The European Central Bank (ECB) and Bank of Japan (BOJ) have divergent policies, with the ECB amid an easing cycle and the BOJ more likely to hike next year. But if we also factor in the likely turbulence of another Trump presidency, the demand for the yen as a safe-haven could also play an important factor in 2025.

And regardless of whether it will be divergent monetary policies of risk-off flows which drives EUR/JPY lower next year, I feel that EUR/JPY bulls have seen the best part of the move after a 5-year rally, and the greater rewards could await bears at next year.

EUR/JPY technical analysis (1-year and monthly charts):

It’s not every day I look at a 1-year candlestick chart, but if want to anticipate the trade of the year, it could be a good start. And upon doing so, three things stand out:

- EUR/JPY is on track for a fifth consecutive bullish year

- It has failed to hold above the 2008 high set amid the global financial crisis (GFC)

- An upper wick has formed, which puts this year on track for a shooting star reversal (bearish)

A closer look at the monthly chart reveals a strong rally from the 2020 low to 2024 high, before the volatile shakeout that saw prices plunge back below the GFC high. It appears that we have seen the first leg lower of a countertrend move, which implies at least one more dip lower next in 2025 as part of an ABC correction.

Assuming wave B landed at 166.82, a 100% projection sits near the 50% retracement level of the rally from the 2020 low around 144. Interestingly, a 138.2% projection lands almost precisely on a 61.8% retracement level of 137.71, whereas a 161.8% projection is just below 133. If these targets seem far-fetched, it should be remembered that yen pairs such as EUR/JPY tend to fall hard and fast during times of turbulence.

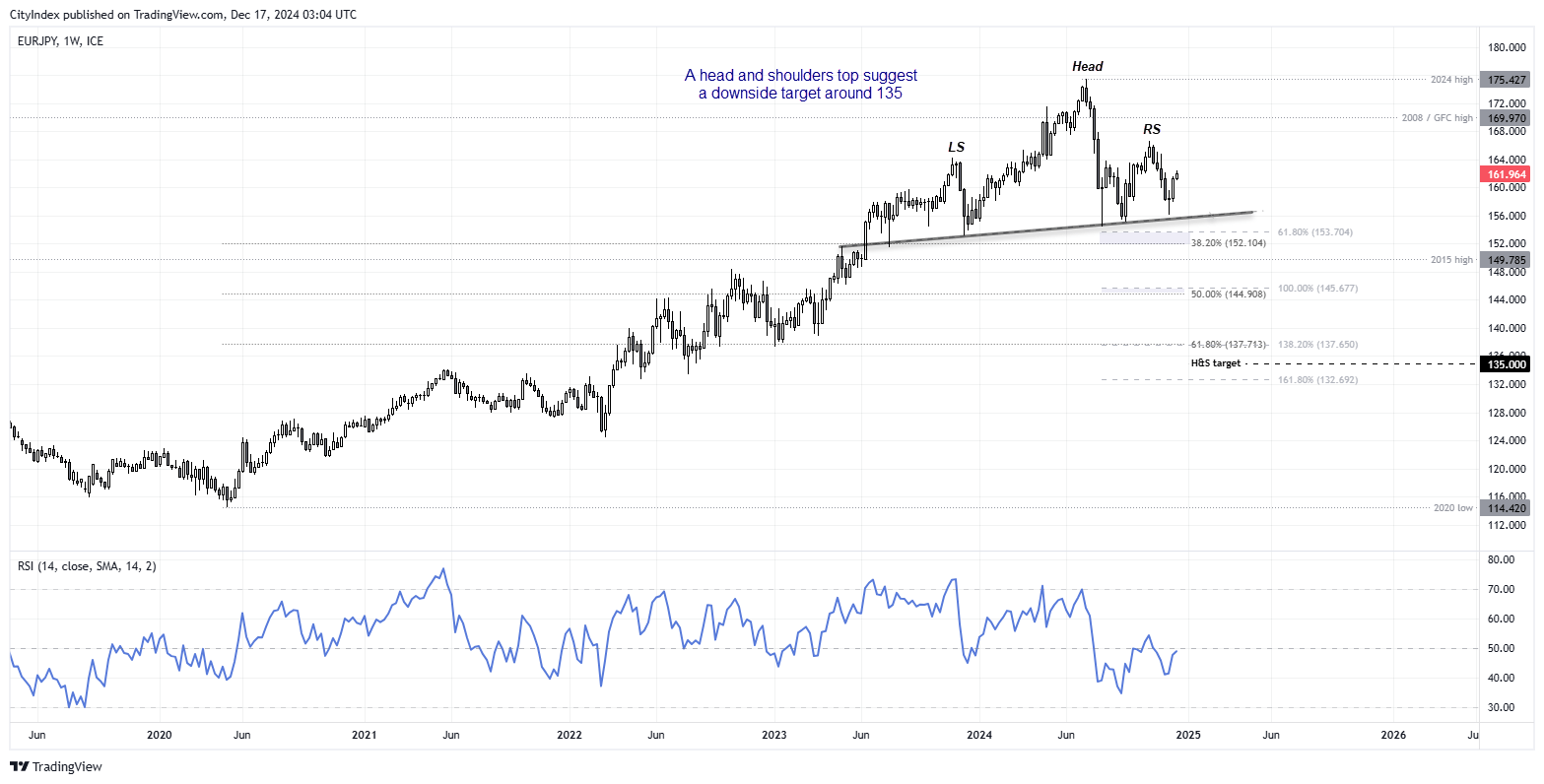

EUR/JPY technical analysis (weekly chart):

The weekly chart shows a potential head and shoulders top, which if successful suggest a downside target around 135. The weekly RSI is confirming price action, yet at the time of writing remains below 50, is trending lower with prices and is yet to reach oversold.

And given the magnitude of the drop from the 2024 high, I suspect bears could be waiting to fade into moves in anticipation of a much deeper correction. Which is also backed up with my proxy indicator for EUR/JPY positioning on the futures market.

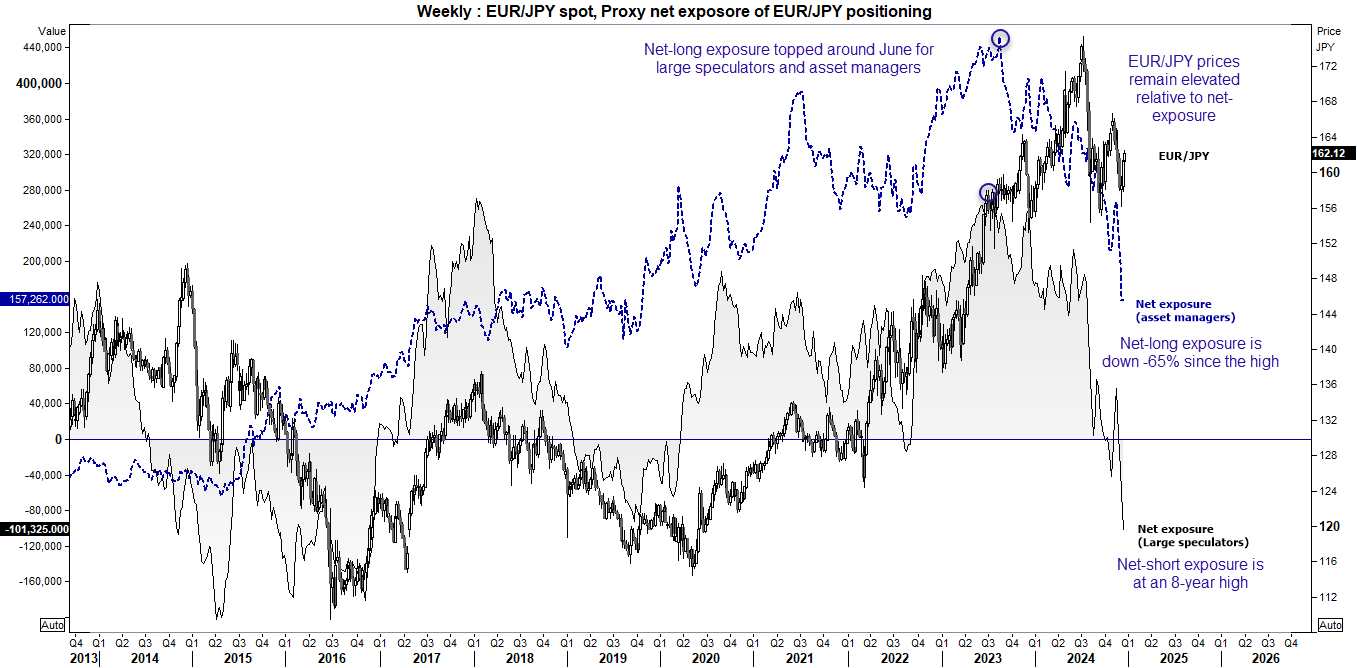

EUR/JPY proxy futures positioning – COT report

I have created a proxy net-exposure indicator for EUR/JPY futures by taking the spread between EUR/USD and JPY/USD net exposure. While the CME do report exposure on EUR/JPY futures, volumes were too low for the readings to be of any use.

- My proxy indicator suggests that net-long exposure to EUR/JPY topped around June for large speculators (shaded) and asset managers (dark blue dashed).

- Large speculators are net short and their most bearish level in eight years.

- While asset managers remain net long, their bullish exposure has fallen by -65% since the June high.

Price may remain elevated for now, but if market positioning is providing the lead it is, next year could be tough for EUR/JPY bulls.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.