NVIDIA (NVDA), the world's largest 3D graphics card producer, rallied 180% from March low. Recently, U.K. Ministers said they will not hesitate to block the 30 billion euro takeover of British chip maker Arm from NVIDIA.

In August, the company reported that 2Q EPS was up 10% on year to $0.99 on revenue of $3.87 billion, up 50% from last year. It is expected to release its 3Q result on November 18 with EPS of $1.678 and revenue of $4.41B.

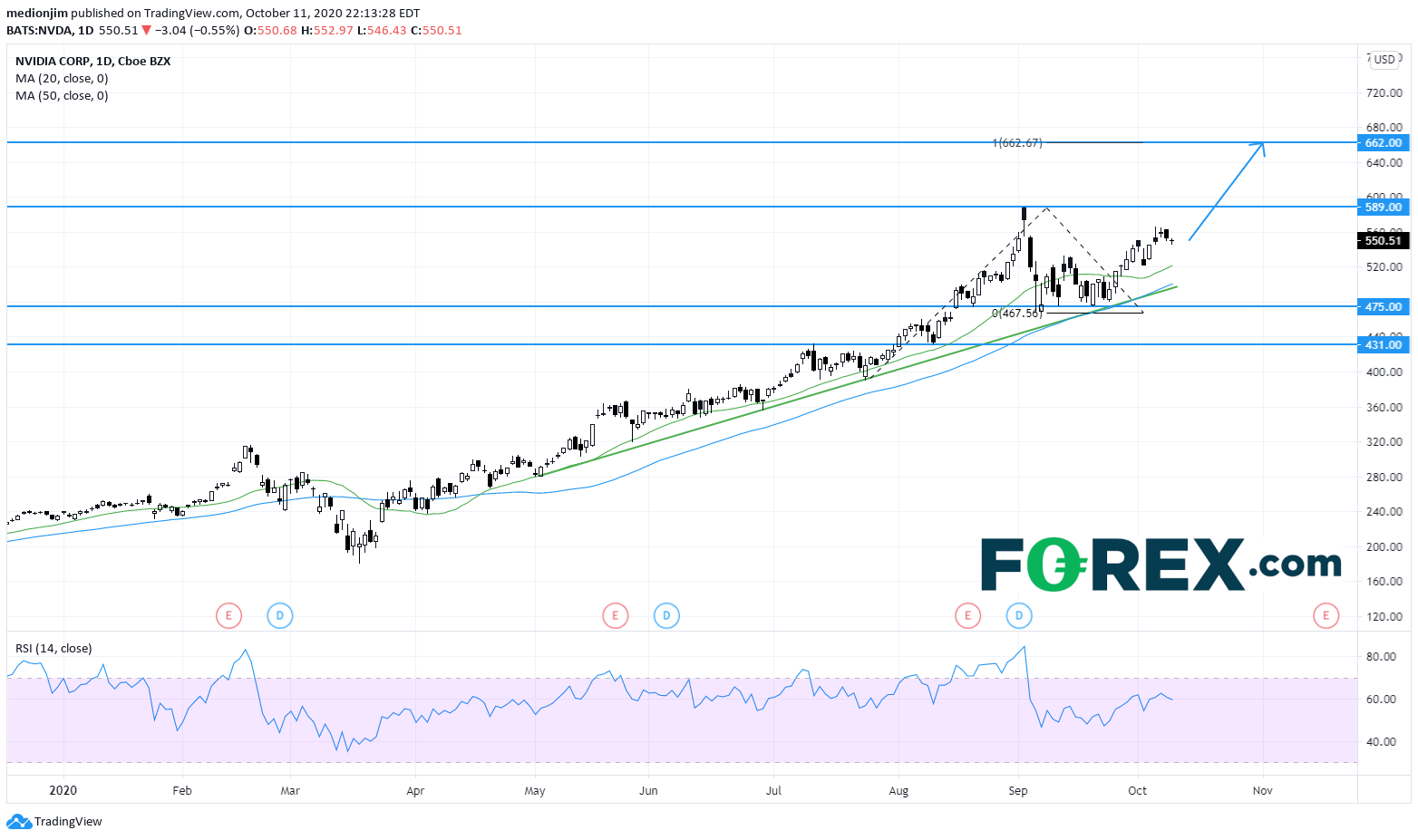

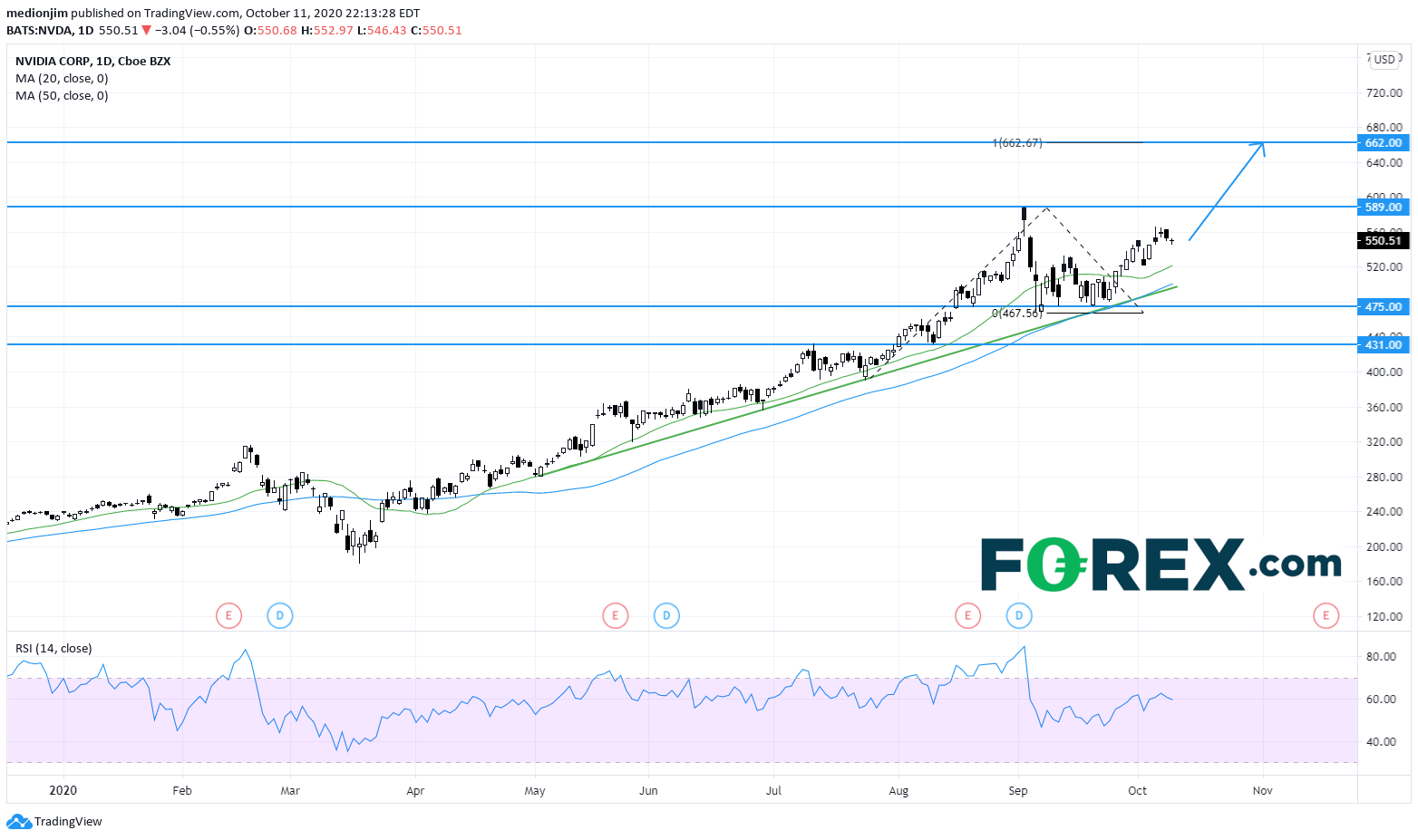

From a technical point of view, the stock is supported by a rising trend line drawn from May. Currently, it is trading above both rising 20-day and 50-day moving averages.

The bullish readers could set the support level at $475, while resistance levels would be located at $589 (record high) and $662 (100% measured move).

Source: Gain Capital, TradingView

In August, the company reported that 2Q EPS was up 10% on year to $0.99 on revenue of $3.87 billion, up 50% from last year. It is expected to release its 3Q result on November 18 with EPS of $1.678 and revenue of $4.41B.

From a technical point of view, the stock is supported by a rising trend line drawn from May. Currently, it is trading above both rising 20-day and 50-day moving averages.

The bullish readers could set the support level at $475, while resistance levels would be located at $589 (record high) and $662 (100% measured move).

Source: Gain Capital, TradingView

Latest market news

Today 07:27 PM

Today 04:20 PM