- Gold analysis: Rising yields and dollar hurt metal

- Will dollar respond to US data this week?

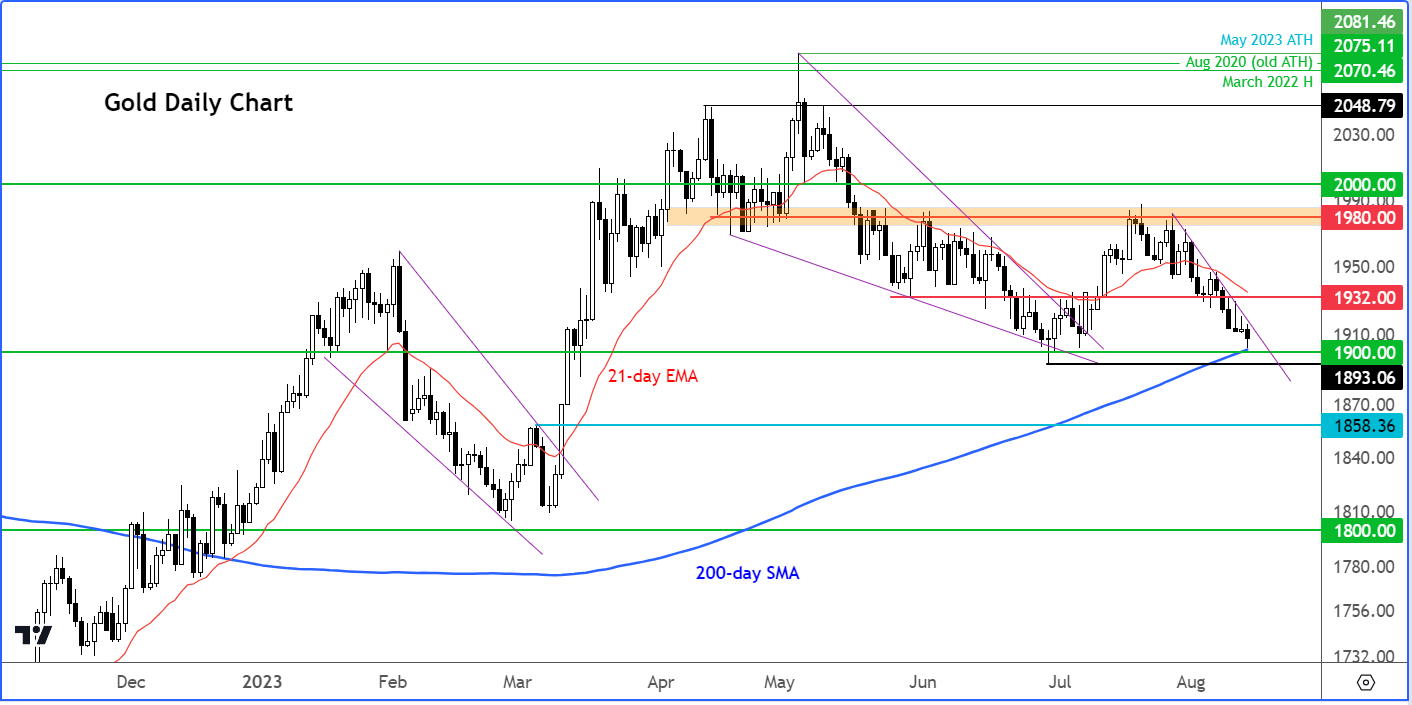

- Gold technical analysis: Drop below $1900 looks increasingly likely

Gold hit its lowest level since June at just above $1900, before bouncing off its lows. The metal has been coming under pressure in recent months because of several reasons, but mainly due to long-dated bond yields remaining elevated is Europe and US, and the fact that the dollar has been trending higher in the last 4 weeks or so.

Will we see the dollar weaken this week? Well, that depends a lot on the direction of risk appetite, as anything else.

Will dollar respond to US data this week?

The slightly softer inflation numbers and a weaker headline jobs report we saw last week failed to cause the dollar to go lower. Therefore, it remains to be seen whether this week’s US retail sales on Tuesday, or the FOMC meeting minutes on Wednesday among several other second-tier data releases throughout the week, will have any major impact. So, we have had pockets of weakness in US data, which should have undermined the dollar and underpin gold, but hasn’t.

So why is the dollar remaining supported?

It could be that the dollar is finding support because of the weakness observed in some equity markets, most notably in China. Here, equities and renminbi both continue to struggle, putting pressure on the positively correlating markets such as the Aussie and kiwi, and thus indirectly boosting the US dollar and undermining gold. Concerns surrounding the perilous financial state of some of China’s largest property developers and the nation’s post pandemic economic struggles have dented investor sentiment.

Also keeping the dollar supported is the economic struggles elsewhere around the world, discouraging investors from building long positions in foreign currencies – although we are starting to see signs of resilience in some economies, for example the UK. Perhaps investors are waiting to see more evidence that the US economy is on a clear downward trajectory, before shunning the dollar again. So, it is important to look for signs of a slowing economy, and not just inflation figures, if you are a dollar bear.

The Fed itself needs more conviction that it is winning the fight against inflation, as some members continue to warn that the central bank still has “more work to do” on prices. Last week saw core inflation ease a tad further to 4.7% while the headline rate edged higher because of base effects to 3.2%, albeit this was better than expected. Price pressures abated nearly across all components, expect the housing market. With interest rates being high, this isn’t going to last very long – we think. And the market agrees, as the probability of another rate hike fell even further.

Gold technical analysis

Gold has fallen in the past 2 weeks and prior to that, there was no clean trend for the metal. The short-term technical outlook therefore remains bearish until we see a clear bullish reversal pattern. With that in mind, the next downside target for gold remains at $1900, the next round handle where we also have the 200-day moving average coming into play.

But with a lack of bullish momentum, prices may need to fall more in the short-term before gold becomes inexpensive in the eyes of the bulls. There’s undoubtedly a lot of sell stop orders below the June low at $1893. This area could be swept soon, given the growing bearish momentum.

On the upside, well there lots of overhead resistance levels, but the most important level is around $1930ish, where we have the 21-day exponential average also coming into play.

But if you zoom out from the recent short-term price action, you will notice that the long-term technical levels on gold are holding, and the metal may push higher again in the not-too-distant future. The bulls must wait for a bullish signal, though, rather than pre-empt any moves as the recent price action has not been too convincing.

Still, it is important not to get too bearish until there is more evidence that the metal has indeed topped out. With the 200-day average sloping upwards, and gold holding its own above the key $1900 support level, there’s still hope for gold bulls, despite the recent bearish price action.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R