- S&P 500 analysis: US 10-year yields approaching Oct 2022 high

- USD/CNH analysis: PBOC’s papering over cracks with yuan fixing

- S&P 500 technical analysis point lower after break of trend

Like the first half of Wednesday’s session, there was a slightly positive tone in markets Thursday with European equity indices and US index futures bouncing sharply off their earlier lows, tracking a strong Chinese yuan and firmer metal prices. The moves are partly due to China’s efforts to prop up the yuan, but this is unlikely to have lasting impact on the wider financial markets.

S&P 500 analysis: US 10-year yields approaching Oct 2022 high

The major indices were higher across the board by mid-day in London, but keep an eye on rising US bond yields, as they approach last year’s high:

Source: TradingView.com

If yields continue to push higher, this could trigger fresh falls in equity markets and therefore weigh on the positively correlating EUR/USD. Rising yields have discouraged investors from investing into growth stocks, which is why the Nasdaq has been underperforming of late. A surprisingly resilient US economy is helping to keep bond yields supported, making stocks which have low dividend yields less attract compared to the higher “risk free” returns from investing in government bonds.

S&P 500 technical analysis

With the S&P 500 breaking and closing below its bullish trend line on Wednesday, the path of least resistance is to the downside until proven otherwise. Therefore, the recovery we are seeing in the futures market could fade later when the cash markets open. Key resistance is now the prior support area around 4431 to 4450 (see red shading on the chart).

The Nasdaq 100 also broke and closed below its own key support area around 15,000. This area is now the most important resistance zone to watch. The path of least resistance is to the downside for the Nasdaq unless we reclaim this area or see a key reversal pattern at lower levels first.

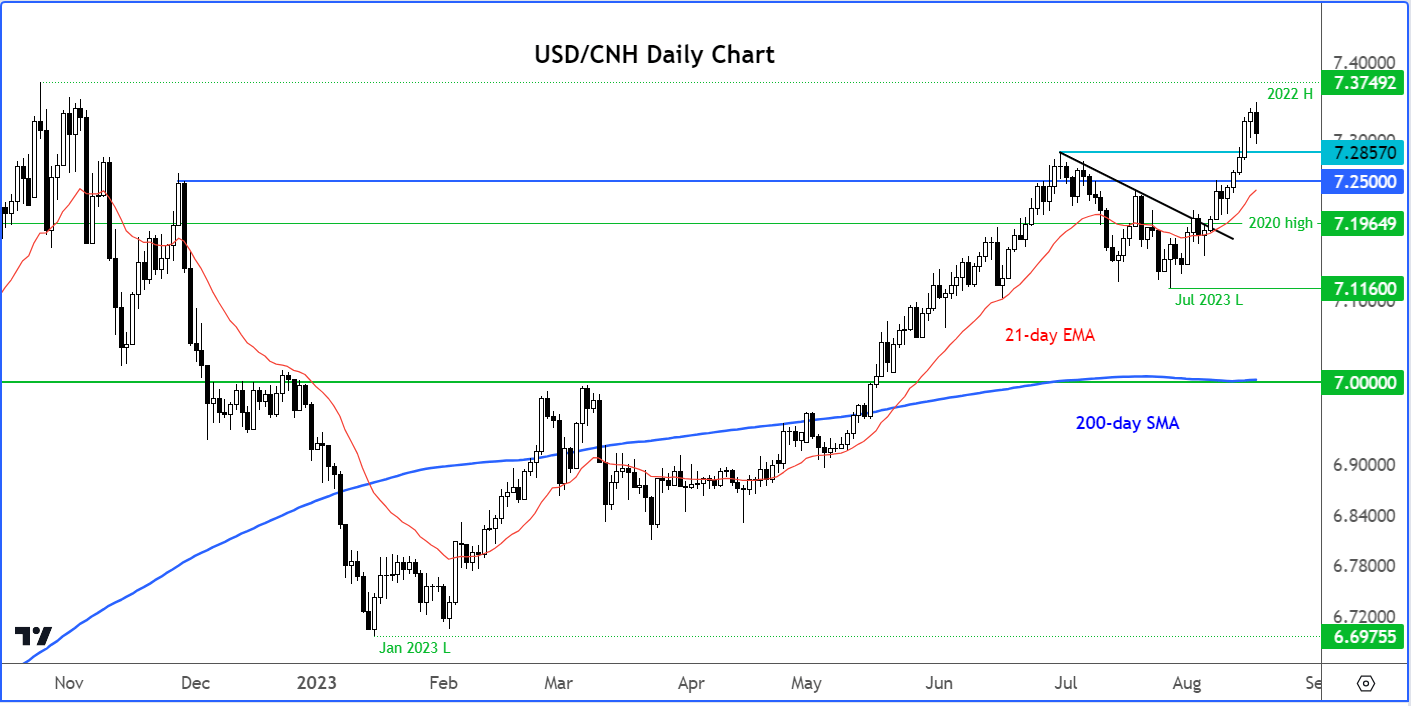

USD/CNH analysis: PBOC’s papering over cracks with yuan fixing

The slight positive tone in markets was perhaps triggered by China ramping up its efforts to stem losses in the yuan. The country’s central banks, the People’s Bank of China set the fixing for the yuan at 7.2076 per US dollar overnight, which was sharply lower from the day before of around 7.2994, representing the largest gap since October. This caused the USD/CNH pair to turn lower:

Source: TradingView.com

In recent days, traders have used the yuan as a proxy for risk appetite, since the currency closely tracks the country’s economic performance. Its repeated falls to fresh yearly lows was already hurting Chinese stocks, failing to keep up with the rising markets elsewhere in the world previously. But in recent weeks, other markets have started to feel the squeeze, too, with US indices falling to fresh 4-week lows this week and European markets also falling significantly, along with the euro.

The fact that China is now intervening more aggressively goes to show how concerned the government has become about the state of the world’s second largest economy. The markets have found mild support from this, but on second thought it might release that, actually, China’s yuan fixing is akin to papering over the cracks. So, it remains to be seen how much of a lift this will provide the markets. Hint: I don’t think it will very much.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R