GBP/USD looks to PMI data

- GBP/USD supported by hawkish BoE expectations

- UK composite PMI to fall to 50.5 from 51.5

- GBP/USD trades range bound between 1.28 and 1.2645

GBP/USD continues to trade within a familiar range around the 1.2750 level.

The pound is supported by expectations that the BoE will need to raise interest rates further in order to tame sticky inflation. Last week CPI data showed that UK inflation cooled to 6.8% YoY but core CPI remained unchanged at 6.9%. However, GBPUSD hasn’t risen significantly following the release and that could be due to rising concerns over the health of the economy and the impact that further rate hikes are likely to have.

Today’s UK PMI data is expected to show that the dominant service sector activity grew at a slower pace, with the PMI easing to 50.8 in August from 51.5 in July. Meanwhile, the manufacturing PMI is forecast to fall to 45 from 45.3. The composite PMI, a good gauge for business activity, is set to stall at 50.3, from 50.8, whereby the level 50 separates expansion from contraction.

Weaker than expected PMI could raise worries of a prolonged slowdown in the UK economy. The data comes as the BoE warns that the share of UK companies facing debt stress could rise to 50% by the end of the year as higher interest rates mean companies face a higher risk of corporate defaults. This could have a negative impact on employment.

The latest jobs survey points to the UK jobs market starting to cool as vacancies and advertised starting salaries fell in July for the first time this year. This could help cool inflation and pull GBP lower.

The US dollar is pausing for breath around a 2-month high ahead of Federal Reserve Chair Powell’s speech on Friday at the Jackson Hole Symposium. A recent run of strong data has raised expectations that Powell could point to higher rates for longer.

Today US PMI data will also be in focus and a strong print could fuel those bets further.

GBP/USD forecast – technical analysis

GBP/USD continues to trade within a familiar range after failing to break out above 1.28 the 50 sma. The RSI is neutral. Buyers will look for a rise 1.28 to open the door to 1.2840 the June high.

On the downside, sellers will look for a move below 1.2680, the weekly low, to bring the 100 sma at 1.2645 into focus. A break below 1.2616, the August low, creates a lower low.

USD/JPY eases ahead of PMI data & Powell’s speech

- US composite PMI to expected at 52 in August vs 52 in July

- Focus on Fed Chair Powell’s speech on Friday at Jackson Hole Symposium

- USD/JPY consolidating around 9-month high

USD/JPY is heading modestly lower but remains close to 146.00 as investors wait cautiously for Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, where he is expected to provide further cues over the direction of monetary policy.

The USD is subdued as traders abstain from taking on big positions ahead of Friday. However, the pair remains close to its 9-month high on BoJ-Fed divergence.

Recent data from the US has shown that the economy is proving to be persistently strong, which is creating a headache for the Fed as it tries to bring inflation back to 2%. As a result, the market is wary that the Fed could keep interest rates higher for longer.

According to CME data the market is pricing in a 15% probability of a rate hike in September and a 40% probability of a rate hike in November.

Attention is turning to US PMI data which is expected to show that the composite PMI holding steady at 52 in August. Stronger than forecast PMI data could fuel bets of a more hawkish Federal Reserve lifting the USD. However, signs of weakness could pull the USD lower.

Meanwhile, the Japanese yen remains above 145.00, a level that has previously triggered intervention by Japanese authorities. Speculation continues to mount that Tokyo could soon step in to support the currency. However, there is a line of thought that it may take a move above 150.00 to spark another intervention.

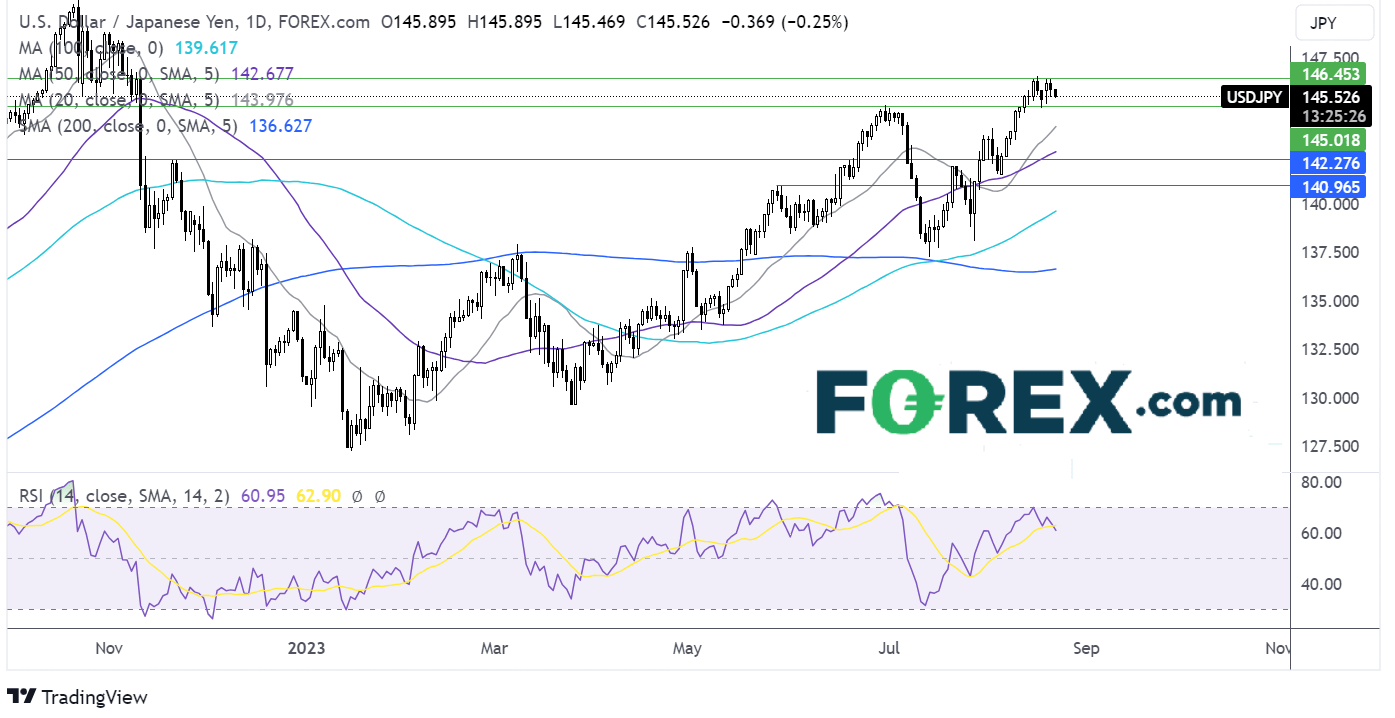

USD/JPY forecast – technical analysis

After a strong run higher USD/JPY is consolidating between 146.50 and 145.00. The pair trades above its 50 & 100 sma which slope higher, suggesting that the upwards path is the one of least resistance.

Immediate resistance is at 145.90 the daily high, with a move above here bringing 146.50 and fresh YTD highs into play.

Sellers will look for a break below 145.00 to create a lower low and expose the 20 sma at 144.00.