Key Events

- BOJ intervention risks align with US Dollar rally and Japanese inflation metrics

- BOJ Governor Ueda to speak at the International Finance Forum on Thursday

- National Core CPI and Japanese/US Flash Manufacturing PMI scheduled for Friday for volatility risks

- Sharp metal retracement sent silver to retest the lower boundary of its one-year uptrend

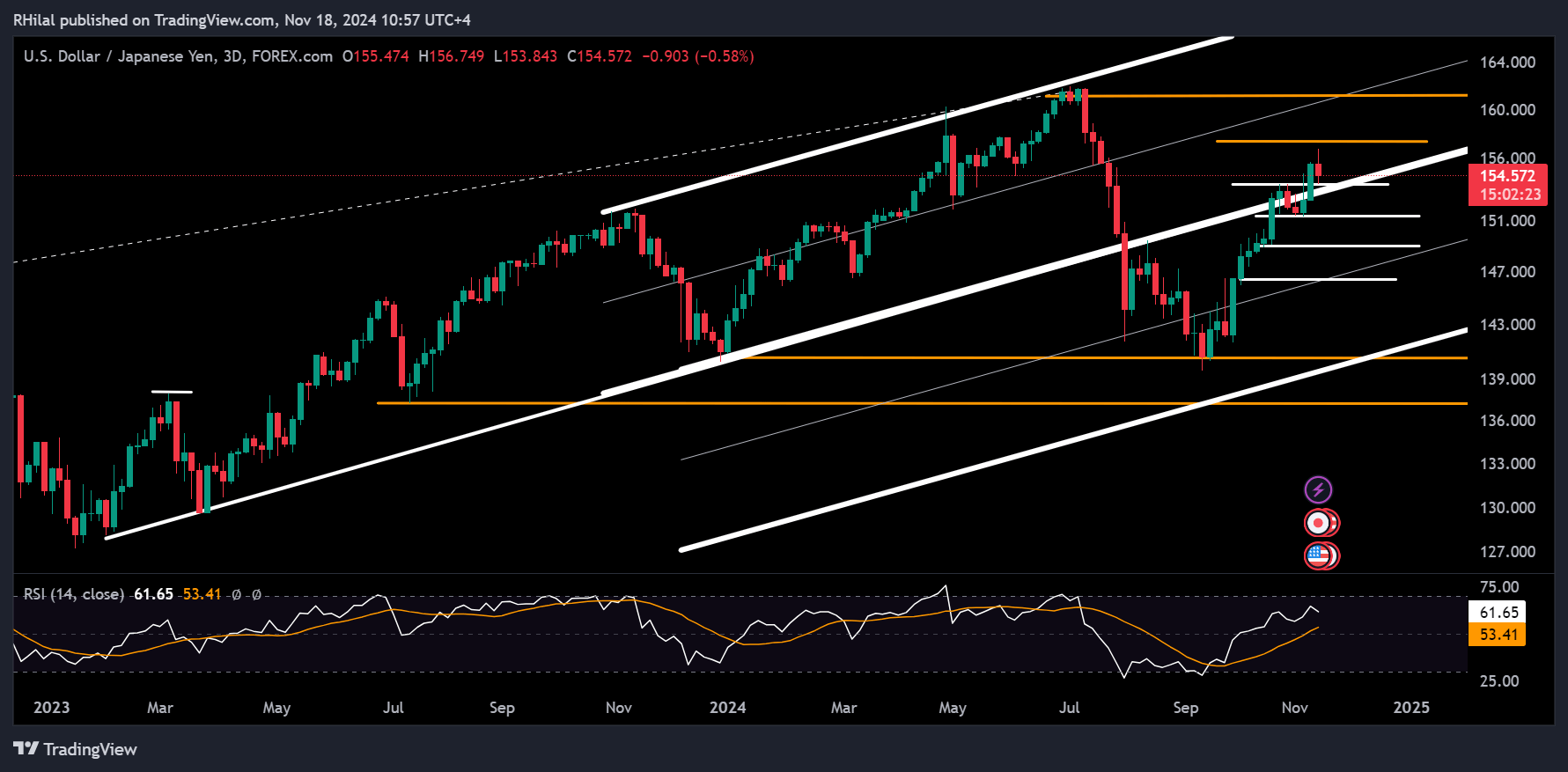

USDJPY Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

Historical chart patterns and BOJ policies against yen weakness suggest that a USDJPY rally beyond the critical resistance levels of 157 and 160 could heighten intervention risks, similar to the BOJ’s market-shaking actions in August. A decisive close above the 107-mark on the DXY could trigger further currency sell-offs, impacting global monetary policy adjustments.

- Upside Potential: Without intervention, USDJPY could break past 157 and 160 resistance levels, heading toward the 167–170 zone, aligning with the upper boundary of the parallel channel connecting the 2023–2024 highs.

- Downside Risk: A retreat below the 151 mark could lead to support at 149 and 146, before potentially confirming a deeper drop toward the yearly low.

BOJ Governor Ueda’s recent remarks emphasize their readiness to act on rates without waiting for complete clarity, warning that delays could necessitate more aggressive hikes.

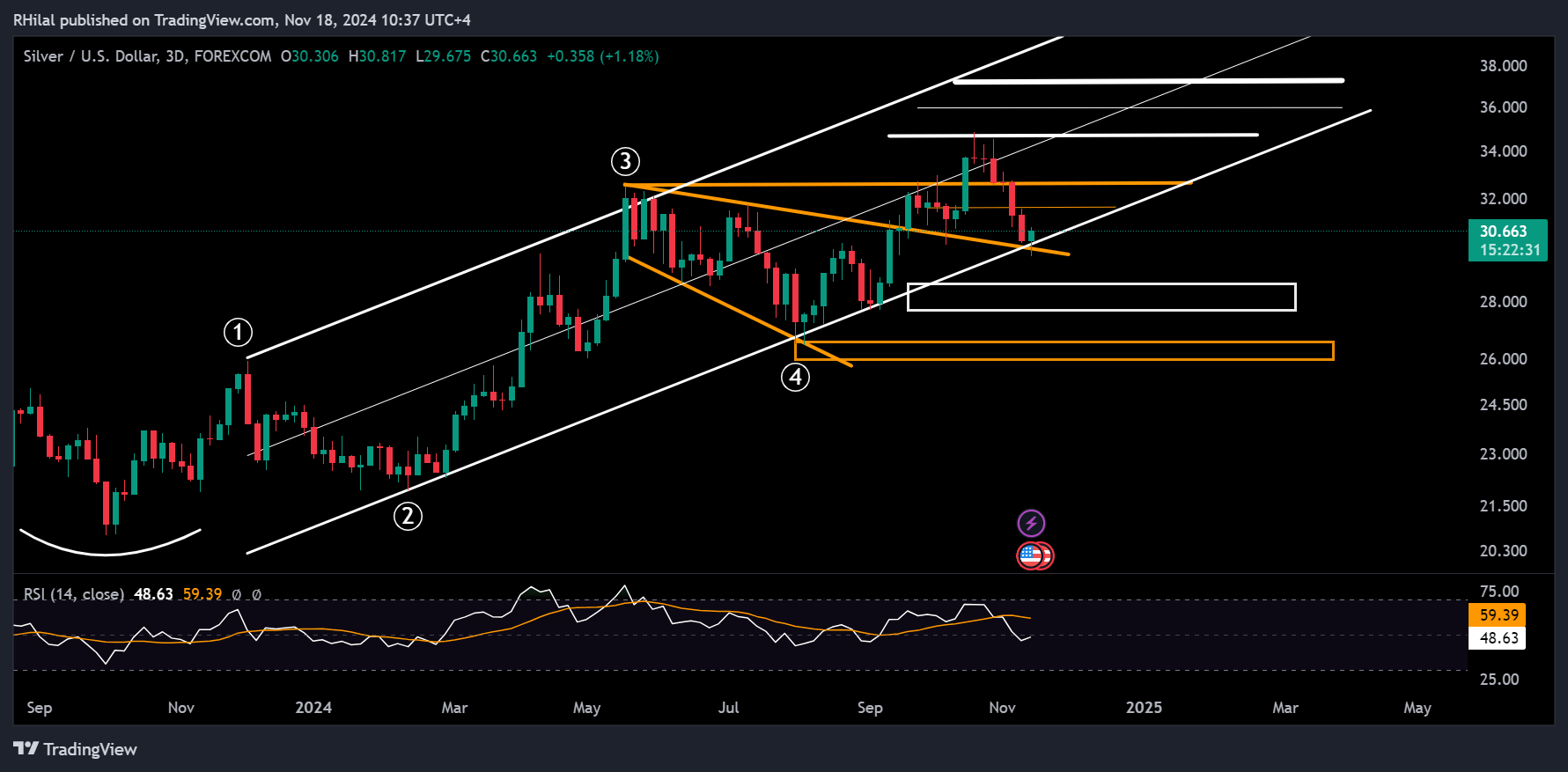

Silver Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

The US Dollar’s rally and a decrease in market uncertainty have driven a sharp retracement in precious metals, pressuring silver to retest key technical levels. These include the trendline connecting consecutive lows between 2023 and 2024, the trendline connecting highs from May to September 2024, and the 0.618 Fibonacci retracement of the trend between August and October 2024.

Silver remains within the boundaries of its one-year up-trending parallel channel, and the scenarios are the following:

- Bullish Scenario: If the primary uptrend holds, silver could recover toward resistance levels at 31.60, 32.60, and 35, with the potential to reach a new decade high of 37

- Bearish Scenario: A decisive close below the critical support at 29.60 could extend the drop toward the 26-price zone, with possible support levels at 28.70 and 27.70

--- Written by Razan Hilal, CMT on X: @Rh_waves