GBP/USD falls after labour market data

- UK unemployment rises to 3.9% vs 3.8%

- Average earnings rise by less than forecast to 6.7%

- GBP/USD fall to below 1.25 towards weekly low of 1.2445

GBP/USD is falling after UK labour market data showed that unemployment unexpectedly rose and wages increased by less than expected, suggesting that signs of weakness could be starting to appear in the labour market.

Unemployment to tier two 3.9% in the 3 months to March up from 3.8%. While employment rose by a healthy 182k in Q1, this was accompanied by a sizeable drop in inactivity. Job vacancies also continued to decline, supporting the view that the jobs market could be loosening around the edges.

Meanwhile, average earnings excluding bonuses rose 6.7% in the 3 months to March, up from 6.6%, less than the 6.8% increase forecast.

The data comes after BoE Chief Economist Huw Pill said that the central bank’s ability to pause interest rate hikes will depend on upside risks to inflation, such as wage growth and labour market tightness. This data could be more supportive of the view that the BoE could pause rate hikes, hence the selloff in the pound. However, inflation data will now be key.

Separately the USD is pushing higher, boosted by hawkish Fed chatter, as Fed speakers remain focused on the fight against inflation.

US debt ceiling talks are set to resume between Joe Biden, House Speaker Steve McCarthy and several Congressional leaders later today.

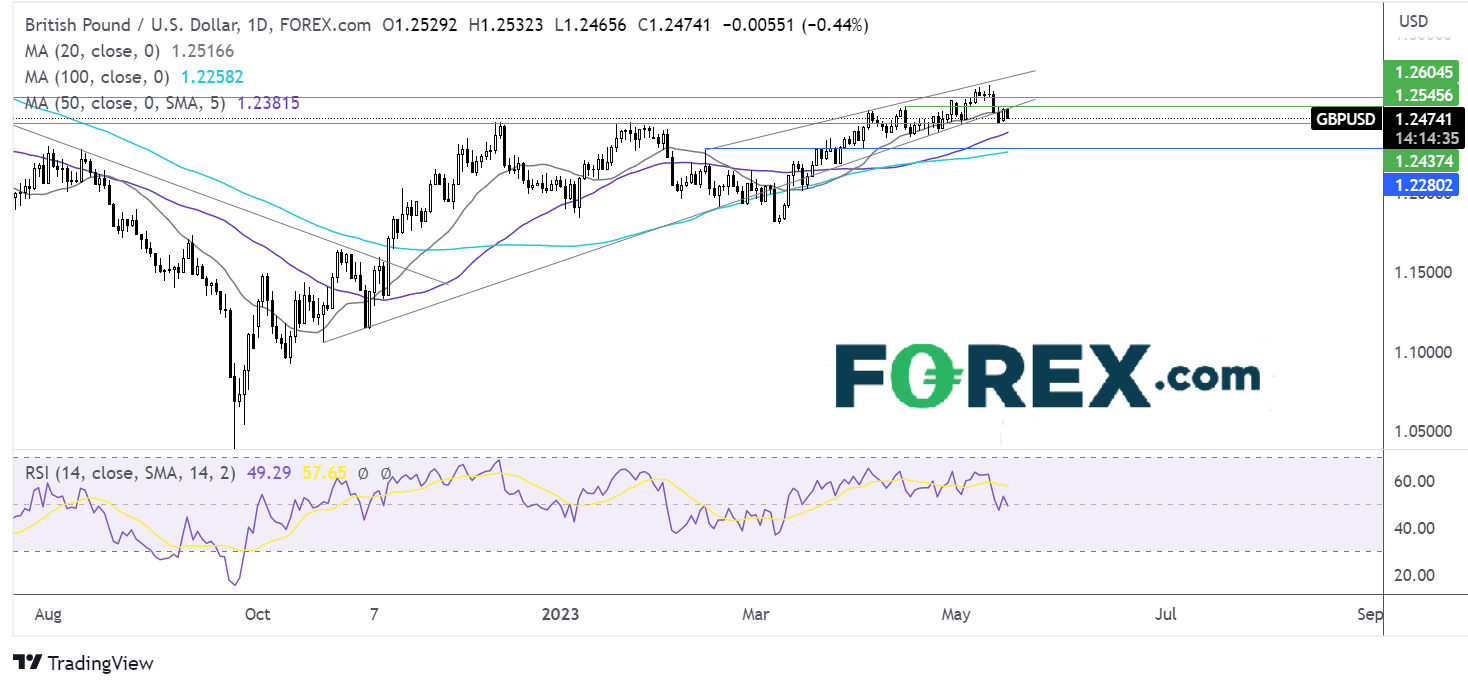

GBP/USD forecast: technical analysis

GBP/USD failed to retake the 20 sma, instead rebounding lower, falling below 1.25, the psychological level as it heads towards the weekly low of 1.2445. A break below here creates a lower low and exposes the 50 sma at 1.2380 and the April low of 1.2275.

On the flip side, buyers need to rise above the 20 sma and rising trendline resistance at 1.2516 and the weekly high of 1.2540 to bring 1.26 round number into play.

EUR/USD rises cautiously ahead of GDP, German ZEW economic sentiment data

- EZ Q1 GDP set to confirm 0.1% growth

- US debt ceiling talks, retail sales in focus

- EURUSD tests rising trendline support

EUR/USD is edging higher for a third straight session as investors look ahead to a busy line both in Europe and the US.

Eurozone Q1 GDP data is expected to show modest growth of 0.1%, keeping the region out of recession. The data comes after the EU Commission upwardly revised its growth forecast for te year to 1% and also upwardly revised its inflation outlook to 5.8% for 2023. Hotter inflation could keep pressure on the ECB to maintain high-interest rates.

German ZEW economic sentiment data is also due and is expected to decline to -5.3 in May after unexpectedly falling to 4.1 in April.

Meanwhile, the USD is edging cautiously higher versus a basket of major currencies, ahead of key debt ceiling talks later today. Comments from House Speaker that talks “aren’t in a good place” weigh on risk sentiment.

US retail sales are also due to be released and are expected to show that sales rose 0.8% MoM, after falling -0.6% in March. Stronger sales could support the view that the Fed could hike rates again in June, after Fed official Thomas Barkin said that he saw no barriers to hiking rates again in June.

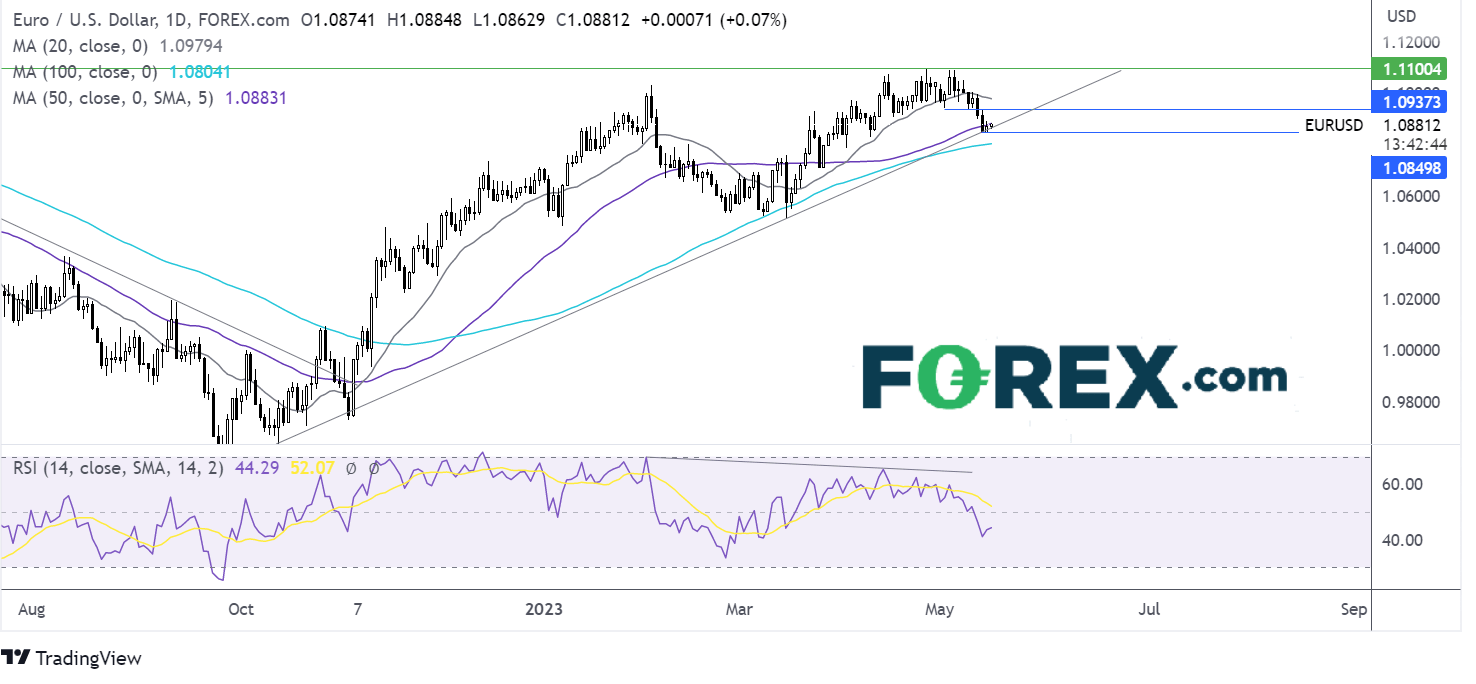

EUR/USD forecast:

Having rebounded lower from 1.10 at the start of the month, EUR/USD is testing the multi-month rising trendline support and the 50 sma. Sellers, supported by the RSI below 50, need a break below this support to create a lower low and extend the selloff towards 1.08 the 100 sma and 1.0790 the April low.

Meanwhile, should buyers successfully defend the rising trendline and rise above 1.0935 Friday’s higher, bulls could look to target 1.10.