased risk of forced carry trade unwinds.

BOJ intervention threat

Finally, the threat of BoJ intervention warrants attention, as it occurred multiple times last year at the Japanese government’s request. Japanese policymakers frequently flag the risk of intervention, especially during periods of sharp yen weakness, but recent history suggests it’s not levels but the speed of moves that can prompt verbal threats to escalate into outright yen buying.

It’s important to note that intervening during a period of rising US Treasury yields is near-useless beyond the extreme short term, merely providing better levels for bulls to re-enter. The BoJ does not have unlimited foreign reserves to waste fighting fundamentals, so intervention during a period of declining US yields would likely yield far more successful and sustained market outcomes.

-- Written by David Scutt, Market Analyst

Follow David on X: @scutty