EUR/USD rise ahead of German business climate data

EUR/USD rose yesterday and is extending those gains today, despite dire PMI data from both the US and the eurozone.

Instead, comments from San Francisco Fed President Mary Daly fueled bets that the Fed could be nearing a dovish pivot, pulling the USD lower.

Today attention shifts to German IFO business climate data, which is expected to fall further from the 2-year low reached in September. German IFO business climate is expected to fall to 83.3 in October from 84.3.

Soaring energy costs are hurting the industry and the cost of living crisis is hurting consumers. These same factors weighed on German PMI data, which was released yesterday. German composite PMI fell to 44.1 a 29 month low adding to evidence that the economy was heading for a recession.

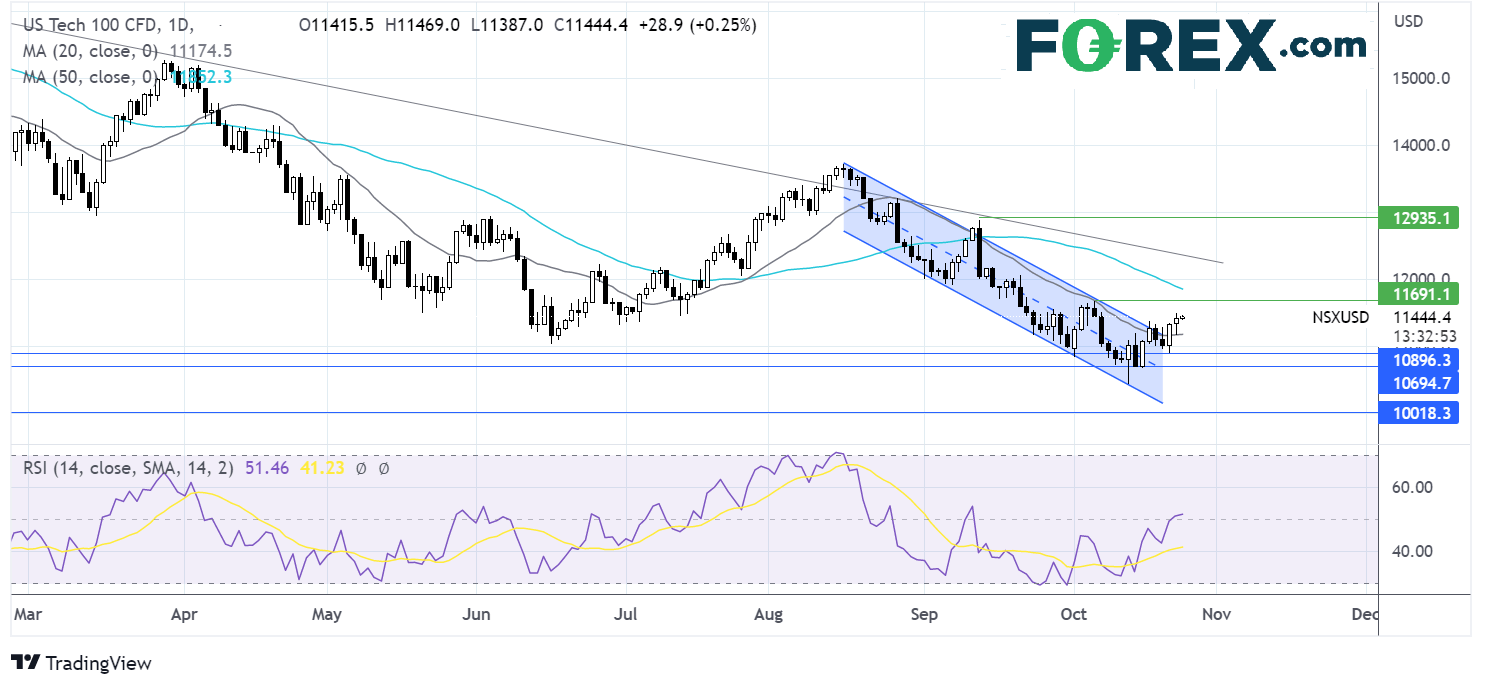

Where next for EUR/USD?

EUR/USD has risen above its 20 sma and is attempting to break above the 50 sma at 0.99. The RSI is just above 50. Buyers will look for a rise above this level to bring parity into focus, the October high.

On the downside, sellers will look for a break below the 20 sma at 0.98, ahead of 0.97 the rising trend line support. A break below here could open the door to 0.9630 the October 13 low.

Nasdaq rises as big tech earnings begin

US stocks have had a strong start to extending gains from last week. Optimism that the Fed could soon be easing back on the pace of rate hikes is lifting demand for stocks. Mary Daly’s comments, following from the article in the WSJ last week, has investors paring back aggressive Fed bets. A 75 basis points hike is priced in for November. Bets for a 50 basis point hike are rising for December, down from 75 bps.

US big tech earnings kick off today with Microsoft and Alphabet. So far earnings season hasn’t been as bad as feared, especially the banks. Now big tech is expected to shed some light on the strength of the consumer and the impact of FX headwinds after the USD surged 17% so far this year.

In addition to earnings, US consumer confidence is expected to soften slightly in October to 106.5, down from 108.00.

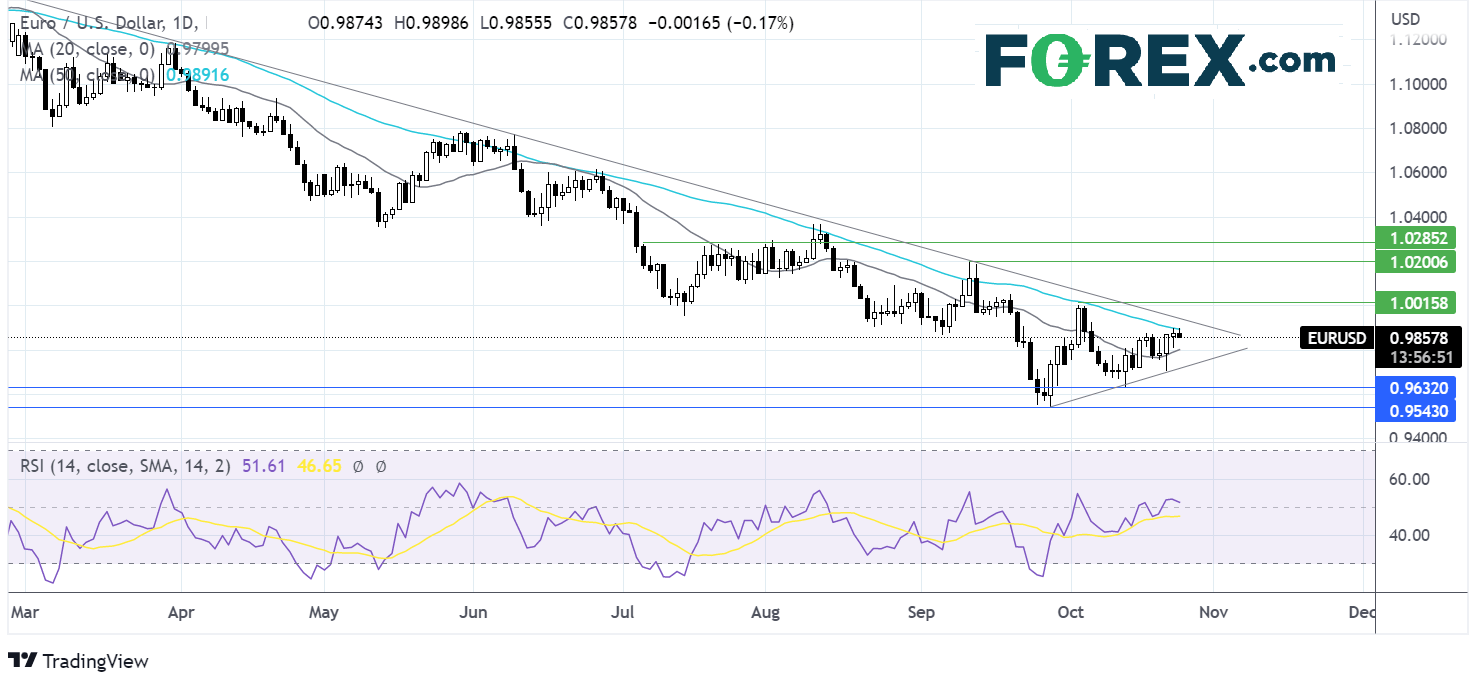

Where next for the Nasdaq?

The Nasdaq has broken out of the falling trendline, pushing above the 20 sma, which along with the RSI over 50 keeps buyers hopeful of further upside.

Buyers will look for a move over 11500 round number and yesterday’s high to bring 11700 the October high into focus. A rise over this level exposes the 50 sma at11850 and negates the near-term downtrend. Above here, 12880 comes into focus the September high.

Failure to hold above the 20 sma could see the index fall to 10875, Friday’s low ahead of 10700 round number. A move below 10430 creates a lower low.