US futures

Dow futures -0.11% at 32580

S&P futures -0.1% at 3960

Nasdaq futures -0.1% at 12028

In Europe

FTSE +0.67% at 7928

Dax +0.04% at 15388

- China manufacturing PMI jumps to 52.6

- US ISM manufacturing PMI due as hawkish Fed worries linger

- Retailers warn of slowing consumer spending

- EUR/USD rallies on hot German inflation

- Oil falls on signs of ample supply

Stocks struggle for direction

US futures are lacking direction as investors weigh up a stronger-than-forecast economic recovery in China against concerns that the Federal Reserve will keep raising interest rates higher for longer.

China’s manufacturing activity grew at the fastest pace in over a decade, fueling bets of a solid economic recovery in the work’s second-largest economy, which could help work towards the soft landing. However, it’s also worth noting that a strong economic recovery in China could also be inflationary, fueling the no-landing scenario.

Fears of persistently high inflation and higher interest rates for longer hit risk sentiment across February. Traders are now pricing in a higher terminal rate of 5.25-5.5%, up from the current 4.5-4.75% range.

Attention is now turning to US ISM manufacturing PMI data, which is expected to show that the sector contracted at a slower pace in February at 48, up from 47.4. Any sign that the sector contracted at a slower pace could calm hawkish Fed bets and lift sentiment in a bad data is good news way.

Corporate news

Lowe’s rises premarket after the home improvement retailer beat quote Lee earnings expectations. However, the upside has been capped by a disappointing full-year sales forecast as surging prices make consumers more cautious.

Kohl’s falls over 7% premarket after the department store chain posted a loss in the key holiday quarter and forecast full-year profit below expectations as customers reined in their spending.

Rivian drops over 8% after the EV maker forecast 2023 output well below estimates and announced a recall of over 12,000 vehicles.

Tesla will be under the spotlight ahead of its investor day, with the EV manufacturer expected to confirm a new factory in Mexico.

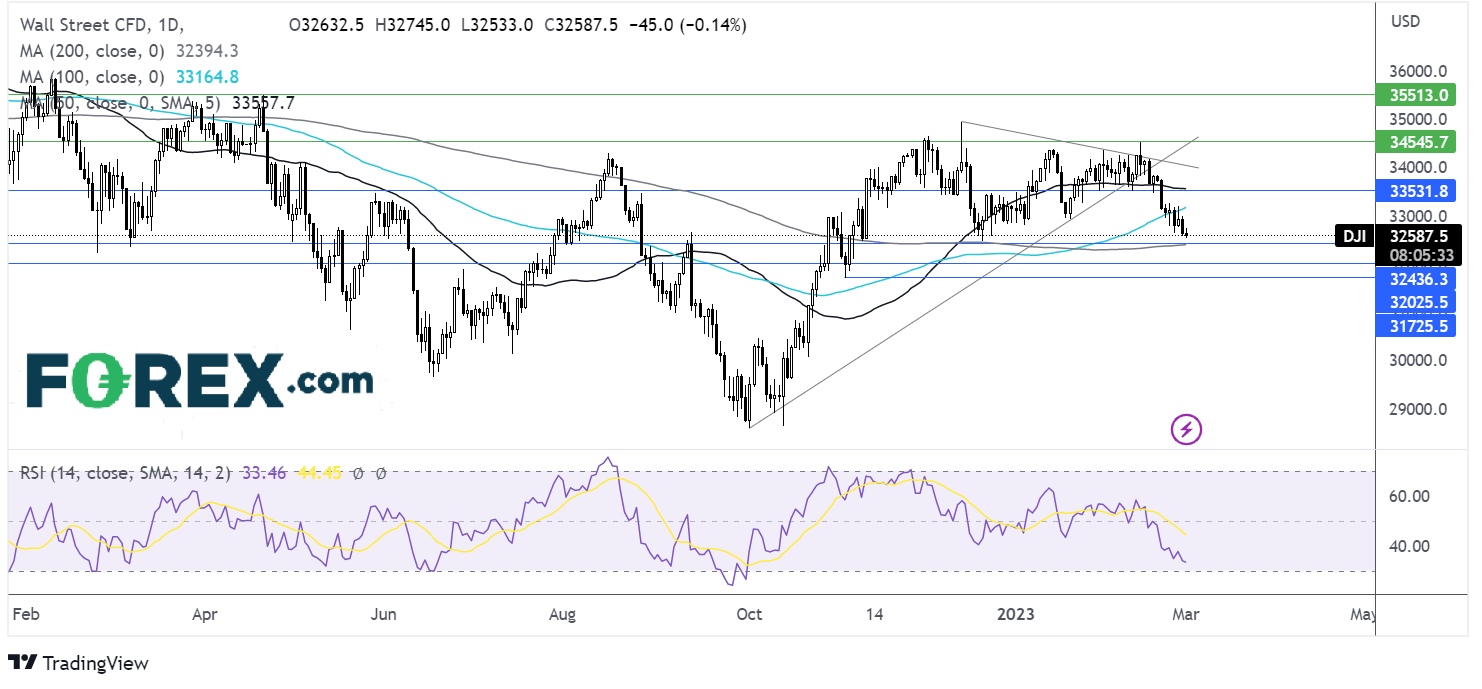

Where next for the Dow Jones?

After running into resistance at 34515 on February 14th, the Dow Jones has fallen sharply lower, breaking below the rising trendline resistance dating back to early October, as well as the 50 & 100 sma. This, together will the RSI below 50 could keep sellers hopeful of further downside. Sellers would need to break below 32470, the December low and 32400, the 200 sma to extend the bearish trend towards 32000 round number 31700, the November low. On the flip side, buyers could look for a rise above 33000 and 33170, the 100 sma to extend gains towards 33550, the 50 sma, and late January lows.

FX markets – USD falls, EUR jumps

The USD is falling sharply as the strong recovery in China is fueling risk appetite hurting demand for the safe haven US dollar. Furthermore, weaker-than-expected US data yesterday suggests that the Fed’s hikes could be taking effect, calming hawkish bets.

EUR/USD is rising, boosted by hawkish ECB bets after German inflation came in hotter than expected at 8.7% YoY. This was in line with January’s meeting and defied expectations of a fall 8.5%. The data comes after Spain and France’s inflation also unexpectedly increased in February. The figures suggest that the ECB still has much work to do to rein in inflation.

GBP/USD is rising boosted by the upbeat market mood and by comments from Bank of England governor Andrew Bailey who said that more monetary policy tightening was likely needed. The manufacturing PMI data confirmed that the sector contracted at a slower pace in February.

EUR/USD +1% at 1.0685

GBP/USD +0.48% at 1.2064

Oil falls on supply worries

Oil prices flipped lower on Wednesday, paring earlier gains as investors weigh up a strong economic rebound in China against signs of ample supply and rising US crude oil inventories.

Strong Chinese data has fuelled optimism that the economy is rebounding, driving the oil demand outlook higher. However, this was overshadowed by reports that Russia's oil production has reached pre-sanction levels for the first time since February last year.

Also adding pressure to the oil prices was the latest API data showing that oil inventories rose by 6.2 million barrels in the week ending February 24th. Attention is now on the EIA data out later today.

WTI crude trades -0.8% at $76.44

Brent trades at -0.45% at $82.95

Looking ahead

15:00 US ISM manufacturing PMI

15:30 Crude oil inventories