Inflation: Some like it hot

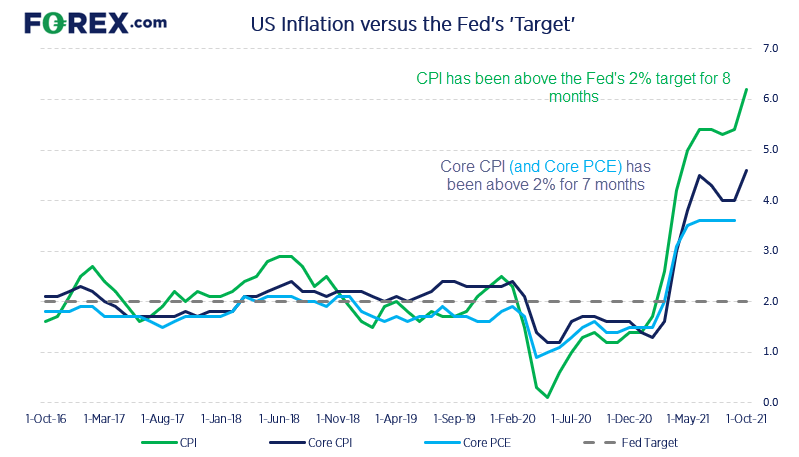

Inflation has been more than testing the market’s patience for the term ‘transitory’, and yesterday’s release was no exception. With US consumer prices rising 6.2% y/y it now sits at its highest level since 1990. If we strip food and energy, core CPI is now at 4.2% - it’s highest level since 1991. This means that CPI has been above the Fed’s 2% target for eight months and core CPI has been above it for seven.

At this stage it appears the Fed are hoping inflation will come down, although persistent bottlenecks in the supply chain with high demand are likely to keep inflation elevated for longer than the Fed would like.

Yet, frustratingly for Fed watchers, the Fed have changed how they target inflation whilst simultaneously hiding behind the term ‘transitory’.

The Fed’s mysterious inflation target

In August 2020 the Federal Reserve changed how they target inflation. Previously, they would simply target a 2% inflation rate, yet now they target an average rate of inflation over an [unspecified] time.

This means they took a relatively objective framework (understood by markets) and replaced it with a subjective/moving target. Throw in the word ‘transitory’ for inflation, traders are trying to decipher how high and long inflation must remain elevated to reach the target which is not actually known. Got that? Great.

Ultimately this makes interpreting forward guidance trickier when markets don’t truly know what their target is. And it almost goes without saying that the Fed would have likely raised rate under their previous inflation target model with the current rates of inflation. So perhaps there is some politics at play.

A Fed-Chair Nomination (and ousting) can be political

Currently, Jerome Powell’s term is due to end in February 2022. If Powell isn’t ‘rolled over’, he will be the second consecutive Fed Chair, behind Lady Yellen, not to get a second term. And that is quite rare by historical standards. And as it was former President-Trump that ousted Yellen, we cannot say with certainty (or any confidence, for that matter) that his decision was made with monetary policy in mind, given she was as dovish as could be and the self-proclaimed ‘King of Debt’ loves low rates. Make of that what you will…

Therefore, we could assume Powell to serve a second term simply because it is the historical norm. But the fact he is a dove should also appease the Biden administration, given the astronomical amount of government debt that has been wracked up before, during and after Covid. The government do not likely to want higher interest rates any more than the average person on the street wants their credit-card rate to rise. And that plays well for doves like Powell.

But… Powell is not the only dove on Wall Street

It has been reported that the dovish Lael Brainard was at the Whitehouse interviewing for Powell’s position last week. We can see from the odds below that Powell remains the favourite, but it took a noteworthy dip following reports of Brainard’s interview. Bostic has also been trending higher of late, yet is clearly the outside chance, although he deemed as the more hawkish of the three. (Perhaps that’s what the Fed actually needs…)

Still, Powell has the widest bipartisan support among the contenders, with Elizabeth Warren being the long vocal critic of this renomination. Former Fed-Chair-turned Treasury Secretary Janet Yellen has officially backed his nomination, and its plausible that Brainard will in fact get the Vice Chair position.

He may face some ‘tough’ questions from the senate as to why inflation is so high and for how long, but nothing more difficult than he has faced already.

So, to answer the question as to whether Powell or inflation will last? We suspect they’ll both be around for a while longer. And that once he is reconfirmed, his hand will be forced to raise rates next year when he cannot say the word ‘transitory’ with a straight face.

As for now, interest rates are higher as bonds fell in response to yesterday’s high inflation print, and the positive yield differential is beneficial for USD/JPY. We noted the importance of the 113.0 area ahead of the CPI report, and its abrupt rally above it strongly suggests its corrective low was seen at 112.72.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.