Gold, XAU/USD Talking Points:

- Gold prices continue to display digestion after the massive moved that showed up between early October and early December.

- Gold had pulled back below the $2k level ahead of the FOMC rate decision and then volleyed back above the big figure after Powell took on a very dovish tone. But, since then, gold bears have not been able to test back-below the $2,000 level and there’s been a hold of support at a confluent spot on the chart.

- I remain of the mind that the sustained bullish trend in gold beyond the 2k figure happens after the Fed formally flips, which does not appear to be taking place in the next couple of months. This can leave gold vulnerable to strong U.S. economic data that extends expectations for when that first cut might take place.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday. It’s free for all to register: Click here to register.

The U.S. Dollar put in its strongest two-day rally in a year, and yet gold prices held higher-low support, refusing to push below the $2,000 psychological level. The last time that spot XAU/USD traded below that level was ahead of the December FOMC rate decision, and that was notable as that was around the time that Powell began to talk up the prospect of rate cuts.

While he seemed a bit less-dovish last week and remained non-committal around the timing of cuts, he similarly talked down the prospect of any additional hikes and that’s helped gold to maintain support above the key psychological level. The NFP report on Friday was jarring to that theme as the report beat on all counts: The headline number smashed expectations and the unemployment rate came in at 3.7% v/s the 3.8% that was expected. The Average Hourly Earnings portion of that report, which points to inflation via wage growth, printed at 4.5% against a 4.1% expectation. And for a Federal Reserve that really seems like they want to cut, that’s not helpful.

That NFP report pushed the strongest two-day rally in the USD in a year; since last February’s NFP report, as a matter of fact (where resistance showed at 103.00 which, perhaps coincidentally, was support in DXY last week just ahead of the NFP report).

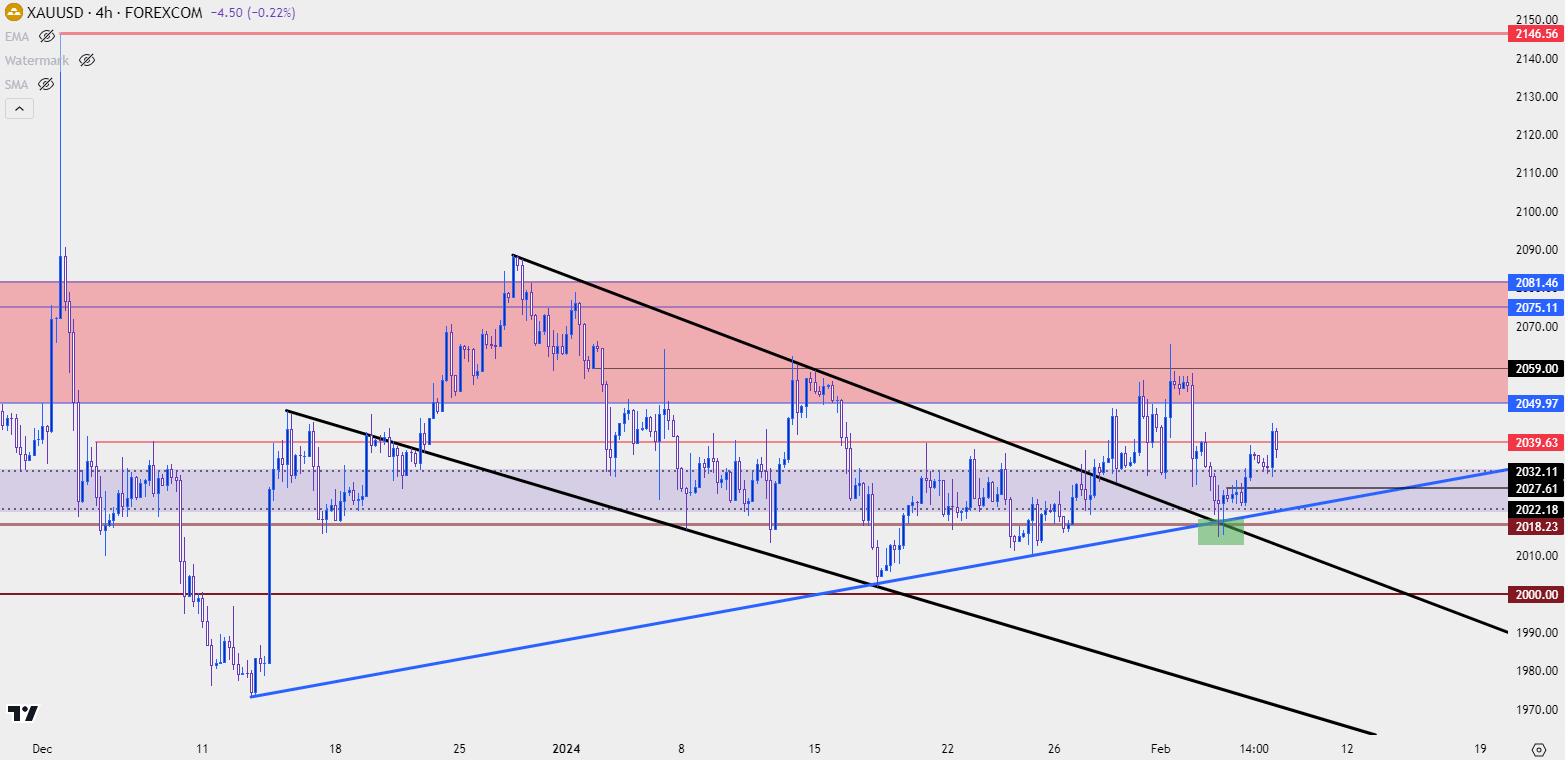

But gold held up well, all factors considered. The Friday breakout in the USD helped to push a pullback in gold and with the dollar continuing its run-on Monday trade, gold continued to pullback, finally finding support at a familiar spot on the chart of $2,018; and there were a few other items also going on at that point. There was also the resistance side of the falling wedge that had broken earlier in the week (in black, below) along with a bullish trendline connecting the December and January swing lows (in blue).

Gold (XAU/USD) Four-Hour Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

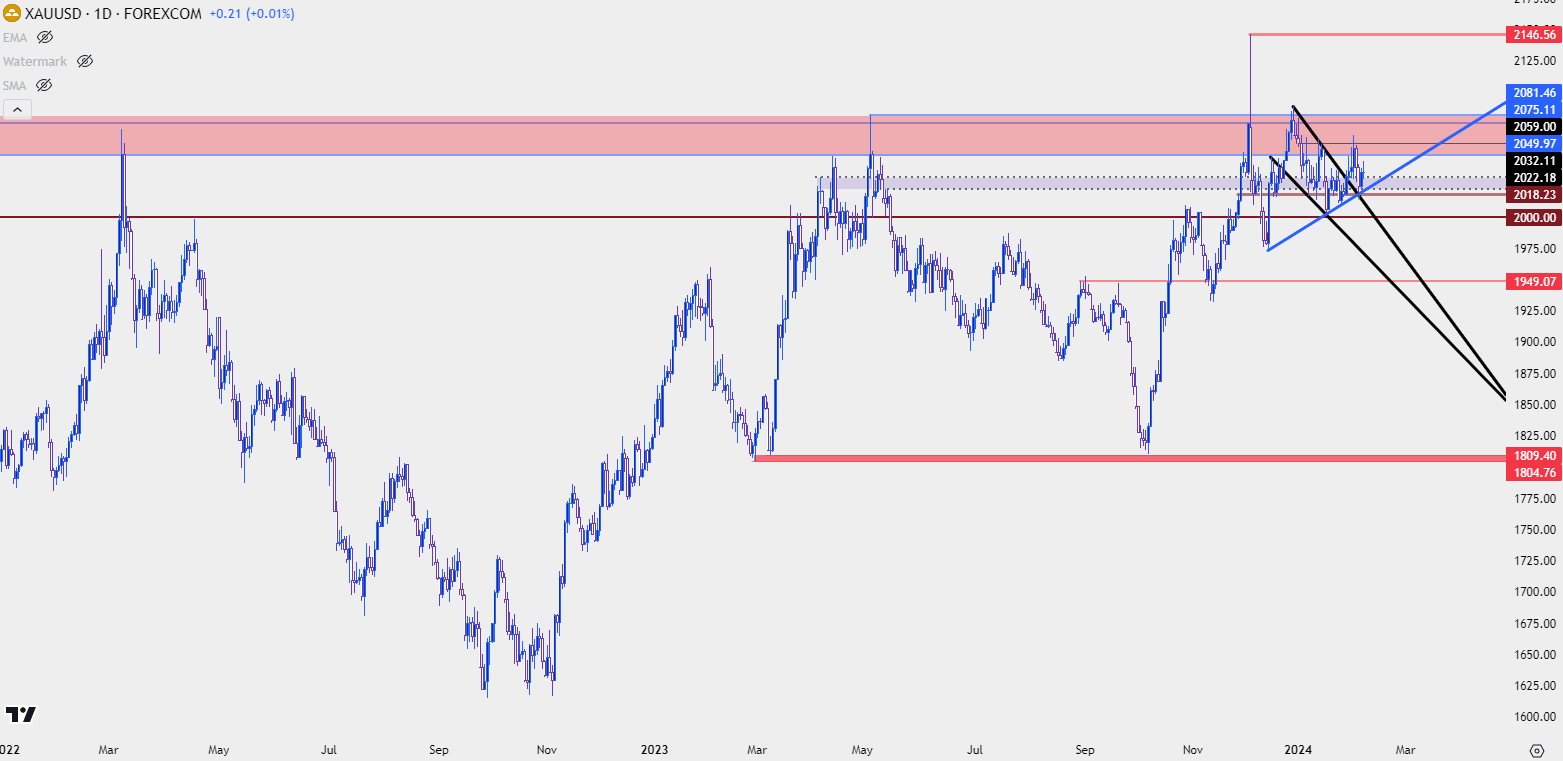

Taking a step back to the daily chart illustrates the congestion that has taken hold. While gold does remain at longer-term resistance, threatening the prospect of breakout continuation of the range that’s held for more than three years, bulls haven’t yet shown much drive beyond the 2059 level that came in to help hold the highs last week. Sure, there have been flickers, but little for sustained drive thus far.

There was an aggressive trend pricing in after extreme-oversold conditions flashed in early-October. Initially, it was a springboard move from support up to the 2k level, which began to pullback. But that trend got another shot-in-the-arm for continuation around the release of CPI in mid-November. That got bulls back in the driver’s seat which pretty much lasted until the spike at the weekly open on December 4th, which I’ve talked about before.

That failed breakout let to a strong pullback; but, once again, the topside got pushed with a bearish-USD item around the December FOMC rate decision, which prodded gold back above $2k and it hasn’t been back-below since.

What has shown, however, has been some aggressive digestion. There are bullish items that can be grasped on to, however, such as the build of a falling wedge which broke last week, or the hold of a bullish trendline connecting December and January lows.

The big question at this point is whether bulls can muster a different response on subsequent re-tests of resistance around the $2,059 level. And, if they can break that, how will they fare at resistance of $2,075 or $2,082?

Gold Daily Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

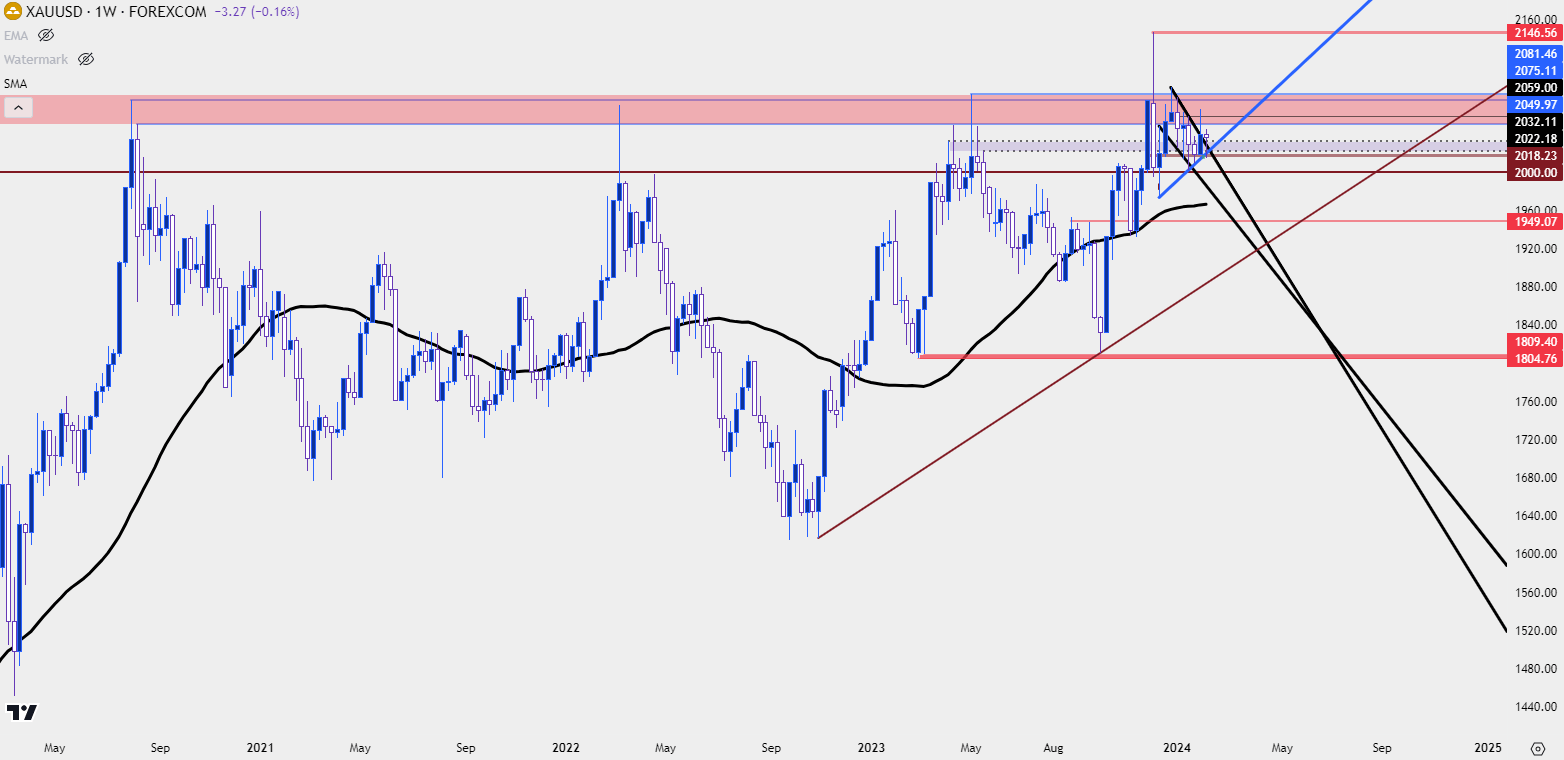

Gold Longer-Term Scenario Plotting

Going out to the weekly chart highlights the range that held since the summer of 2020. Even as the Fed was heavy handed on loose policy in late-2020 and 2021, gold continued to range with a tendency for resistance to hold around the $2,050-2,075 area.

Bears went on the attack last year as summer rolled in, right around the time that the USD was trying to form a bottom. And as rates rallied into October along with the U.S. Dollar putting in 11 consecutive weeks of gains, gold prices were smashed-lower.

But what was different that time is that bulls stepped in above the $1800 level, and that portion of the range never completed. The next attempt at resistance at $2,050-$2,075 led into that breakout, along with a print of a fresh ATH, even though that move couldn’t hold. But, as you can see from the weekly chart, buyers have been holding the line and there’s been an inability for bears to push below the $2k level.

In my opinion – this is an example of buyers holding on for the possibility of some dovish push from the Fed. But I think that’s an item that takes place later this year, which would mean that those expectations for a dovish Fed and a soft USD would need some form of a jolt to finally give gold bears the wherewithal to push below the $2,000 psychological level.

Until that happens, the short-term bullish structure that’s held in gold can keep the door open for buyers looking for a re-test of $2,059.

Gold Weekly Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist