- EUR/USD outlook: Loss of risk appetite among reasons behind dollar strength

- Economic data highlights for EUR/USD include German CPI and US Core PCE Price Index

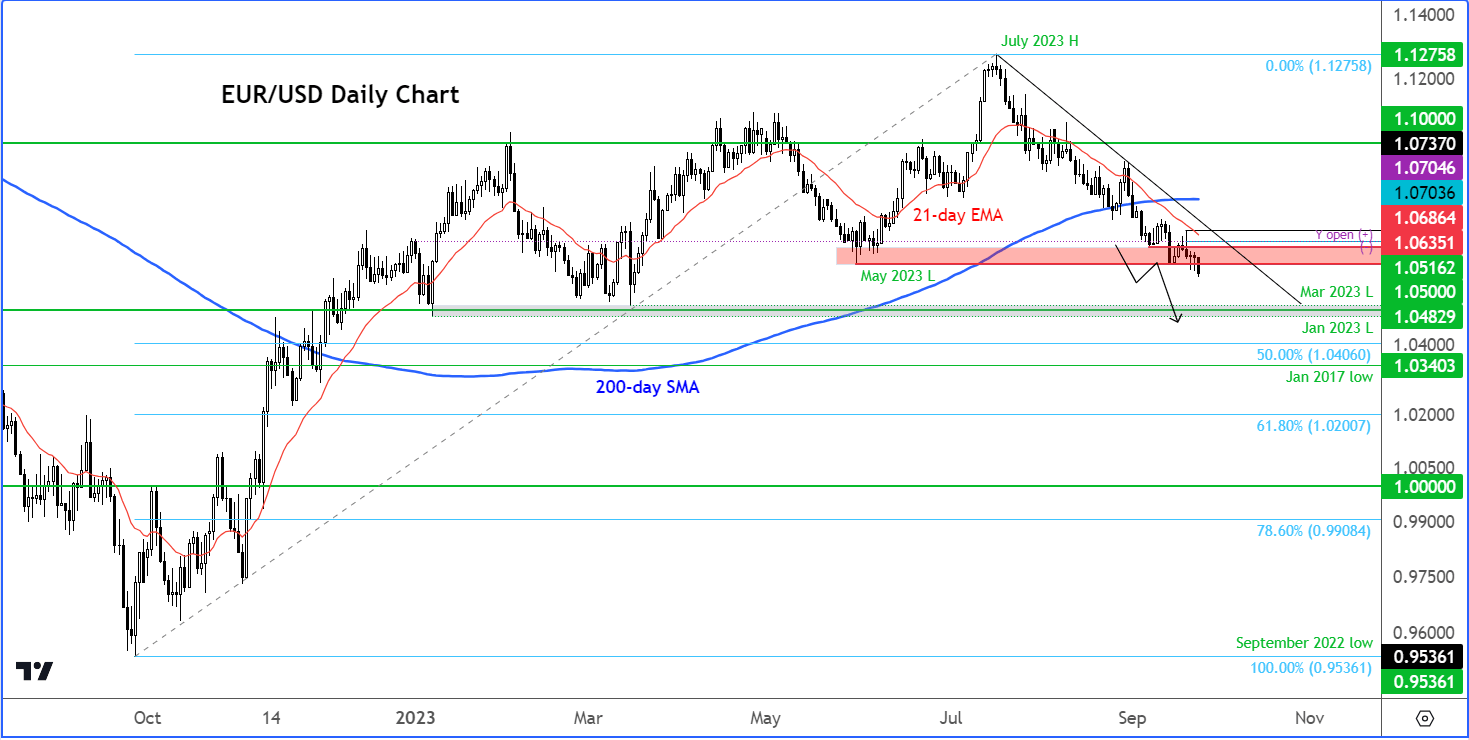

- EUR/USD technical analysis: Bears eye 1.05 as another support gives way

The EUR/USD has been among a growing number of major FX pairs breaking to fresh multi-month lows. Today it broke below 1.06 handle for the first time since March. The euro’s latest losses come after the Dollar Index ended higher for the tenth consecutive week and as risk appetite remained low across financial markets, with major indices breaking further lower this morning. The EUR/USD will be among the key FX pairs to watch this week.

EUR/USD outlook: Loss of risk appetite, rising US yields underpin USD

Markets have struggled in recent weeks amid concerns over rising oil prices and bond yields, subdued economic activity across the global manufacturing sector and still-high inflation in major developed economies. As a result, investors have lost appetite for taking on too much risk. They have been selling stocks and buying dollars. Traders have been happy to sit on the offer and slam the EUR/USD and other asset prices back down each time we see a bit of relief rally. Even gold has fallen today amid rising bond yields and the dollar.

The US 10-year yield has now broken another psychological barrier at 4.50%:

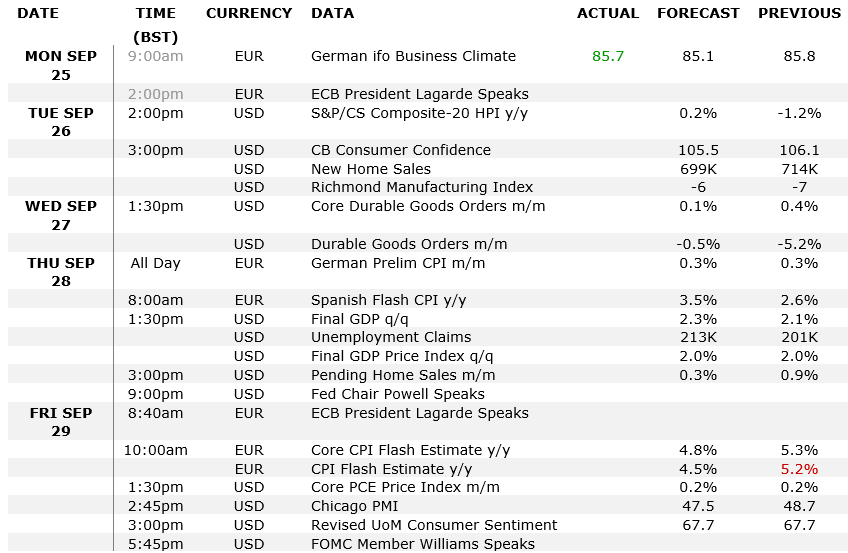

Economic data highlights for EUR/USD

The EUR/USD will remain in focus with this week’s economic calendar containing plenty of Eurozone data and a couple of US pointers to look forward to.

German ifo Business Climate

Monday, September 25

09:00 BST

Monday’s publication of German ifo Business Climate failed to offer any help to the downbeat currency, as it deteriorated further. The index, which is based on 9,000 surveyed manufacturers, builders, wholesalers, services, and retailers, has now declined for 5 straight months, further fuelling concerns over the health of the Eurozone's biggest economy.

German Prelim CPI

Thursday, September 28

12:00 BST

The ECB was among the more dovish of central banks in September, causing the euro to fall against most major currencies. The single currency is in focus again this week, with the publication of several Eurozone macro pointers, including German ifo Business Climate (see above). Perhaps the most important data could be the German CPI which would come a day ahead of the Eurozone CPI (Friday) estimate. The euro bulls would need to see a strong print to help arrest the single currency’s decline.

US core PCE Price Index

Friday, September 29

13:30 BST

Last week’s hawkish pause from the Fed triggered a sharp sell-off in stocks and bonds, while lifting yields and the dollar higher. The Fed is worried about inflation and oil prices remaining high. Investors are worried the Fed’s tightening cycle may not be over just yet, after the central bank’s strong inclination towards rate cuts being pushed further out in 2024, with the possibility of one more hike before the end of this year. If the Fed’s favourite inflation measure – the Core PCE Price Index – also mirror the CPI from a couple of weeks ago and come in higher, then this should further support the dollar. A noticeable miss is what the dollar bears, or EUR/USD bulls, would be desperate to see.

Here are the rest of this week’s data highlights, relevant to the EUR/USD pair:

So, we have plenty of Eurozone data to look forward to this week, including inflation figures from Germany and the Eurozone. However, Friday’s Core PCE aside, it is going to be a quieter one for US data, which could provide an excuse for the dollar longs to book some profit after such as strong rally. That being said, we will only turn bearish on the dollar once a trend of weaker data emerges for the world’s largest economy. Until then, we would expect any short-term weakness for the dollar to fade. Put another way, any short-term strength in EUR/USD is likely to be short-lived for as long as US data remains relatively stronger than Eurozone data.

EUR/USD outlook: technical analysis

While this week’s macro calendar is quieter, markets could remain lively, as we have already seen so far in Monday’s session. As more and more support levels break down, this is likely to trigger follow-up technical selling.

For the EUR/USD, the line in the sand was around 1.0635, the May low. Once this level gave way, we saw further selling pressure come in to drive rates below 1.06 handle for the first time since March.

If the EUR/USD closes Monday’s session (well) below that broken 1.0635 level, then any short-term strength back into the 1.0600-1.0635 area later in the week could well get faded into, keeping the bearish trend alive.

The next downside target is around the 1.05 handle, which is where the lows of January (1.0483) and March (1.0516) were approximately formed.

A higher high is now needed for the EUR/USD bulls. The most recent high prior to the latest breakdown is last week’s high at 1.0737. This is now the line in the sand for many bearish speculators.

Source for charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R