The three major U.S. stock indices ended higher yesterday, as investors shook off fears over a second coronavirus wave. U.S. economic advisor Larry Kudlow said he is not too worried about the resurgences of Covid-19 cases and it is "highly likely" that the Congress and the White House will coordinate on another fiscal stimulus package after July break.

Technically, the outlook of 3 major indices in the U.S. market remains bullish. Below charts would demonstarte the technical view of those indices.

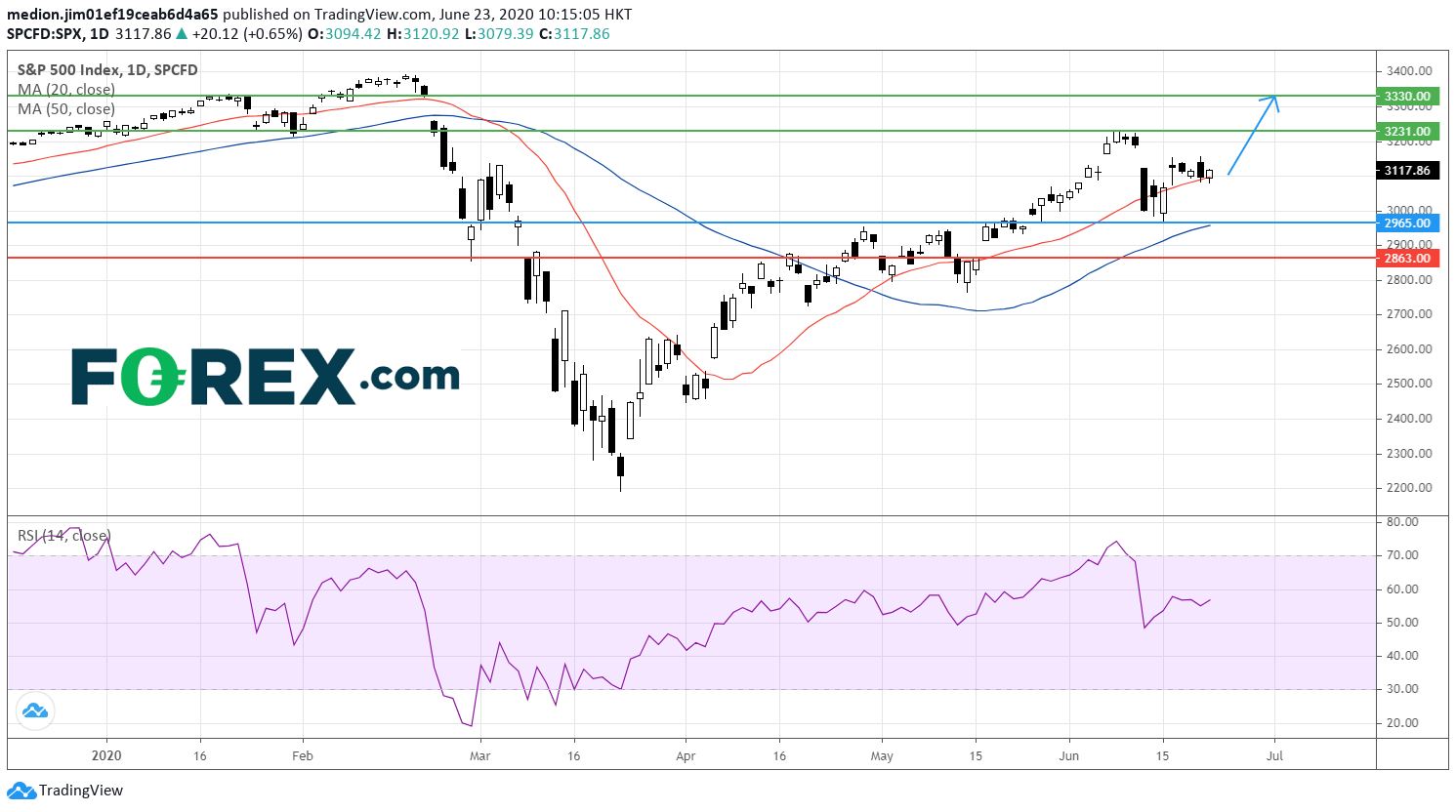

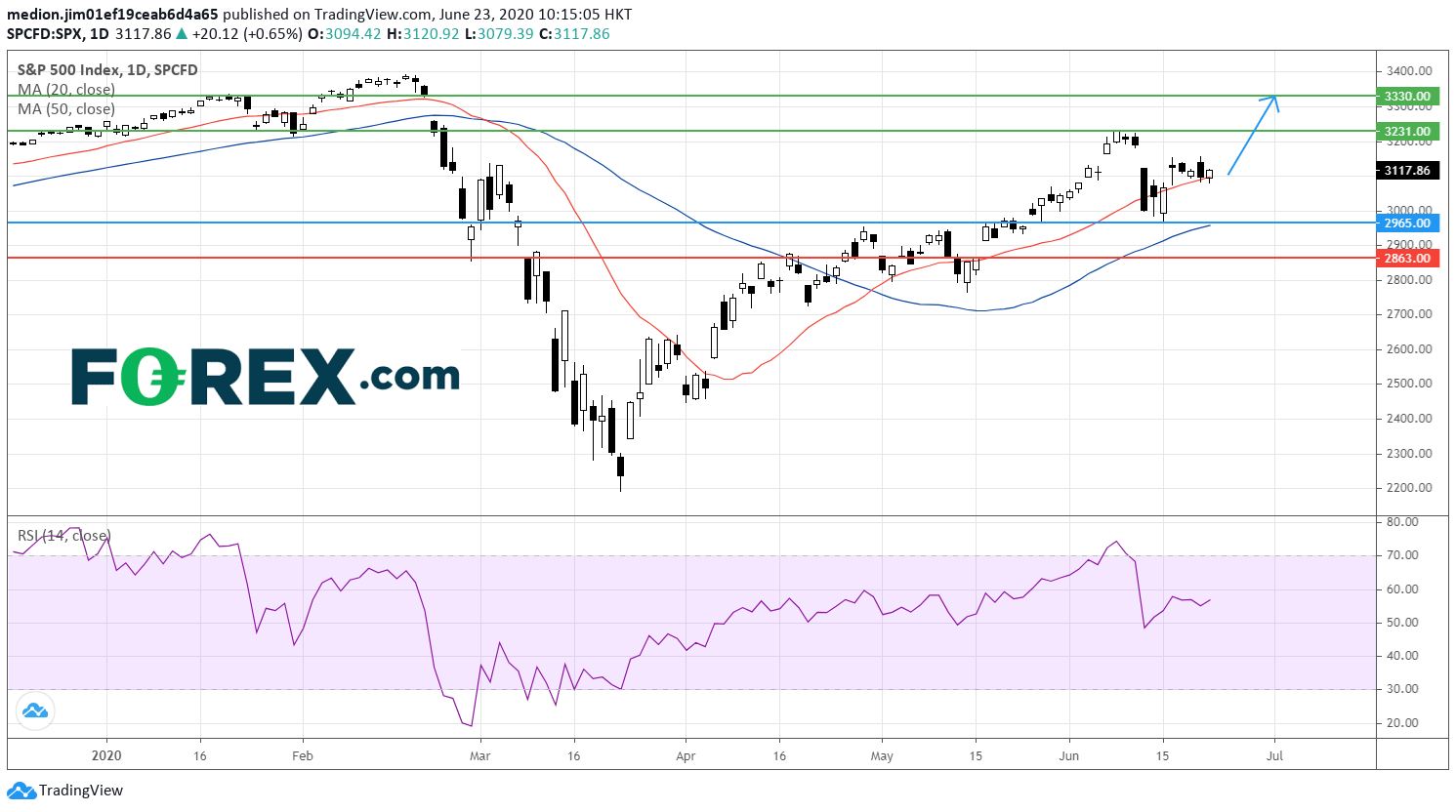

SPX 500 Index:

Source: GAIN Capital, TradingView

SPX 500 Index recorded a series of higher tops and higher bottoms since March low. Currently, the nearest support level of index prices would be located at 2965 (the previous low and the rising 50-day moving average), while the resistance level would be located at 3210 and 3330.

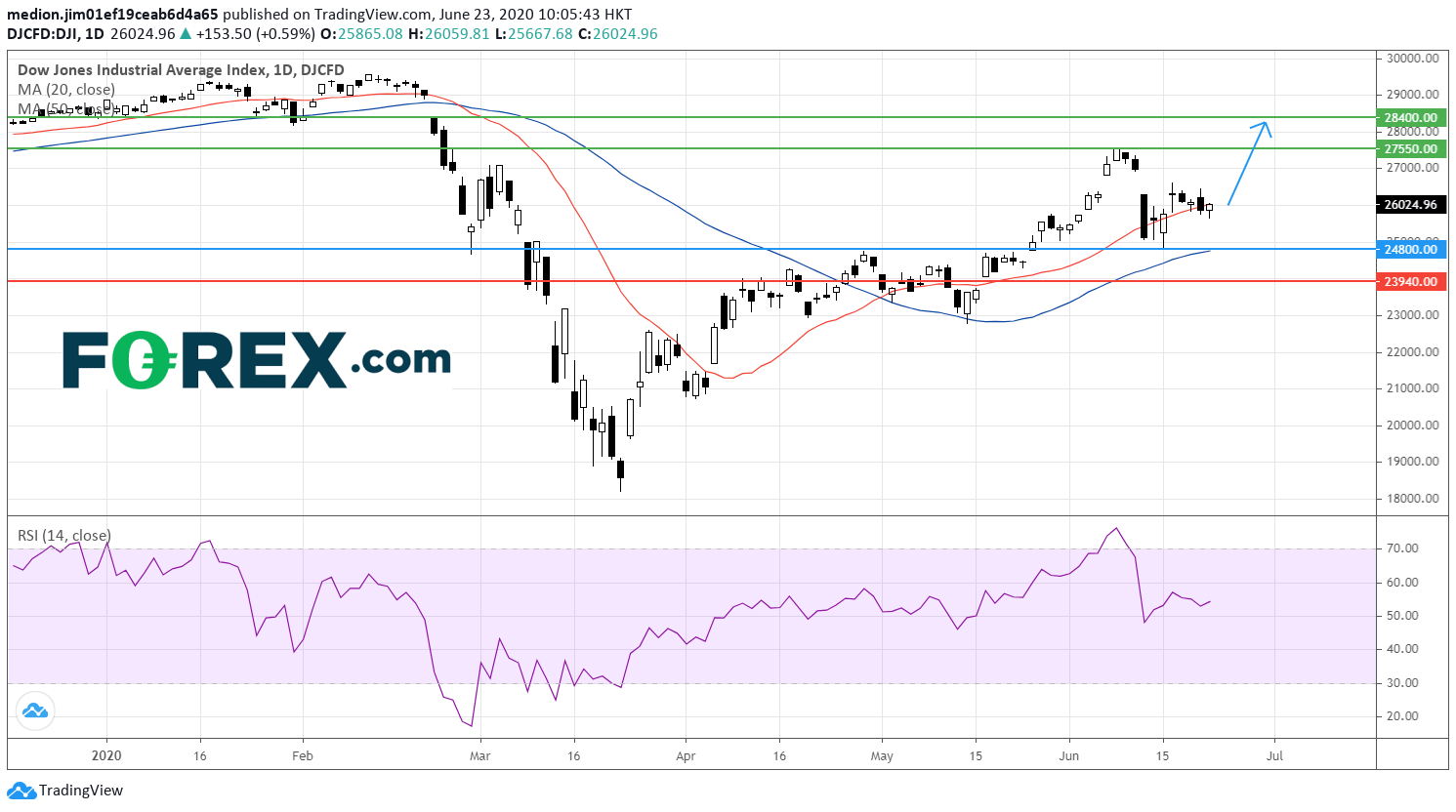

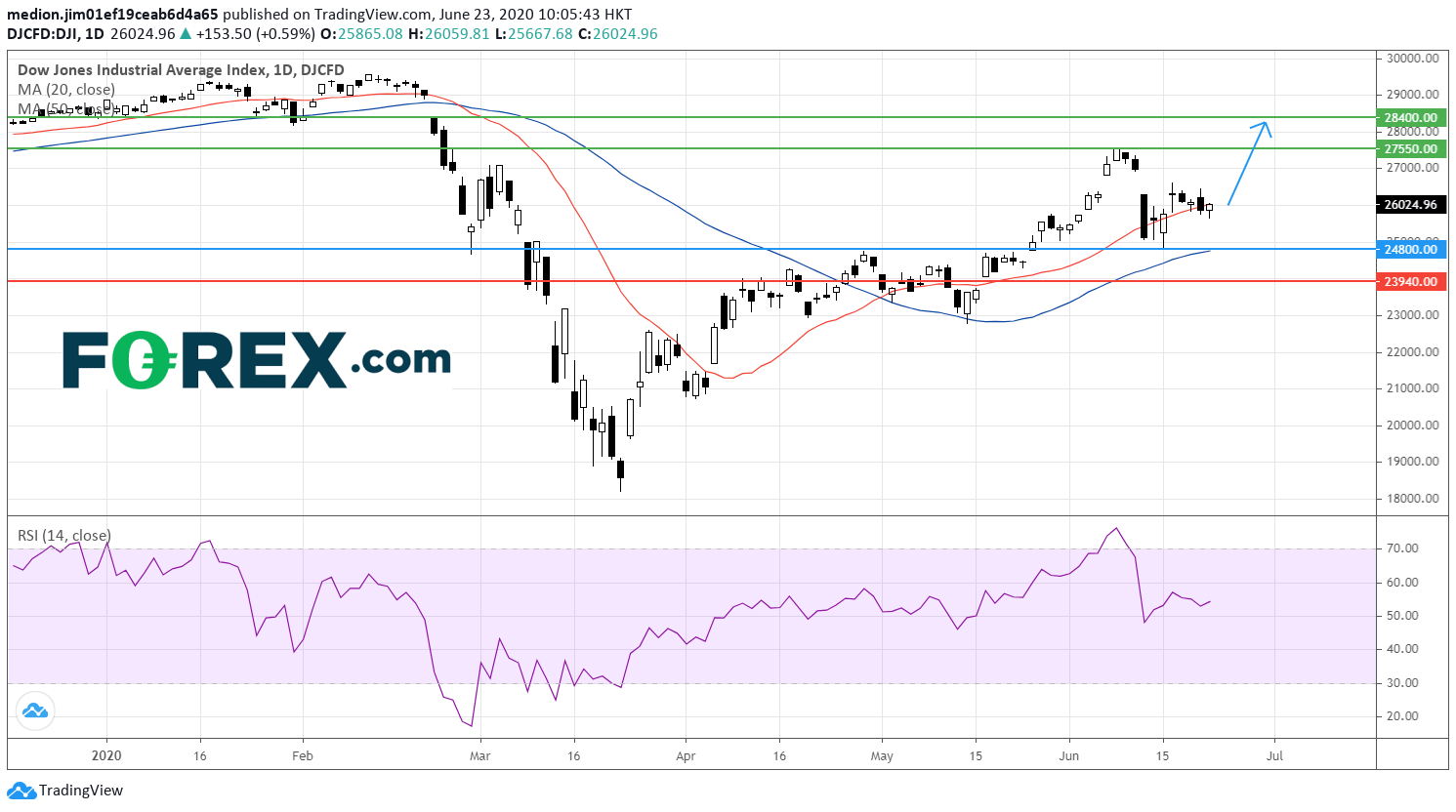

Dow Jones Industrial Average Index:

Source: GAIN Capital, TradingView

Dow Jones Industrial Average remains supported by a rising 50-day moving average. As long as the previous low at 24800 is not broken, the index should consider a rise to the previous high at 27550.

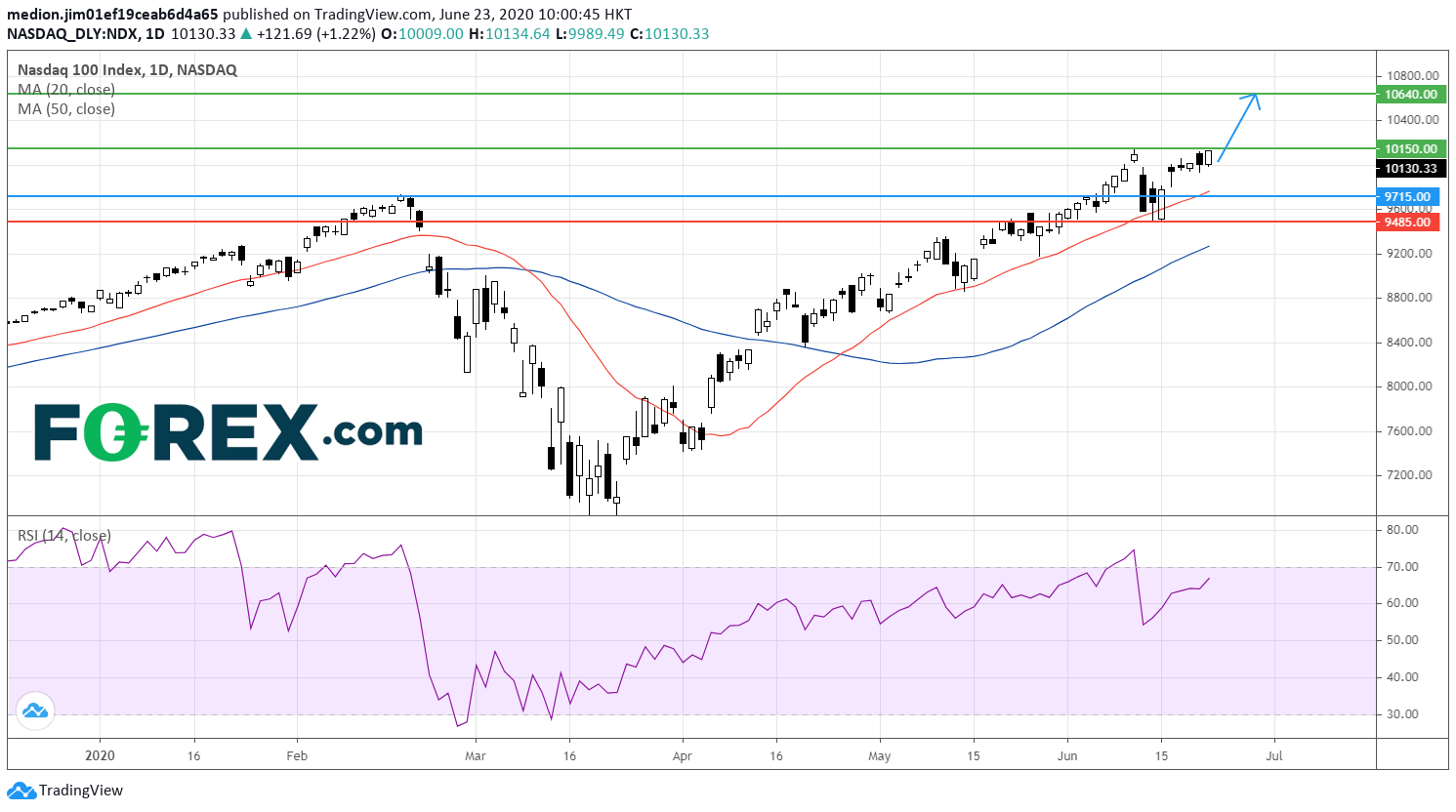

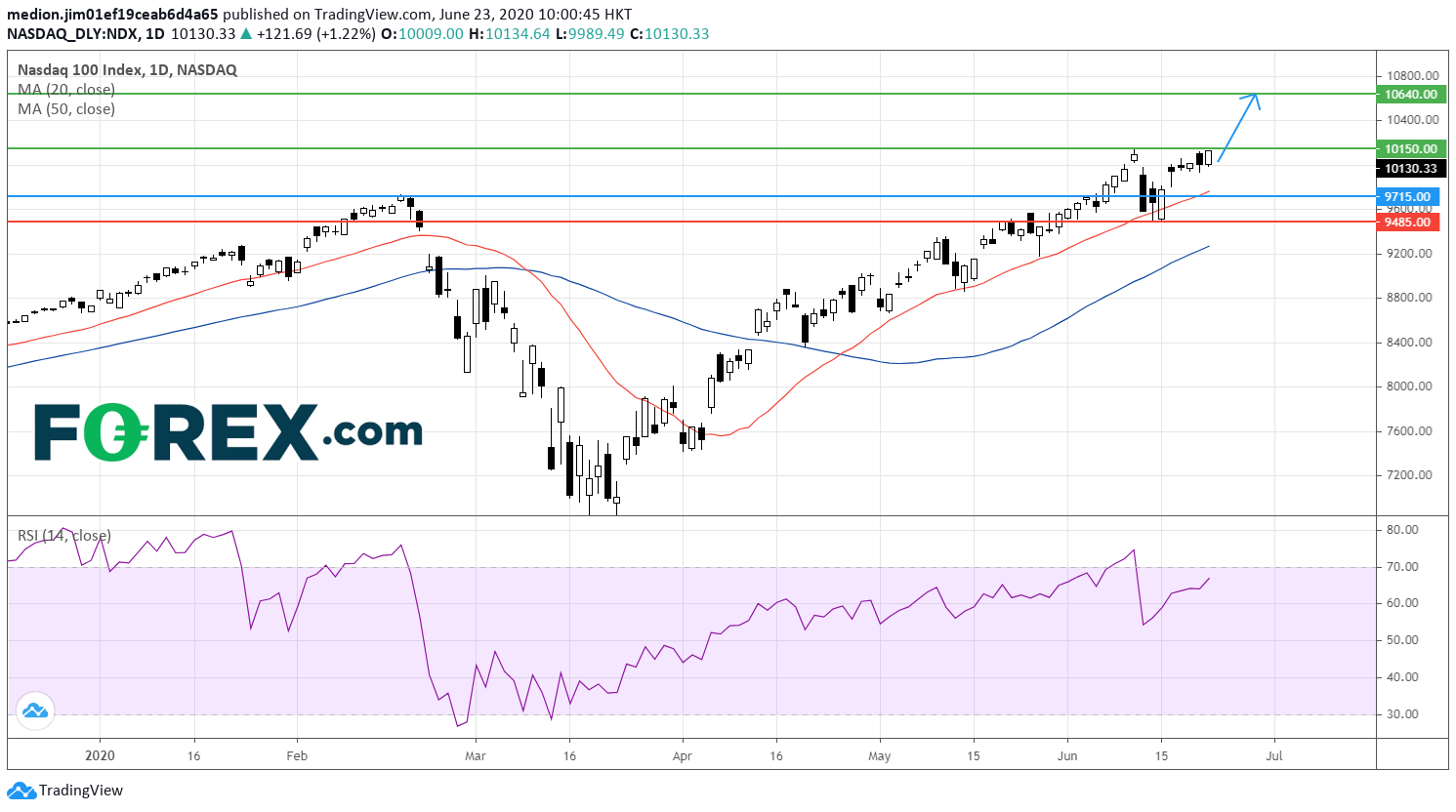

Nasdaq 100 Index:

Source: GAIN Capital, TradingView

The Nasdaq 100 Index is challenging the record high resistance at 10150. A break above this level would bring a rise to 10640. The nearest support level is located at 9715 (around the 20-day moving average).

In fact, the Nasdaq Composite climbed to a record close, with technology companies leading the rally. The change of behaviour caused by the pandemic has confirmed technology's essential role, while investors were also convinced by tech giants' huge cash reserves that will carry them through the crisis. For instance, according to CNBC, Apple (AAPL) has 192.8 billion dollars on hand as of end-March, much

The U.S. market is focused on the technology sectors rather than traditional manufacturers. We could see that the Nasdaq Index is already at the Record high, but the Dow Jones index has not challenged the record high before the outbreak of COVID-19.

Let's take a look on the market capitalization of those IT Giants, such as Apple ($1.56T), Microsoft ($1.52T), Amazon ($1.35T) and Alphabet ($992.67B).

We can see that the difference between the major IT companies and traditional manufactures are so large, as IT giants are able to keep the high growth rate.

Recently, the Federal Reserve announced that they would start to purchase the individual corporate bonds. As market liquidity is increasing, the companies in both sectors should be easier to get the loan from the market.

Technically, the outlook of 3 major indices in the U.S. market remains bullish. Below charts would demonstarte the technical view of those indices.

SPX 500 Index:

Source: GAIN Capital, TradingView

SPX 500 Index recorded a series of higher tops and higher bottoms since March low. Currently, the nearest support level of index prices would be located at 2965 (the previous low and the rising 50-day moving average), while the resistance level would be located at 3210 and 3330.

Dow Jones Industrial Average Index:

Source: GAIN Capital, TradingView

Dow Jones Industrial Average remains supported by a rising 50-day moving average. As long as the previous low at 24800 is not broken, the index should consider a rise to the previous high at 27550.

Nasdaq 100 Index:

Source: GAIN Capital, TradingView

The Nasdaq 100 Index is challenging the record high resistance at 10150. A break above this level would bring a rise to 10640. The nearest support level is located at 9715 (around the 20-day moving average).

In fact, the Nasdaq Composite climbed to a record close, with technology companies leading the rally. The change of behaviour caused by the pandemic has confirmed technology's essential role, while investors were also convinced by tech giants' huge cash reserves that will carry them through the crisis. For instance, according to CNBC, Apple (AAPL) has 192.8 billion dollars on hand as of end-March, much

The U.S. market is focused on the technology sectors rather than traditional manufacturers. We could see that the Nasdaq Index is already at the Record high, but the Dow Jones index has not challenged the record high before the outbreak of COVID-19.

Let's take a look on the market capitalization of those IT Giants, such as Apple ($1.56T), Microsoft ($1.52T), Amazon ($1.35T) and Alphabet ($992.67B).

In traditional manufacturers in the U.S. market, we selected 2 famous manufacturers from Don Jones index. Their market capitalization showed as below Boeing ($106.39B) and Caterpillar ($68.08B).

We can see that the difference between the major IT companies and traditional manufactures are so large, as IT giants are able to keep the high growth rate.

Recently, the Federal Reserve announced that they would start to purchase the individual corporate bonds. As market liquidity is increasing, the companies in both sectors should be easier to get the loan from the market.

In fact, the companies in the IT sector could get the loan to develop the new products to maintain the growth rate. However, traditional manufacturers would focus on company liquidity for the operational use, as the outbreak of COVID-19 hit them seriously. Therefore, IT companies should find a new growth point under the loose liquidity conditions, which share prices could continue to be outperforming.

Latest market news

Today 04:00 AM

Yesterday 11:30 PM

Yesterday 08:00 PM

Yesterday 06:32 PM

Yesterday 02:45 PM

Yesterday 01:33 PM