DAX rises after GDP upward revision, but China worries could cap gains

The DAX is heading higher, extending gains from yesterday, lifted by improving data.

German Q3 GDP was upwardly revised to 0.4%, from 0.3%. GDP rose 0.2% in Q2. Meanwhile, German GFK consumer confidence also improved to 40.2, up from -41.9. The data comes after data yesterday showed that German business morale improved by more than forecast to 86, up from 84.5.

While a recession is looking unavoidable in the eurozone’s largest economy, fears over soaring energy bills have calmed slightly, which is helping confidence both for consumers and businesses.

Gains could still be capped by China’s record-high COVID inflections. China is a key trading partner for Germany. Slowing growth there as lockdowns ramp up could weigh on Germany’s economic outlook.

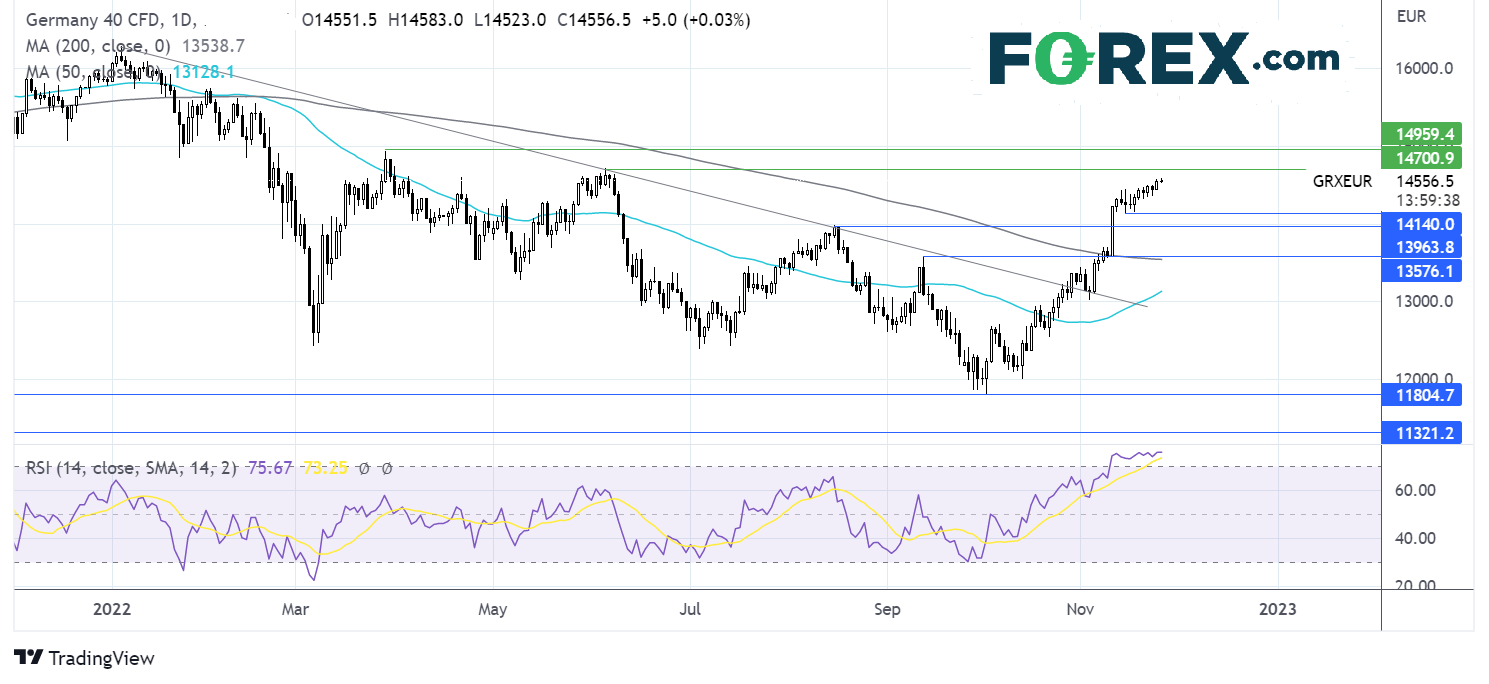

Where next for the DAX?

The DAX has extended gains above the 200 sma and above the 14500-round number. The RSI is in overbought territory, so buyers should be cautious. Some consolidation or a fall lower could be on the cards before further gains.

Buyers will look for a rise over 14700, the September peak, with a rise over here bringing 14930, the March high, back into focus.

On the flip side, immediate support can be seen at 14100, the weekly low. A break below here and 13950, the August high, exposes the 200 sma at 13530.

AUD/USD falls as China COVID cases rise

AUD/USD is falling on Friday, snapping a four-day winning run as worries about China’s COVID picture are rising. China’s record level of infection has seen localised lockdown restrictions increase. Any exit from the zero COVID policy is looking like a distant possibility.

Meanwhile, the USD is trading lower versus its major peers amid the ongoing fallout from the dovish FOMC minutes. Trading could be light owing to the Thanksgiving holiday.

There is no high-impacting Australian or US data due to be released today. Instead, sentiment is likely to drive the pair.

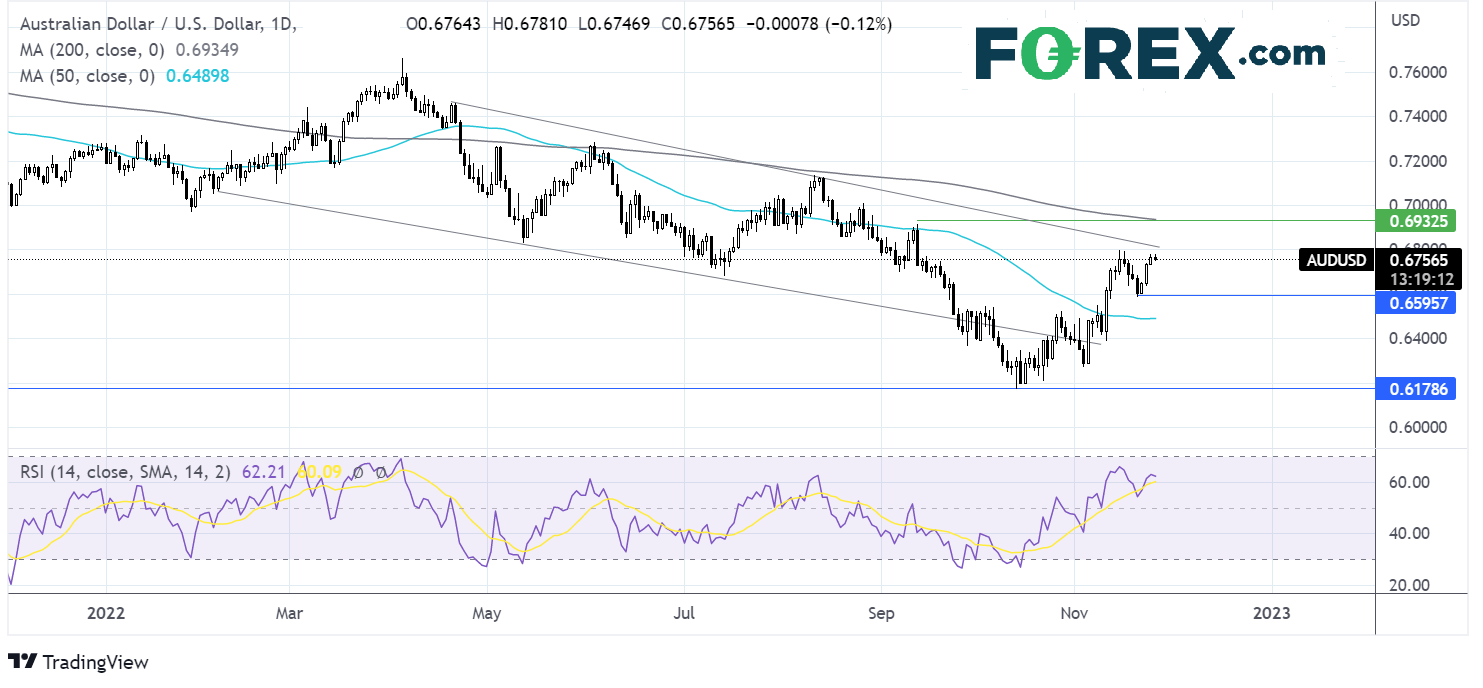

Where next for the AUD/USD?

AUD/USD has been trading in a falling channel since April. After rebounding from the weekly low of 0.6580, bulls have run out of steam. The RSI remains over 50 supporting further upside.

However, buyers must push above 0.68790, the weekly high, and the November 15 high to test 0.6815, the upper band of the falling channel. A rise above here exposes the 200 sma at 0.6940.

On the downside, should sellers successfully defend the weekly high, bears could head toward 0.66, last week’s low. A break below here brings the 50 sma into play.