USD/JPY, US Dollar Talking Points:

- It’s been a strong morning for the US Dollar and, in-turn, a stark turn-around in EUR/USD after the pair reversed following fresh yearly highs.

- USD/JPY remains key for USD-scenarios and while the fundamental backdrop is and has been dimming, the technical backdrop paints a different picture.

- I looked into these markets in-depth in yesterday’s webinar, and you’re welcome to sign up for the next. I had an updated look around the US Dollar in the below video. Click here for webinar registration information.

There wasn’t much news to speak of this morning but that didn’t stop the US Dollar from posing a strong turn after a failed run at the lows.

DXY came within a pip of testing the yearly low last night and as I said in yesterday’s webinar, the picture was not pretty in the USD. But – I also noted how sellers have had an open door to drive a trend for the past couple of weeks and had, so far, failed to do so, speaking to other dynamics showing across major FX-pairs.

In EUR/USD, the pair tested a big level of long-term resistance and that has so far set the high of the day while bringing on a strong pullback. It’s still early there, but this speaks to the possibility of the ‘capitulation scenario’ that I had spoken of in yesterday’s webinar and then again in this morning’s article.

Perhaps more pressing for the US Dollar, however, is the USD/JPY pair. Logically speaking the fundamental argument behind the pair grows less and less attractive. The pair ran from sub-103 in early-2021 to above 160 in July of 2024. The main push point behind the move was the carry trade, with high US rates and low Japanese rates – but that argument is shifting. And it doesn’t look like the Fed will be hiking anytime soon, so that fundamental argument can be expected to worsen in the months and perhaps even years ahead.

Nonetheless, USD/JPY hasn’t even retraced 38.2% of the trend that was produced by that carry trade. There was a breakdown attempt at the 140.00 handle early last week and that level came close, but sellers stalled, leading into a build of higher-lows as USD/JPY snapped back. So, from a fundamental perspective, there could be more room to move-lower. But that’s not what currently shows in the technical backdrop.

At this point, bulls have continued to press higher-highs and lows after last week’s failed breakdown attempt at the 140.00 handle.

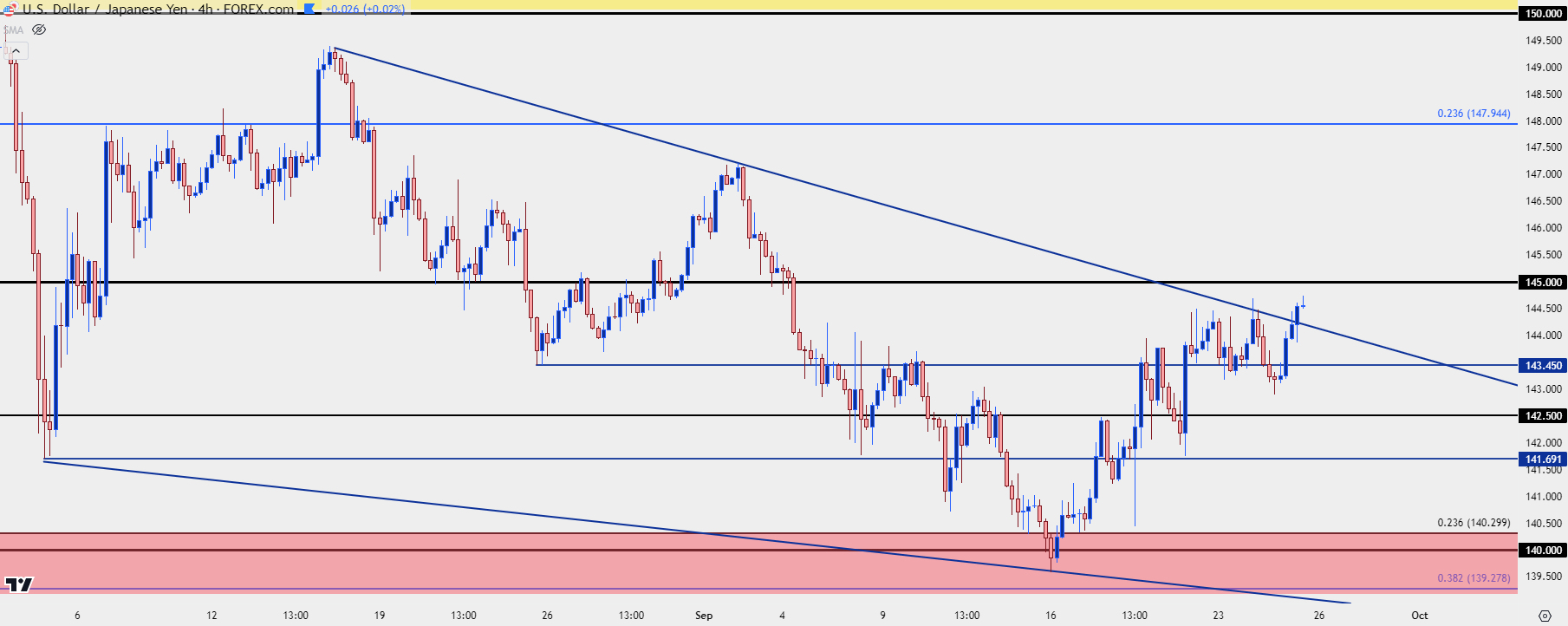

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY How High Does the Retracement Run?

At this point USD/JPY hasn’t even retraced 23.6% of the sell-off that started in July. That level is confluent with the 145.00 psychological level overhead and I think that’ll be a key test for the pair.

At this point we have a test of the resistance trendline making up the falling wedge formation. Those are often approached with aim of bullish reversal and if we can see buyers push, with 145 as the next key spot, the door then gets opened for tests of 147.16 and then a confluent spot around the 148.00 handle.

Perhaps more interesting would be a trip back up to the 150-151.95 zone in the pair. That was a key spot for the past couple of years in USD/JPY and if we do see price push that high, there would likely be headlines talking about ‘return of the carry’ or similar. That would make little sense given the fundamental tides, but headlines have a tendency to follow price and not the other way around.

Interestingly the 50% mark of the sell-off plots near the middle of that zone at 150.77.

But that’s a ways’ away from the current chart, and below I’ll get closer with near-term strategy.

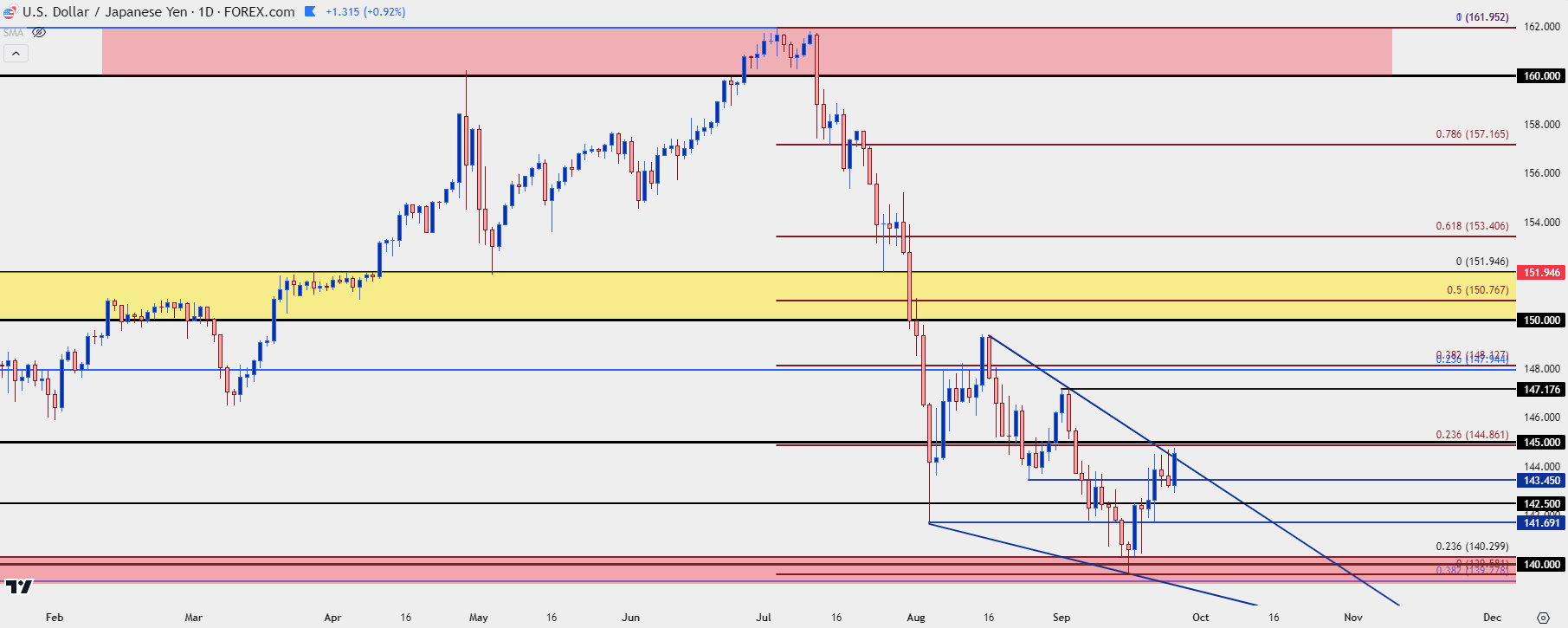

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY

You’ll probably hear me say quite often that I don’t chase breakouts and the above is no different. The next major objective on the long side of the pair is re-test of the 145.00 handle. If that comes in, the look is then for higher-low support. If price blows through that level quickly then 145.00 itself could become the spot for that higher-low support.

This caution is especially important when we have the deduction of a bearish fundamental backdrop but a bullish technical outlay. Perhaps 145.00 is what encourages longer-term bulls to close off carry trades? We just have to wait and see to read the response.

Above 145.00 the next level that I’m tracking is the swing at 147.18, and then that confluent area around the 148.00 handle where there’s the 38.2% retracement of the sell-off very near the 23.6% retracement of the 2021-2024 major move.

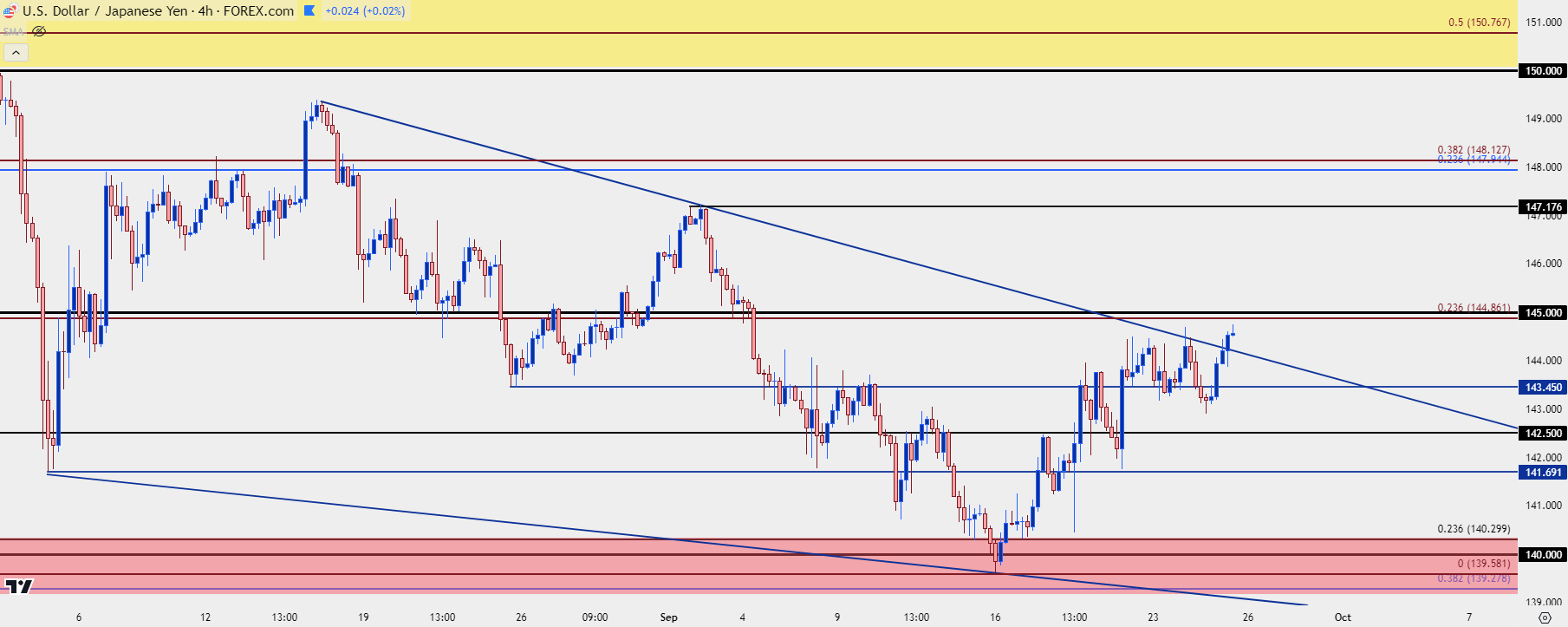

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist