Vaccine optimism boosted risk appetite, lifting Asian markets overnight putting European bourses on track for a stronger start. Stronger than forecast UK inflation data has added to the risk on tone. Meanwhile, elevated US – Chinese tensions are broadly being shrugged off.

Risk sentiment has soared after Moderna Inc said that its covid-19 vaccine candidate produced a “robust” immune response in all 45 patients in its early stage trial and without safety issues. The findings support further development of the vaccine and Phase 3 trials are expected to start at the end of this month.

A vaccine is the surest and quickest way for the global economy to bounce back to pre-coronavirus levels. Social distancing would no longer be needed, shops and particularly the leisure and hospitality sectors could return to business as usual. In shot a vaccine is the only way to recession proof the economy against coronavirus. For this reason, the markets are so sensitive towards vaccine development news. As we move through the second half of the year, we can expect vaccine news to pick up, with Oxford University /AstraZeneca already in Phase 3 testing in south Africa and Brazil.

UK Inflation surges

UK inflation surged +0.6% mom in June unexpectedly picking up from May and surpassing expectation s of 0.4%. On an annual basis, inflation increased 1.4%, ahead of the 1.2% forecast. As lockdown measures were eased and the UK economy gradually reopened, demand has picked up boosting inflation. This is some well needed good news after yesterday’s GDP misery and has returned some faith that he UK economy is on the road to recovery, albeit a long road.

UK inflation surged +0.6% mom in June unexpectedly picking up from May and surpassing expectation s of 0.4%. On an annual basis, inflation increased 1.4%, ahead of the 1.2% forecast. As lockdown measures were eased and the UK economy gradually reopened, demand has picked up boosting inflation. This is some well needed good news after yesterday’s GDP misery and has returned some faith that he UK economy is on the road to recovery, albeit a long road.

Petrol prices played a part as oil continues to climb from its March nadir and as Brits jump back into their cars after lock. Core inflation was slightly less impressive, slipping to a still solid 0.5%. GBP/USD trades +0.3%.

China troubles brushed off

As risk appetite rises stocks are pushing higher and the safe haven dollar has fallen out of favour. News that President Trump has ordered an end to Hong Kong’s special status in relation against China’s national security law in Hong Kong has broadly gone unnoticed. This follows reports that the UK will phase out the use of Huawei technology.

Coronavirus numbers are also being overshadowed by vaccine optimism. The tally in the US reached 3.4 million, with 136,000 deaths recorded. California has re-imposed lockdown measures across the hardest hit counties in the state amid record covid numbers.

As risk appetite rises stocks are pushing higher and the safe haven dollar has fallen out of favour. News that President Trump has ordered an end to Hong Kong’s special status in relation against China’s national security law in Hong Kong has broadly gone unnoticed. This follows reports that the UK will phase out the use of Huawei technology.

Coronavirus numbers are also being overshadowed by vaccine optimism. The tally in the US reached 3.4 million, with 136,000 deaths recorded. California has re-imposed lockdown measures across the hardest hit counties in the state amid record covid numbers.

EUR solid on stimulus hopes

On the currency markets, the Euro is a star performer rising to 4 month highs on hopes that the economic recovery stimulus plan will be agreed after Germany’s Angela Merkel and Spain’s PM Pedro Sanchez committed to moving forward with the EU Fund.

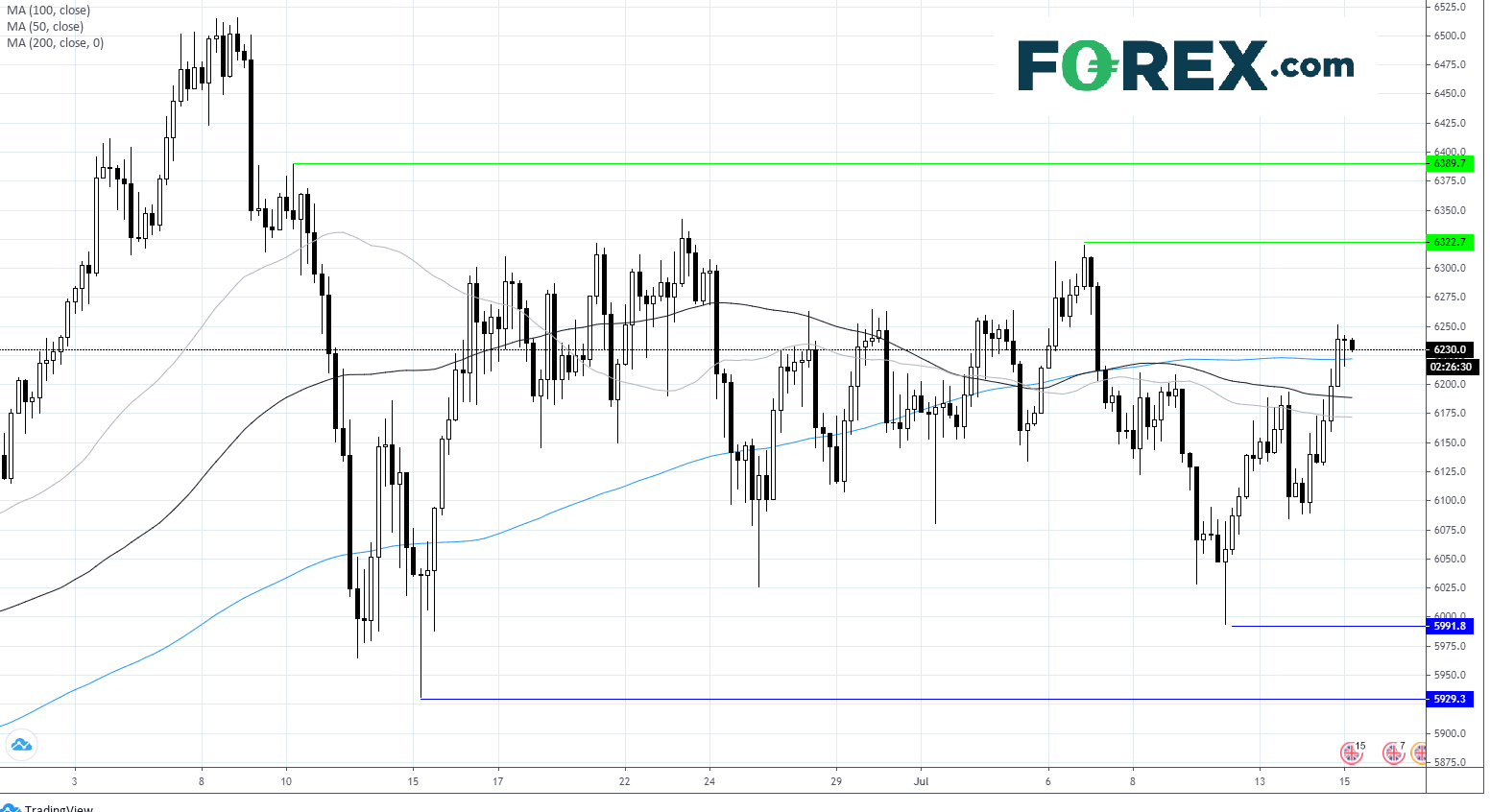

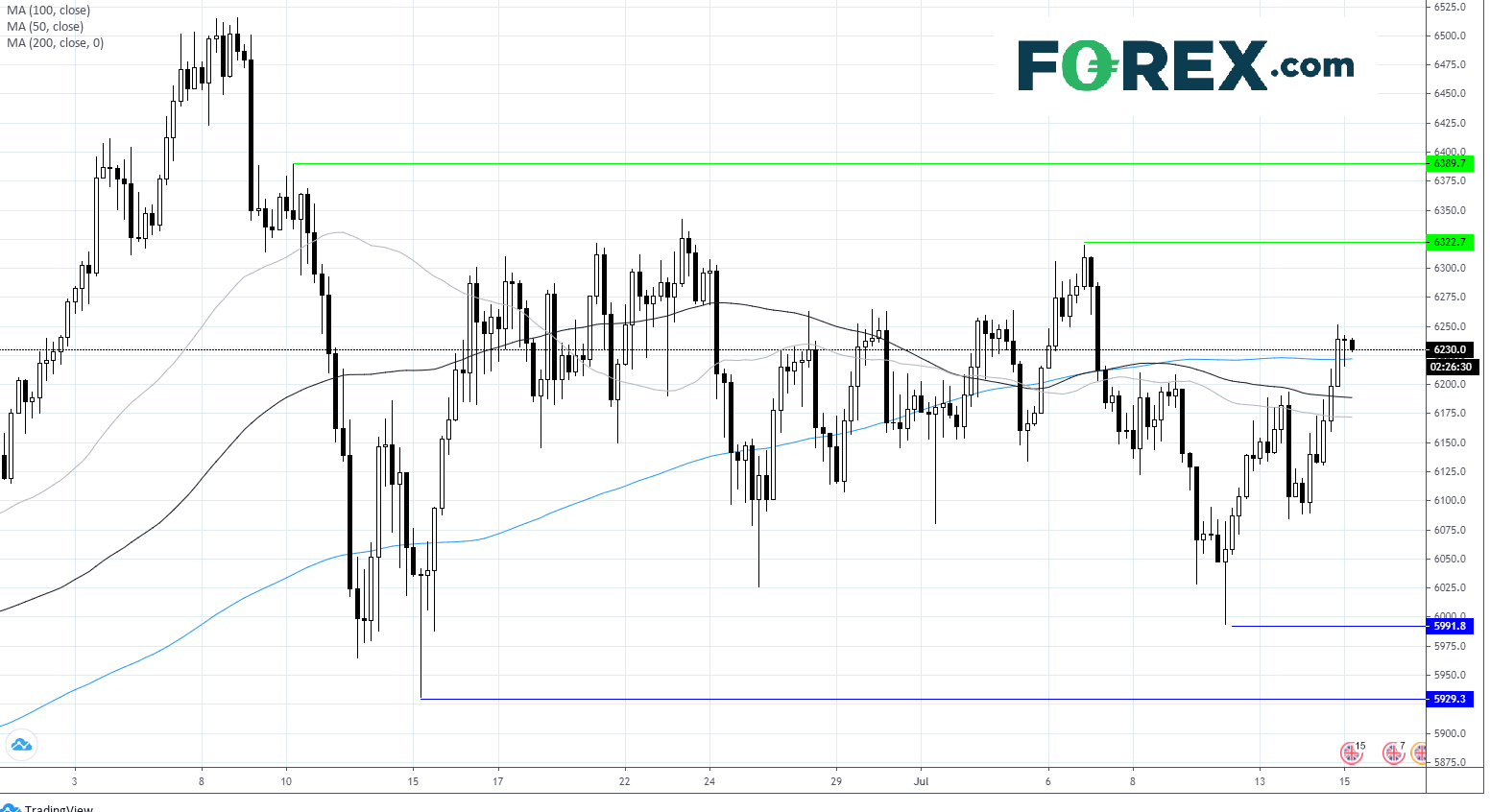

FTSE Chart

Latest market news

Yesterday 11:30 PM

Yesterday 01:30 PM

Yesterday 07:00 AM

December 27, 2024 02:00 PM

December 27, 2024 08:00 AM

December 26, 2024 04:00 PM