When yen bulls increase their long exposure by 40% in a week, it is probably worth noting. Especially when large speculators had pushed net-short exposure to a 6-year high the week prior. Every turning point must start somewhere, and I continue to suspect this turning point already has.

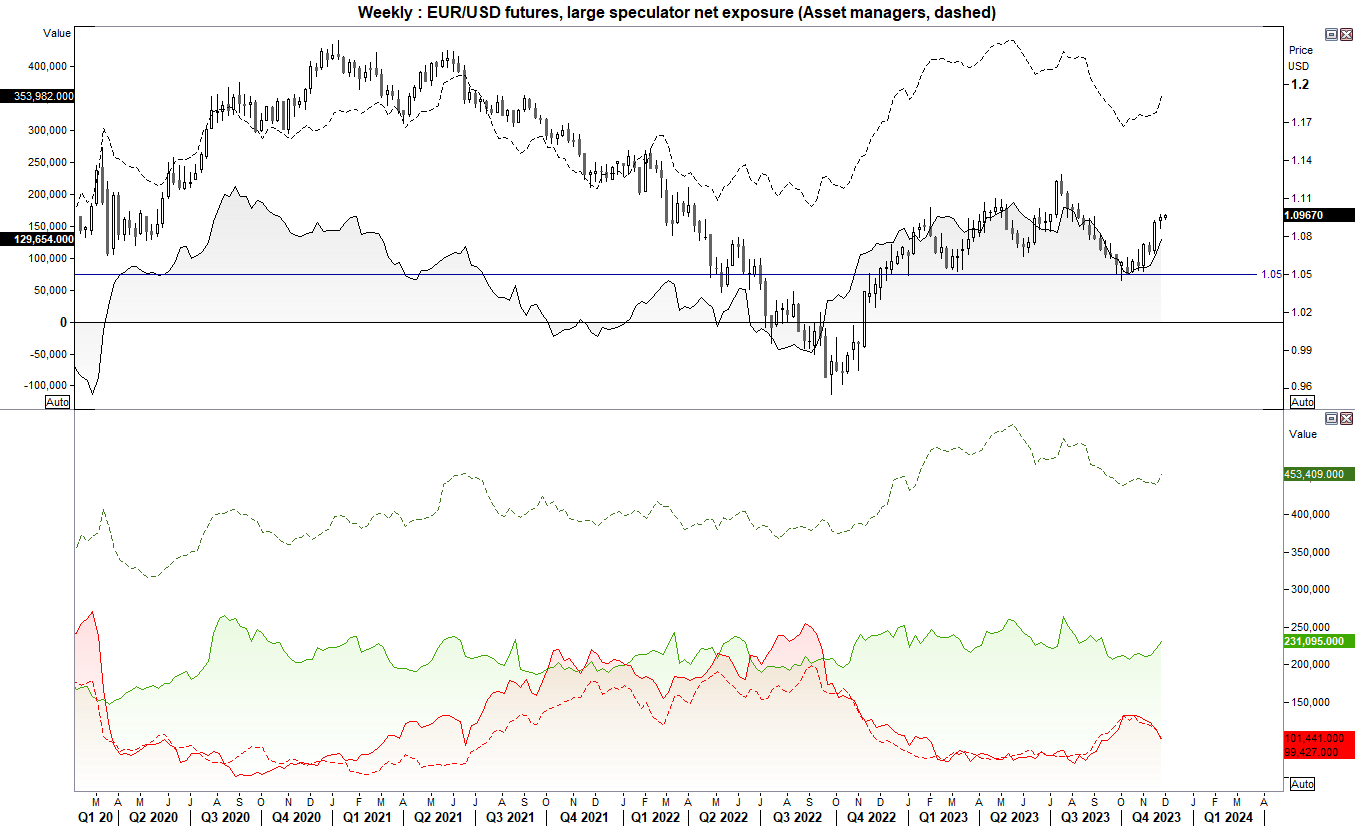

The Euro rally may also have some juice left in the tank looking at the combination of short covering and now longs being added in its favour.

For anyone wondering whether US indices have pushed their luck with their recent rally, take a look at how real money accounts are positioned on Nasdaq futures as they remain very bullish indeed. If there is cause for concern for US markets, it may be that the rally on S&P 500 and the Dow Jones have also retested their recent peaks yet asset managers have not piled into these longs to justify their rallies.

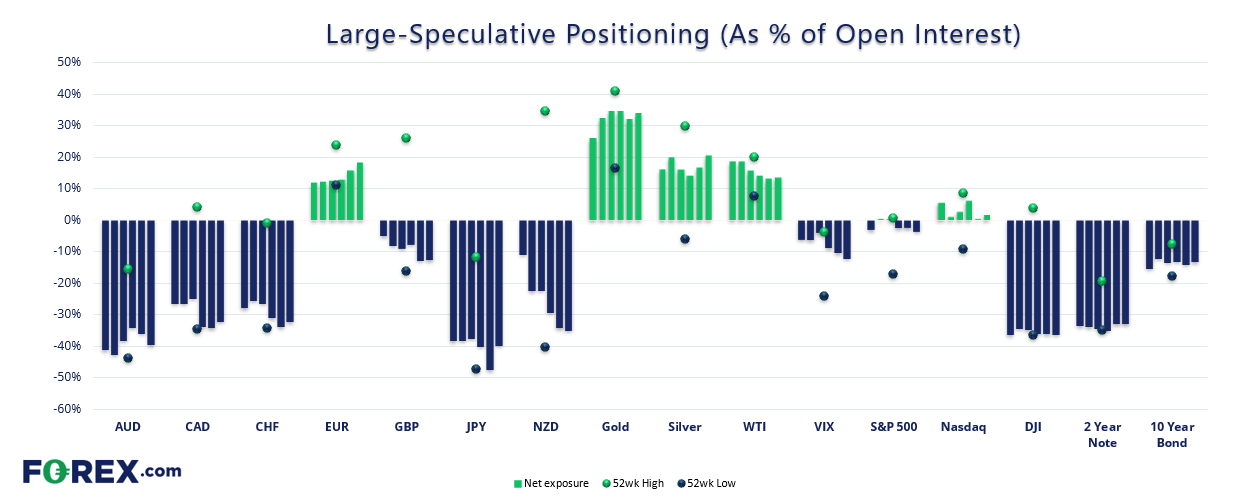

Large speculative COT positioning (as of Tuesday 21st Nov, 2023):

- Net-long exposure to EUR/USD futures rose for a third week to an 11-week high

- Yet net-long exposure to US dollar index futures (also) also rose

- Net-short exposure to Canadian dollar futures (CAD/USD) decreased for the first week in eight

- JPY futures traders increased gross longs by 41.3% last week and reduced shorts by -8.4%

- Net-short exposure to VIX futures rose to an 8-week high (which implies lower expectations of volatility for the S&P 500 in 30 days)

JPY/USD (Japanese yen futures) positioning – COT report:

I once again raised the alarm for a potential sentiment extreme on yen futures, and it now seems the tide is finally turning. We saw the combination of longs added and shorts reduced while the yen continued to strengthen, just one week after net-short exposure rose to a 6-year high. Specifically, large speculators increased long exposure by 41.3% and reduced shorts by -8.4%, which saw net-short exposure fall at its fastest pace in 18 weeks.

EUR/USD (Euro dollar futures) positioning – COT report:

Both large speculators and asset managers reduced their short exposure to EUR/USD futures for a fifth week and increased long exposure last week. Much of the euro’s rally has been a bet against the US dollar as opposed to a bet on Europe, but with the ECB now done with hikes and traders now pricing in Fed cuts, I still see the potential for a higher EUR/USD over the coming weeks.

Nasdaq, Dow Jones, S&P 500 asset manager positioning – COT report:

Asset managers continue to favour the Nasdaq 100 over the Down Jones and S&P 500, according to positioning of asset managers. Net-long exposure to Nasdaq futures rose to a 6-year high, yet still is only around half the level of net-long exposure seen around 10 years ago. It is also worth noting that exposure to the Nasdaq is the only one to hit a new cycle high among the ‘big three’ US indices, with the Dow Jones remaining in net-short exposure and the S&P 500 net-long exposure remaining well beneath its September peak.

So as much as I wince looking at the Nasdaq perched around its cycle high on low volatility, there are some deep pockets betting on the Nasdaq. And that means it remains a preferred market to long during bullish times, whereas the Dow may be the preferred short during bearish times.

WTI crude oil (CL) positioning – COT report:

We’re yet to see bulls return to crude oil futures, but once again we see the appetite to short the market dwindle. Just 2k short contracts were added last week, although at the same time we’re seeing long closed out as well. The main take from this is that we may be closer to the end of the bearish move than the start, although we’re yet to see speculators bid it in a meaningful way. And we may need to wait for an OPEC surprise later this week