USD/JPY, Japanese Yen Talking Points:

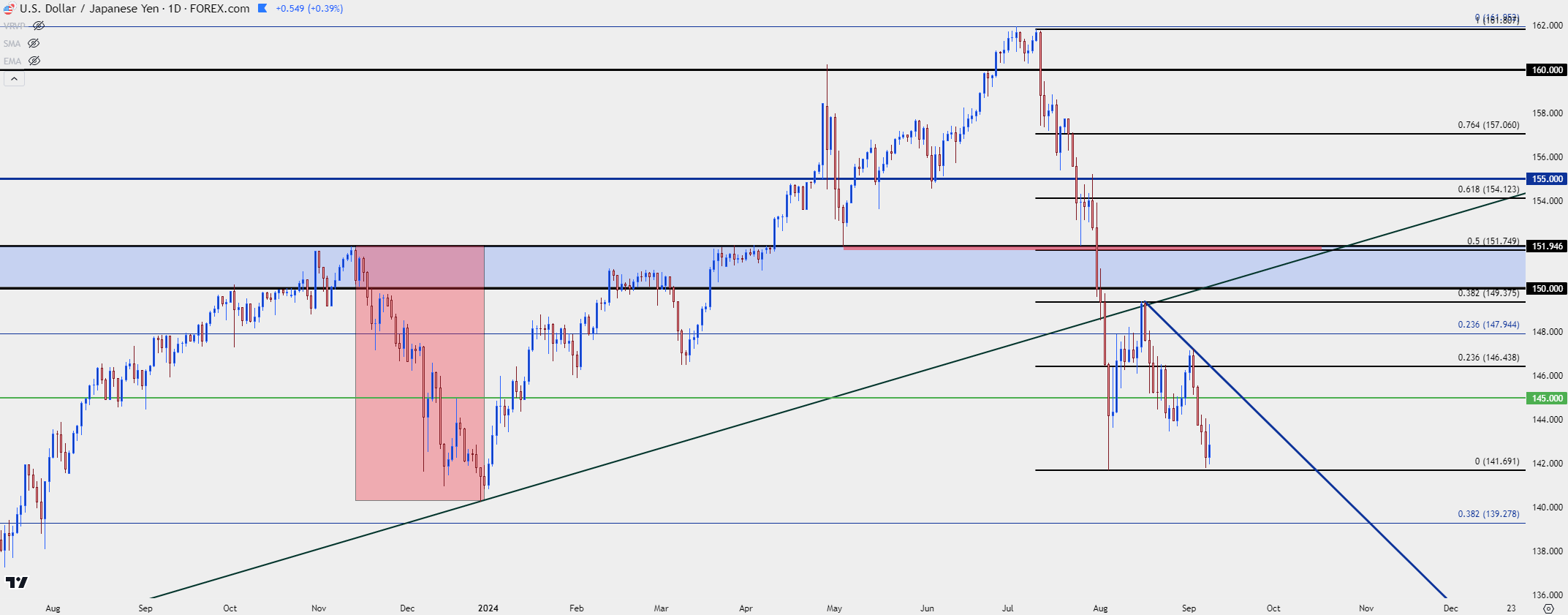

- USD/JPY bears returned last Thursday with a bearish engulf on the daily chart.

- To end last week sellers came within 8 pips from a re-test of the eight-month low before pulling back. The big question now is whether they can continue to push or whether a larger pullback will appear.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

The fundamental case for the long side of USD/JPY continues to dim but that doesn’t mean that price will pose a linear move-lower. While there likely remains a considerable portion of longer-term bulls still holding on to positions from the carry trade that had built over the past three years, the aggression with which the pair sold-off highlights that there were likely a lot of shorts that had opened in anticipation of a pullback move, and sure enough, the one-month range that led into the low on August 5th comprised more than 2,000 pips of range.

At that point, a clean 38.2% retracement showed after setting that low a month ago, after which bears hit back for another move of almost 600 pips. At that point, the 145 level was back in-play and as I had warned a couple of weeks ago, there was a growing appearance of a bear trap scenario, which led into another topside move.

But it was last Tuesday that bears made another statement with a bearish engulfing formation on the daily chart. The rest of the week was punctuated with pain for bulls as sellers continued to push, coming within eight pips of re-testing the low from August 5th.

So far this week, bears have continued to shy away from that re-test but at this point, it’s difficult to make much of a bullish case for the pair from a fundamental vantage point.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

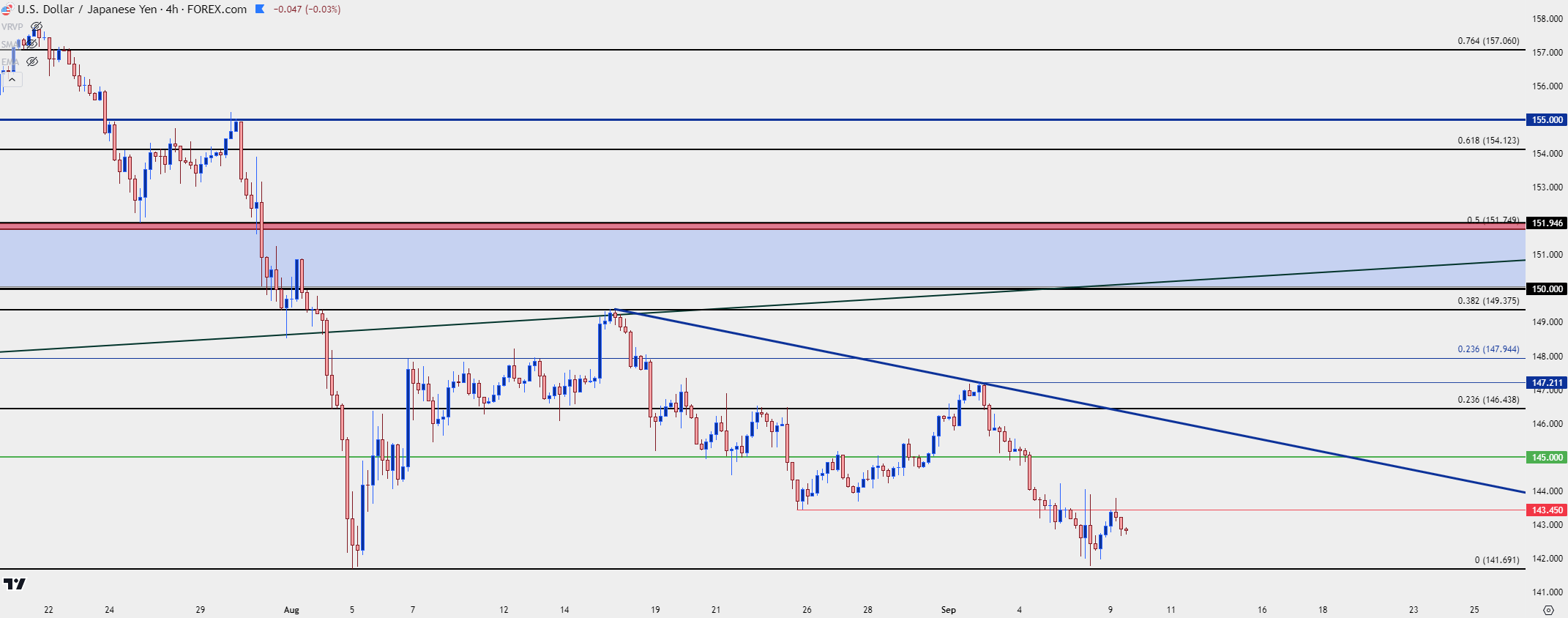

USD/JPY Strategy

At this point it seems like we’ll be getting a rate cut from the Fed in short order, and it seems a distant prospect to assume any actions from the BoJ that may lead to more Yen-weakness, even though the bank has said that they don’t have plans for hikes in the near-term. But, positioning matters and this statement can span across timeframes, where a longer-term bullish position is at odds with short-term bearish positions.

In USD/JPY with sellers stalling ahead of a test of the low, the door then re-opens for the possibility of a larger pullback. This would be driven by short-cover from traders that had ridden the wave down as the pair posted a move of more than 500 pips from last week’s high. That short-term oversold nature can make for a daunting prospect for new entrants into the market and, instead, it casts the look for lower-high resistance at prior spots of support.

There’s already one of these prices in-play at the 143.45 swing-low from late-August; and above that, the 145.00 psychological level continues to loom large. Given last week’s swing-high at 147.21, there would also be a possibility of lower-high resistance at the 146.44 Fibonacci level which would similarly keep the door open for bearish continuation scenarios.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

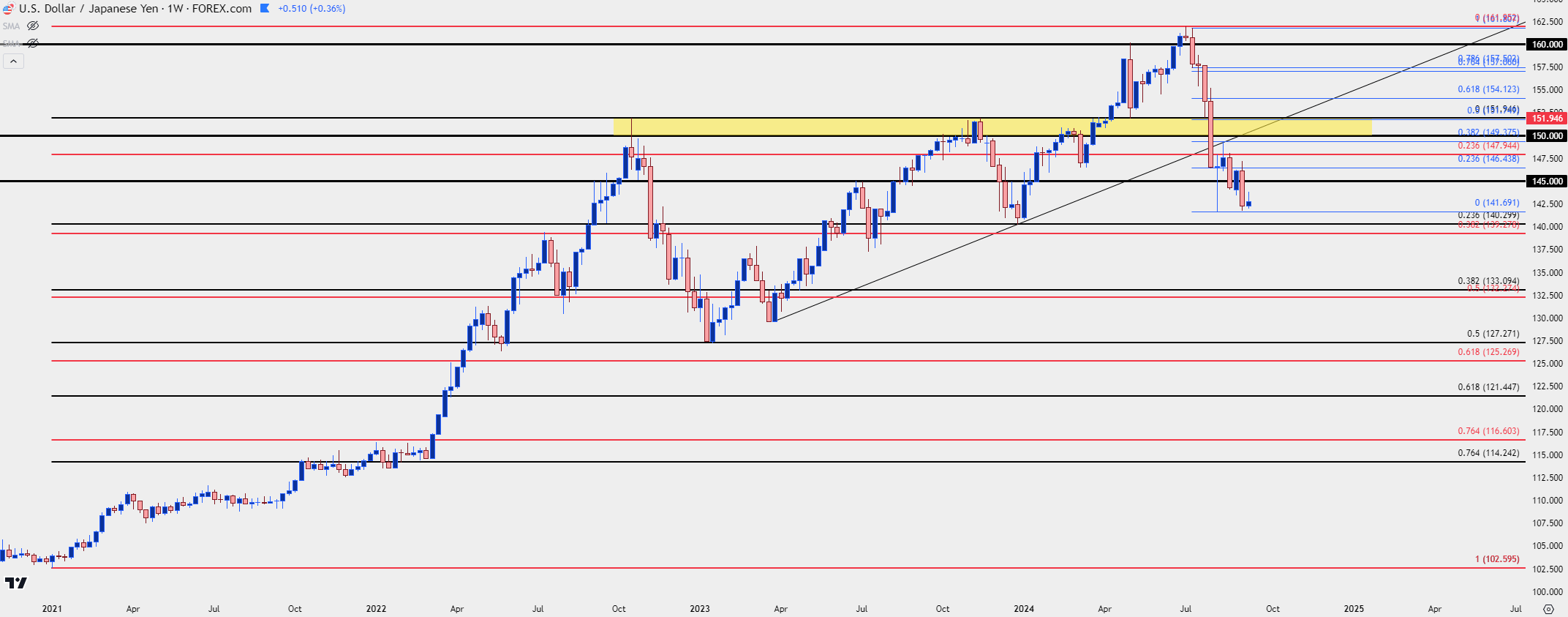

USD/JPY Bigger Picture

Given the three-plus years that the carry trade drove the long side of the pair, combined with the fact that we haven’t yet seen 38.2% of that bullish trend erased, I’m of the opinion that there’s still more carry left to unwind. Timing that, however, will remain a challenge as is always the case with shorter-term strategy.

Much as we’ve seen continued gyration around the 145.00 level, major psychological prices can be key levels to track for such scenarios.

The current 2024 low plots at 140.30 and below that, the 140 handle looms large. For longer-term bulls this could be an area of interest for possible stops. Stops on long positions are ‘sell to close’ logic often oriented to execute ‘at best.’ This can hasten declines as more supply comes on the market after the big figure was traded through, similar to what happened on the upside of price back in April, when USD/JPY shot through the 151.95 level that had previously been defended by the Bank of Japan.

How the pair reacts there will be an important item for bigger picture strategy dynamics and, at this point, there’s a cluster of possible supports around that level, down to the 38.2% Fibonacci retracement of the 2021-2024 major move.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist