USD/JPY Talking Points:

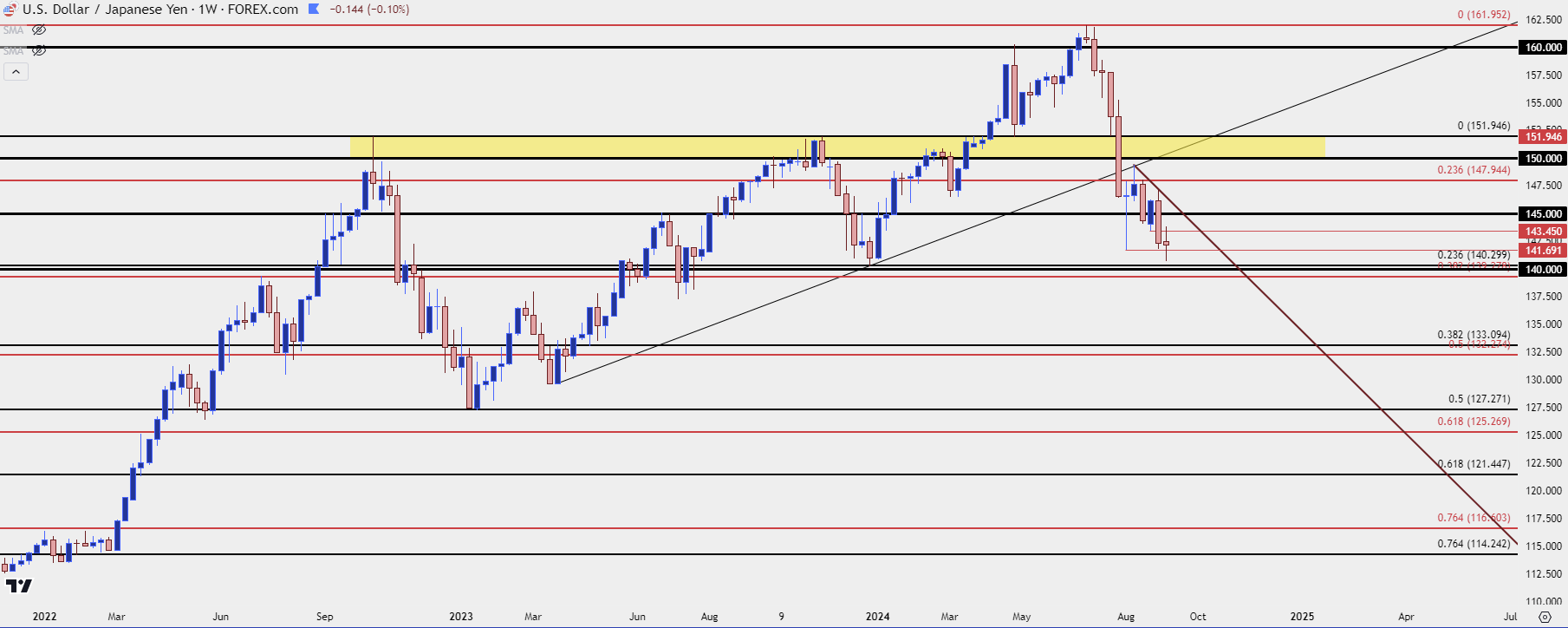

- The fundamental case behind the long side of USD/JPY is growing more dim as the FOMC gets closer to the start of a rate cutting cycle.

- At this point the pair hasn’t yet re-tested the 38.2% retracement from the 2021-2024 major move that came into play as US inflation and then US rates moved-higher.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

Trends do not move in a straight line, nor are they perfectly driven by fundamentals. As a case in point we can look at the carry trade when USD/JPY was working higher from 2021 into 2024. Throughout that period US rates remained higher than Japanese rates and carry traders could earn rollover for being long the pair, while shorts were in a position to pay rollover. This incentive certainly had impact as USD/JPY went from sub-103 in early 2021 to above 160 in 2024, but that didn’t stop a couple of sizable retracements from showing in November of 2022 and 2023. Those retracements were largely driven by how one-sided the move had become, and even the slightest hint of change was enough to compel profit taking from longs and profit seeking for shorter-term bears.

But for each of those retracements the FOMC remained in a similar spot, unable to cut rates as inflation in the US remained stubbornly high. And that’s what’s changed here as the Fed gets closer to kicking off a rate cut cycle at their meeting next week.

At this point USD/JPY remains well-elevated on a longer-term basis and another bear trap appeared last night. There is a large spot of support potential around the 140.00 handle so if/when bears can take that out, that would be a notable event. But, until then I remain cautious of chasing the pair lower given the short-term oversold readings that have shown of late, which I’ll look at after the next chart.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

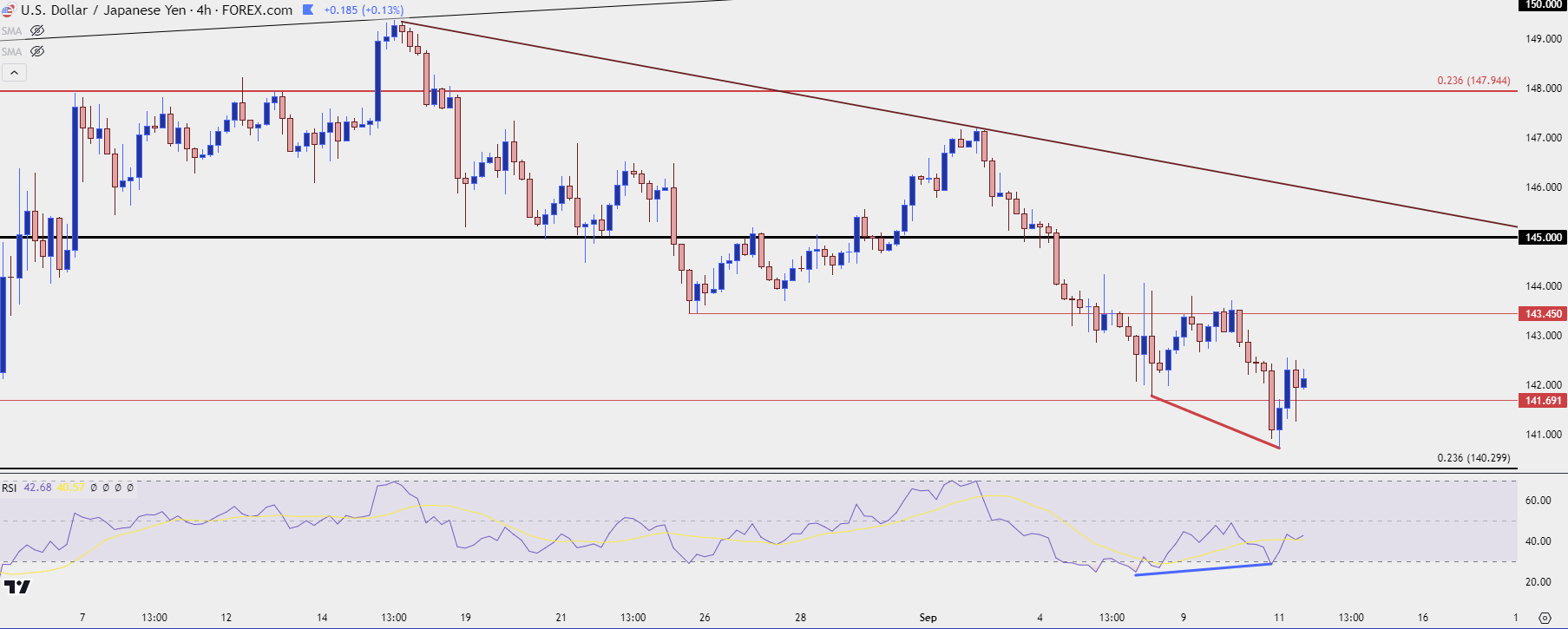

USD/JPY Shorter-Term

Bears have been showing caution around re-tests of lows. Last week we saw sellers pull up less than eight pips shy of the prior swing-low from August. This allowed for a pullback to prior support of 143.45, which I had looked at in yesterday’s webinar.

And then last night bears were able to push below that point but, again, seller interest seemed to diminish shortly after.

From those two recent events, we’ve seen a case of RSI divergence build on the four-hour chart and this is something that suggests the possibility of a larger pullback, as the short-term move appears to be a bit long-in-the-tooth.

This highlights lower-high resistance potential around spots such as the same 143.45, or the 145.00 level that had set a bear trap a few weeks ago, or perhaps even to the bearish trendline that projects to just inside of the 146.00 level.

A case can even be made for a rally up to the 147.94 Fibonacci level, and a hold there could still constitute a lower-high inside of the August 15th swing.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist