- Traders reduced net-long exposure to the US by -$6.9 billion last week, according to IMM

- Euro futures were net-long for a second consecutive week

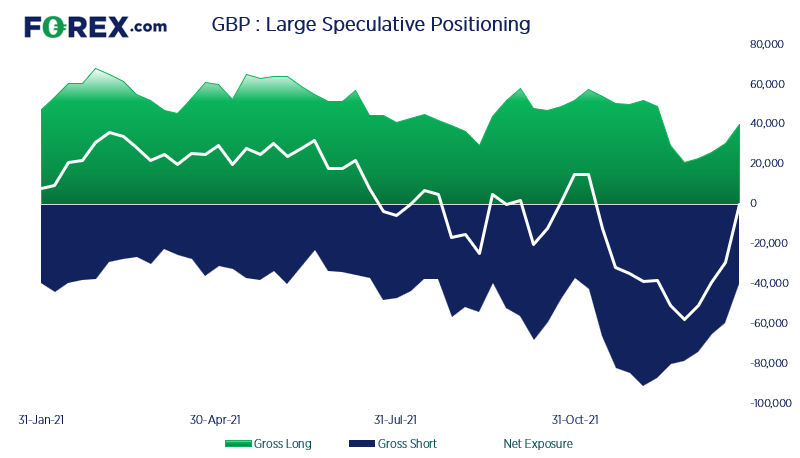

- Traders were net-short GBP futures by just 247 contracts, its least bearish level in 11 weeks.

- Large speculators flipped to net-long exposure on CAD and MXN futures

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

GBP futures:

Traders appear on the cusp of flipping to net-long exposure on British pound futures. At just 247 contracts net-short, it is the least bearish traders have been since November. And with new longs and shorts being initiated over the past 4-weeks (with longs as an increasing pace) then it is no longer exclusively a short-covering rally. With that said, GBP fell to an 8-day low on Friday so they amy still be net-short at the time of writing.

Guide to Pound sterling

CAD futures:

Traders flipped to net-long exposure on the Canadian dollar for the first time in 8-weeks last Tuesday. 5.5k long contracts were added and bears added -9.4k, which is a healthy sign for the bullish case. To put this into perspective, the +14.9k addition to net-long exposure is a _2 standard deviation move. However, traders drove prices below 0.80 on Friday and the weekly chart printed a small bearish hammer, so it is touch and go as to whether bulls can retain their lead this week.

Read our guide on the A guide to CAD

MXN futures:

Large speculators flipped to net-long exposure on the Mexican peso last week for the first time since May 2021. Over the past 4-week bulls have added 45.4k contracts yet, at the same time, bears also added 35.7k contracts. This is not exactly what we want to see for a strong bullish cases as investors are mostly hedging their bets. The Peso has also risen for 7-consecutive weeks so we cannot help but wonder if that streak is about to be broken and bulls reconsider their exposure.

As of Tuesday 18th January 2022:

- Large speculators trimmed net-long exposure to its least bullish level since late October

- Net-long exposure to copper futures rose to a 10-week high

traders increased net-long exposure by another 25.3k contracts, with 18.8k longs added and 6.5k short contracts removed