- Traders trimmed net-long exposure to the US dollar for a fifth consecutive week. According to data from IMM, traders are now net-long the dollar by $6.2 billion (down -$1.4 billion on the week).

- Large speculators pushed net-long exposure to euro futures to their most bullish level since in 6-months

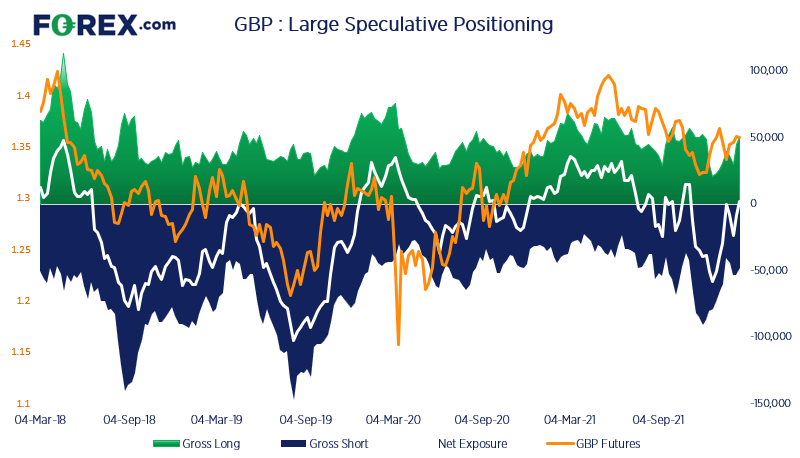

- Traders flipped to net-log exposure on GBP futures

- Excluding GBP, all weekly changes among FX majors were below 10k contracts

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

US dollar:

Bullish exposure to the US dollar continues to dwindle, which is at odds with the fact that the Fed are about to embark on multiple hikes. Yet it’s also possible that, with so many hikes now expected, investors are concerned that the Fed may tip the US into recession. According to data from IMM, net-long exposure to the dollar has fallen to its lowest level since April and has fallen for five consecutive weeks. Meanwhile, traders are their most bullish on emerging markets against the dollar in around 2 years.

GBP futures:

Traders flipped to net-long exposure on the British pound for the first time since November. Bears trimmed -5.3k contract yet added 5.4k long contracts which tipped traders to net-long exposure of 2.2k contracts. So traders have now placed their bets but we now need prices to back up this bias and break higher.

AUD futures:

Traders remain overwhelmingly net-short the Australian dollar. In fact net-short exposure is close to a record level of bearishness whilst bulls are side lined. But a problem many bears are facing is that AUD prices remain well supported above 70c. This means that if prices do not move lower as anticipated, bears may be forced to close out and inadvertently end up supporting a short-covering rally they didn’t see coming.

As of Tuesday 15th February 2022

- Managed funds on gold futures rose to a 3-month high

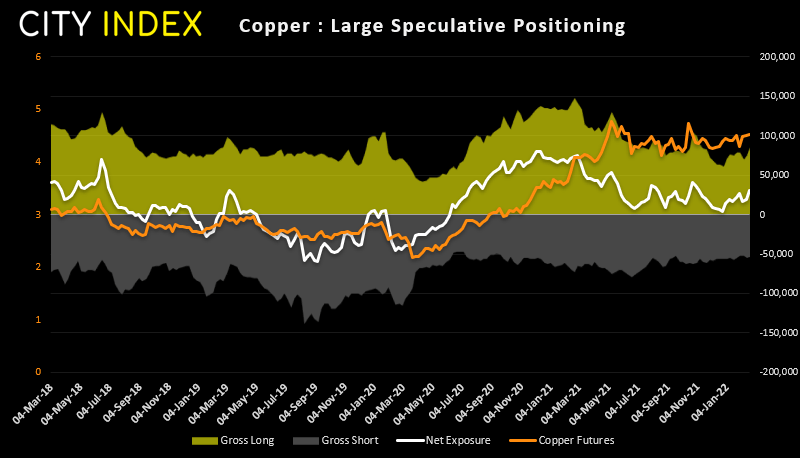

- Net-long exposure to copper rose to a 16-week high

Gold futures:

Gold grabbed plenty of headlines last week amidst the tensions between Russia and Ukraine, helping it rally for a third consecutive week and challenge $1900. Managed funds piled into the yellow metal and were their most bullish on it in three-months but, looking at how prices rallied into the weekend, we strongly suspect net-long exposure if actually much higher than the delayed COT data suggests. The biggest threat to gold prices right now is a Russian retreat. And as that doesn’t look very likely then we expect dips to be bought and for an eventual break above 1900.

Copper futures:

Positioning on copper futures has piqued our interest as net-long exposure has risen to its highest level in 16-weels, and at its fastest over the same period. Furthermore, it was seen with rising gross longs and reduction of shorts so we might just have the early indications of a bullish rally developing. But what we now need to see is prices rising sustainably above $4.50 and for them to challenge the $4.70 highs, or we may be at risk of another leg lower as these pre-emptive bulls are forced to liquidate.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.