US futures

Dow futures -0.11% at 34360

S&P futures +0.0% at 4446

Nasdaq futures +0.19% at 15198

In Europe

FTSE +0.01% at 7530

Dax -0.17% at 16122

- US2 year & 10 year treasury yield invert by most in 42 years

- Tesla jumps 6% on record deliveries

- US manufacturing PMI data is due

- Oil rises as Russia and Saudi Arabia cut output

Treasury market sounds recession alarm

US stocks are pointing to a flat open after Tesla’s share price jumped 6% on record deliveries after data on Friday saw US inflation cool and ahead of US manufacturing PMI data.

The market mood is relatively upbeat as stocks kick off the first trading day of the second half, which is expected to be dominated by speculation over how high interest rates could go central banks will keep rates elevated.

All 3 US major indices enjoyed a strong start to 2023, with the S&P trading 14% higher, boosted by the AI frenzy and a handful of tech stocks. However, gains in the year’s second half could be harder to come by.

The crazy one U.S. Treasury 2-year and 10-year yield curves invented in the most in 42 years in a signal that the financial markets see the Federal Reserve’s current hiking cycle tipping the US economy into recession. The treasury note yield hit the widest since 1981 at 110.80 basis points.

Attention now turns to the US ISM manufacturing PMI which is expected to tick higher to 47 in June from 46.9. The level 50 separates expansion from contraction.

The US stocks markets will close at 1 pm ET and remain closed tomorrow for the Independence Day public holiday.

Corporate news

Tesla rises 6% pre-market after delivering 466,140 vehicles in Q2, an 83% YoY increase and a record level. The jump in deliveries comes after Elon Musk slashed prices to boost demand.

XPeng jumps 10% pre-market after the Chinese EV maker reported a surge in June deliveries, up 27% on the month.

Apple will be under the spotlight after a report in the FT that the tech giant is cutting its output goals for its mixed reality headset ProVision due to the products’ complexity.

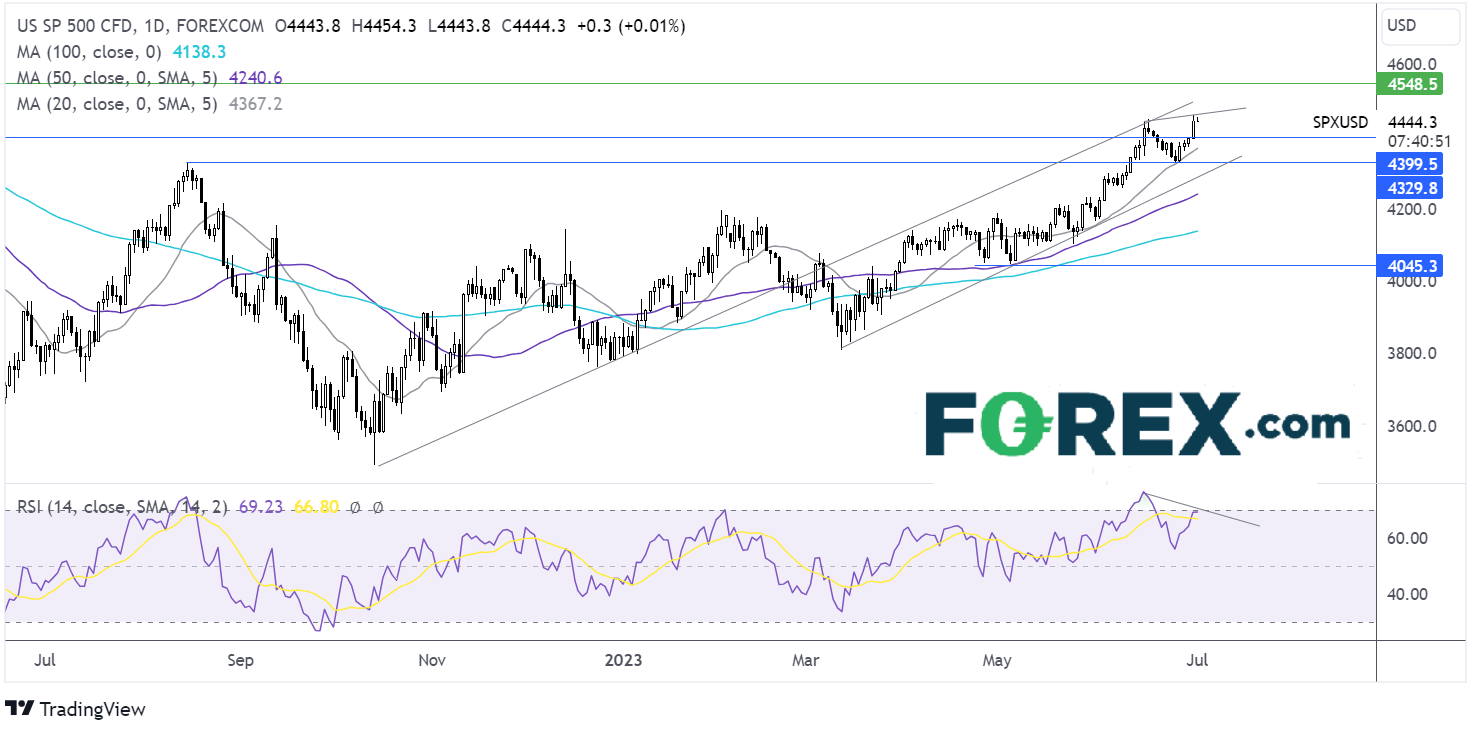

S&P500 outlook – technical analysis

After rebounding off the 20 sma last week, the S&P500 pushed higher to a fresh 2023 high of 4459 on Friday. The price hovers around this level, remaining within its multi-month rising channel. The RSI remains out of overbought territory, but RSI bearish divergence suggests that the rise higher could be running out of steam. Buyers will look for a rise above 4459, the 2023 high, to bring the September 2021 high of 4525 into focus. On the downside, sellers could look for a break below 4400, the round number, to expose the 20 sma at 4370. A break below here opens the door to 4335, the June low.

FX markets – USD rises, EUR falls

The USD is rising as investors look past Friday’s cooler-than-expected core PCE print and price in an almost 90% probability of the Fed hiking rates by 25 basis points in July. Attention is now turning to US ISM manufacturing data for further clues.

EURUSD it's falling as the downturn in eurozone manufacturing intensified in June. The manufacturing PMI fell to a 37-month low, reflecting the sharpest decline in demand since October 2022. Germany led the decline, with the PMI falling to 41.

GBPUSD is falling against a stronger U.S. dollar after UK manufacturing PMI fell to 46.5 in June, down from 47.1 in May. This was still above the preliminary reading of 46.2 but marked a 6-month low as new orders and employment both contracted.

EUR/USD -0.23% at 1.0895

GBP/USD -0.2% at 1.2670

Oil jumps on Saudi Arabia and Russia oil production cuts

Oil prices have jumped higher at the start of the week after Saudi Arabia and Russia announced supply cuts for August in a move that has overshadowed concerns over slowing global growth.

Saudi Arabia said it would extend its voluntary cuts of 1 million barrels per day for another month, across August. Meanwhile, Russia is seeking to increase global oil prices and announced it will reduce oil exports by 500,000 barrels per day in August.

These cuts amount to around 1.5% of the global oil supply. The prospect of tighter supply across August has boosted oil prices, overshadowing worries of slowing demand. China’s manufacturing PMI showed that growth slowed in June to 50.5 from 50.9, adding to evidence that the recovery from the pandemic is slowing.

Today’s announcements come ahead of the OPEC+ meeting later in the week.

WTI crude trades +1.2% at $71.50

Brent trades at +1% at $76.15

Looking ahead

14:45 US manufacturing PMI

15:00 US ISM manufacturing PMI