Gold rises towards $1900 on Fed re-pricing

Gold is rising for a fourth straight day as U S treasury yields fall answer U.S. dollar weekend.

The precious metal is refreshing a 5-week high on the broad USD selloff as the fallout from the Silicon Valley Bank collapse revives bets of a more dovish Federal Reserve.

The US has said that it will repay SVB deposits in full, calming fears of contagion significantly. However, Fed bets are also being pared, with Goldman Sachs scrapping expectations of a March rate hike. JP Morgan is pricing in a 25 bps hike.

A slower pace of hikes would give the US central bank more time to assess the impact of the historically fast pace of rate hikes on the economy. Treasury yields are dropping quickly, with the 2-year yield down 18 bps to 4.34%, the steepest 3-day fall in over 35 years.

The Fed is now entering the blackout period ahead of the FOMC next week, where the markets were pricing in a 50-bps hike mid-last week.

The next major catalyst will be US inflation data due tomorrow, which could be the last hope for Gold bears. A hotter-than-forecast inflation print could fuel rate hike bets, but cooling inflation could help non-yielding gold higher.

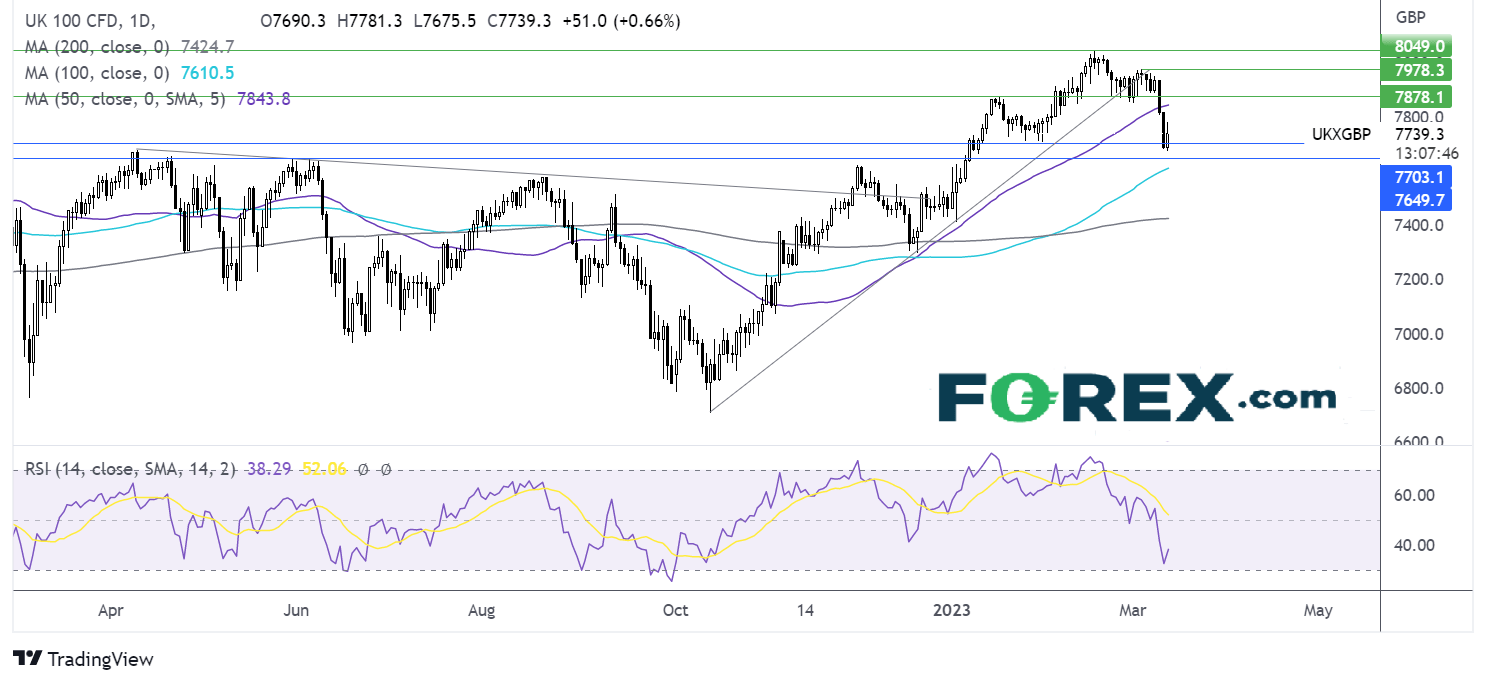

Where next for Gold prices?

Gold broke out of the symmetrical triangle and spiked higher to 1894, a 5-week high. However, it was unable to maintain the price and has slipped back to support at the 50 sma. A decisive break above the 50 sma, along with the bullish RSI, keeps buyers hopeful of further upside. A rise above 1894 could open the door to 1900 round number.

Meanwhile, sellers could focus on the long upper wick, which suggests that there was little demand at the higher price. Failure to close above the 50 sma could see sellers look towards the falling trendline support at 1846 to re-enter the triangle. A break below 1814 is needed for a downside breakout from the triangle.

FTSE unchanged after HSBC takes over SVB’s UK arm

In a transaction facilitated by the BoE, HSBC will take over the UK arm of the troubled US tech lender. The 11th-hour move means that no taxpayer’s money will be involved, and customer deposits will be protected.

This is important as the UK positions itself as a hub for a tech start-up and looks to highlight the importance of the sector to the British economy, supporting hundreds of thousands of jobs.

HSBC is Europe’s largest bank which should bring a sense of relief and reassurance to the sector.

While tech stocks are leading the charge higher in the US, the FTSE is notoriously shot of tech stocks to drive the rebound.

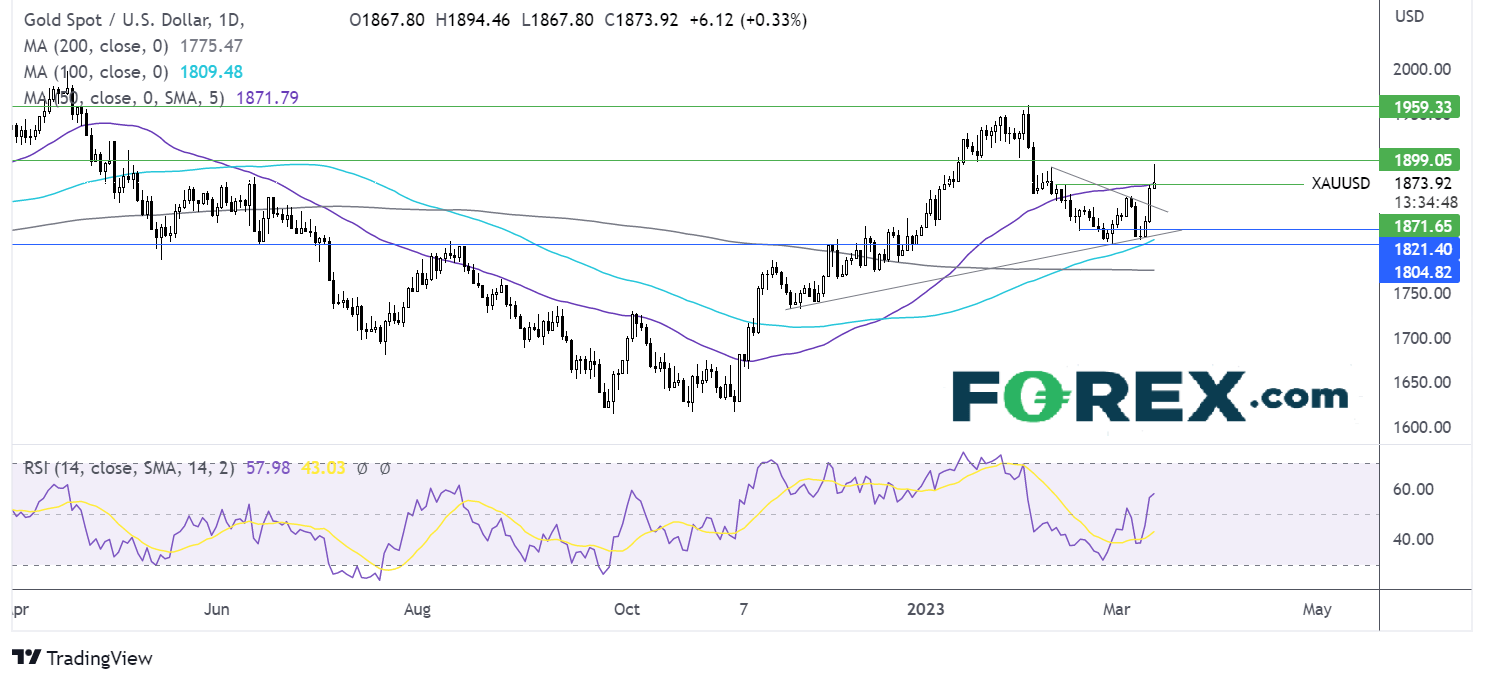

Where next for the FTSE?

The FTSE aggressively broke below the 50 sma, finding support at 7675. The rebound has pushed back over 7700 but remains below the 50 sma and the RSI is below 50, keeping sellers hopeful of further losses.

Sellers will look for a fall below 7640 the June high, with a break below here exposing the 100 sma at 7615.

Meanwhile, buyers could look for a rise above 7675 to extend the recovery towards the 50 sma at 7840, negating the near-term downtrend and brining 7980, the March high into play.