US Dollar Outlook: USD/JPY

USD/JPY reverses ahead of the monthly high (157.48) as the update to the US Consumer Price Index (CPI) reveals slowing inflation, but the exchange rate may continue to track the positive slope in the 50-Day SMA (155.31) as the Federal Reserve is widely expected to retain a restrictive policy.

USD/JPY Reverses Ahead of Monthly High with Fed and BoJ on Tap

USD/JPY trades to a fresh weekly low (155.72) as the US CPI narrows to 3.3% in May from 3.4% per annum the month prior, with the core rate of inflation also slowing to 3.4% from 3.6% during the same period.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It remains to be seen if the Federal Open Market Committee (FOMC) will respond to the recent data prints as the Non-Farm Payrolls (NFP) report reflects a resilient labor market, and developments coming out of the Fed may sway foreign exchange markets as the central bank is slated to update the Summary of Economic Projections (SEP).

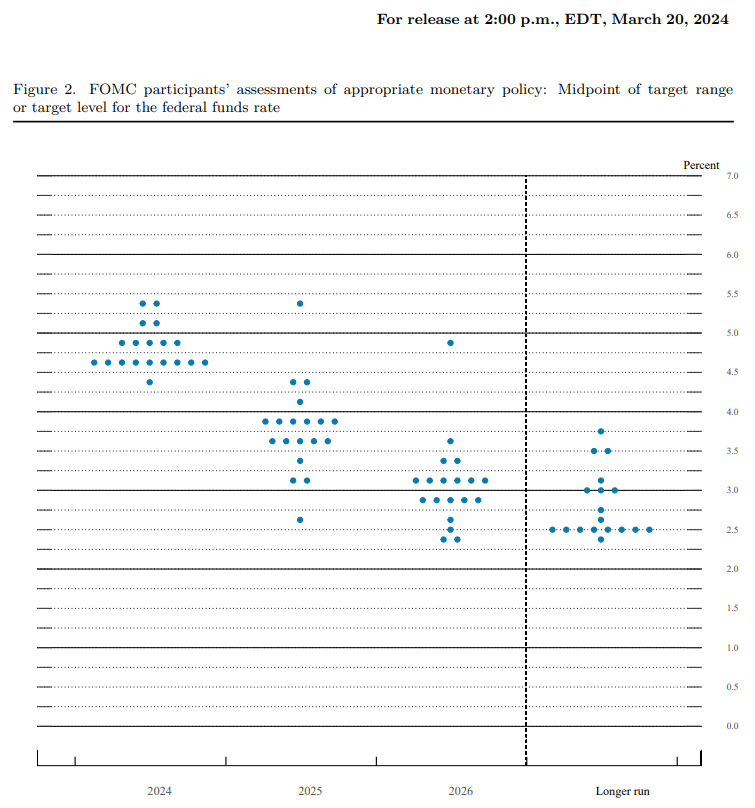

Federal Reserve Summary of Economic Projections (SEP)

Source: FOMC

The FOMC is expected to keep US interest rates at the current threshold of 5.25% to 5.50% as the central bank continues to combat inflation, and the update to the Fed’s SEP may show a growing dissent within the committee as ‘many participants commented on their uncertainty about the degree of restrictiveness.’

In turn, the fresh forecasts coming out of the Fed may generate a bullish reaction in the Greenback should Chairman Jerome Powell and Co. tame speculation for a rate cut in 2024, but USD/JPY may struggle to retain the advance from the monthly low (154.54) if the FOMC shows a greater willingness to pursue a less restrictive policy later this year.

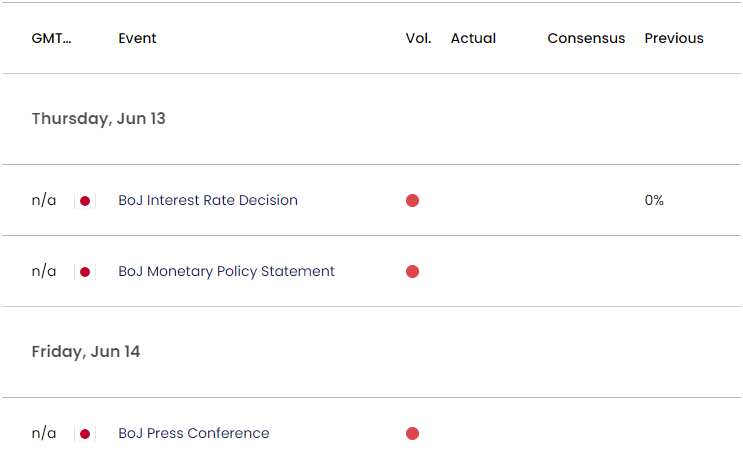

Japan Economic Calendar

Moreover, the Bank of Japan (BoJ) meeting may also influence USD/JPY as board member Seiji Adachi ‘anticipates that accommodative financial conditions will be maintained for the time being,’ with the official going onto say that ‘I believe it is vital to adjust the degree of monetary accommodation gradually’ while speaking with local leaders in Kumamoto.

The comments suggest that BoJ is in no rush to embark on a rate-hiking cycle as the central bank insist that ‘in the current situation where underlying inflation is below 2 percent, accommodative financial conditions need to be maintained for a fairly long period,’ but Governor Kazuo Ueda and Co. may gradually alter the forward guidance for monetary policy as the bank pledges to ‘adjust the degree of monetary accommodation in a way that does not exert stress on the economy.

With that said, a hawkish statement from the BoJ may drag on USD/JPY as market participants brace for higher interest rates in Japan, but more of the same from the BoJ may keep the exchange rate afloat as the Fed remains reluctant to switch gears.

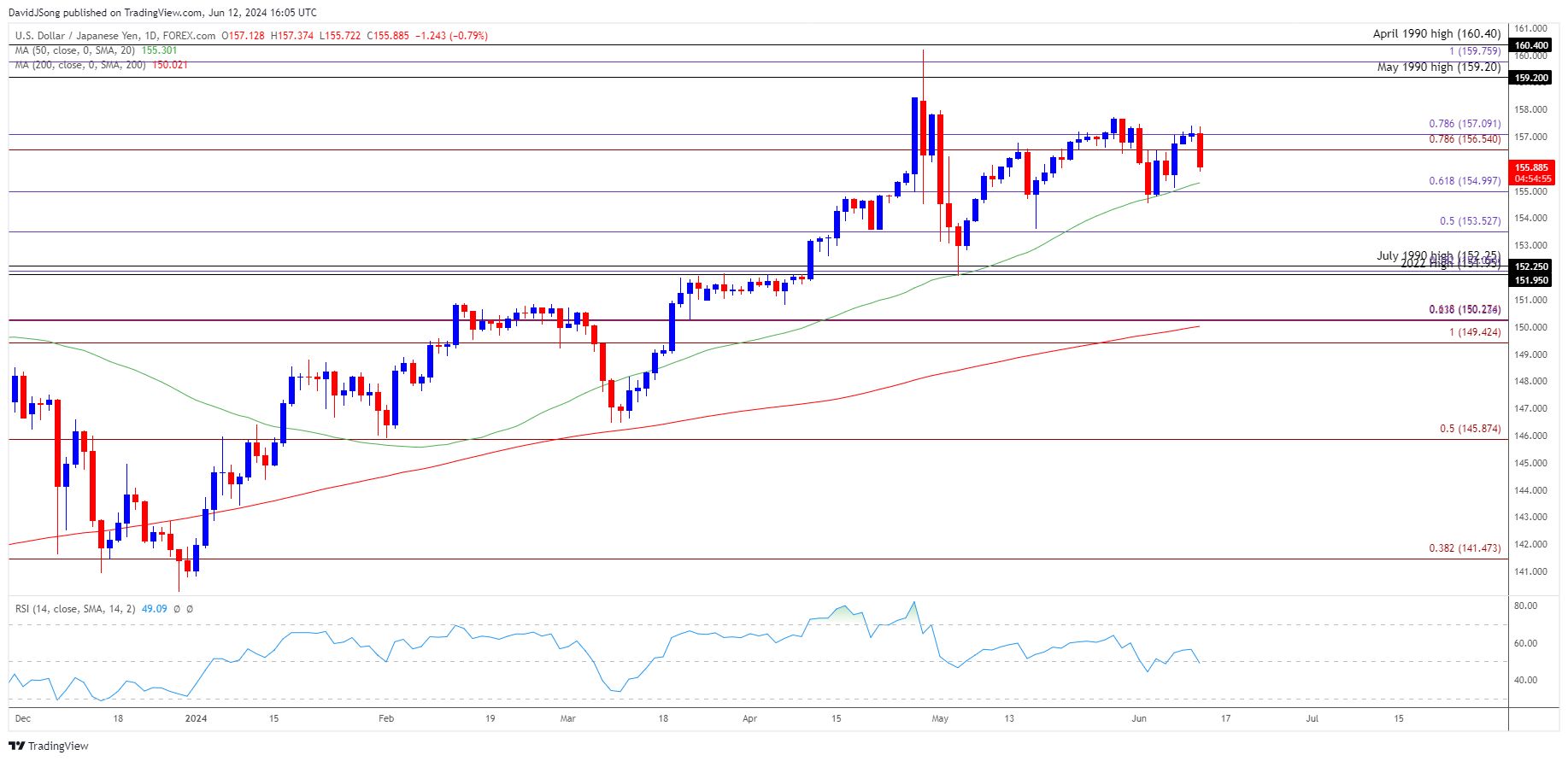

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY pulls back ahead of the monthly high (157.48) to snap the recent series of higher highs and lows, with a move below 155.00 (61.8% Fibonacci extension) raising the scope for a test of the monthly low (154.54).

- A break/close below 153.50 (50% Fibonacci extension) brings the May low (151.87) on the radar, but USD/JPY may track the positive slope in the 50-Day SMA (155.30) should it continue to close above the moving average.

- A breach above the monthly high (157.48) raises the scope for a test of the May high (157.99), with the next area of interest coming in around the May 1990 high (159.20).

Additional Market Outlooks

USD/CAD Clears May High with Fed Expected to Retain Restrictive Policy

US Dollar Forecast: GBP/USD Slips Below June Opening Range Ahead of Fed

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong