US Dollar Outlook: USD/JPY

USD/JPY seems to be bouncing back ahead the monthly low (141.69) even as the Federal Reserve signals a looming adjustment in monetary policy as it snaps the recent series of lower highs and lows.

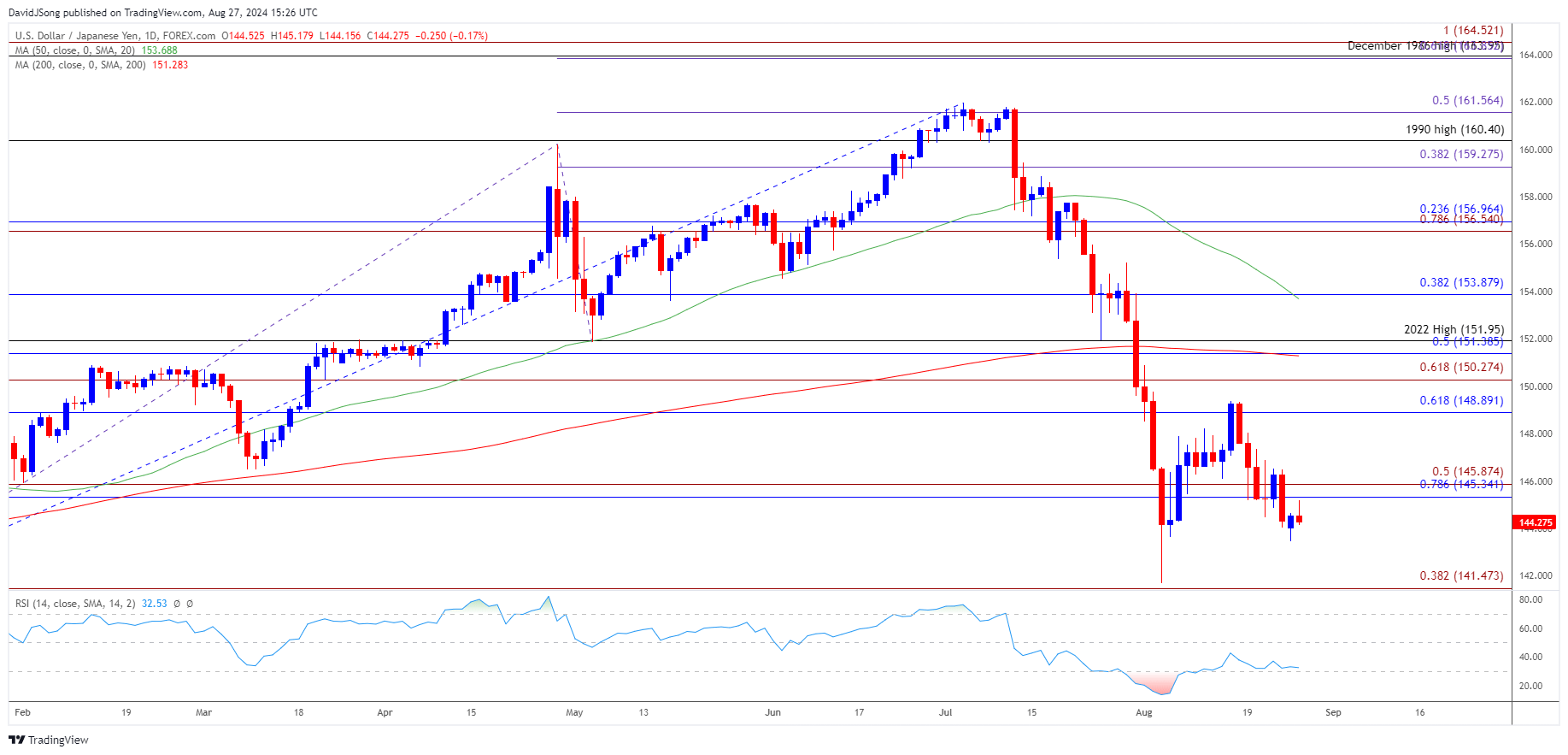

USD/JPY Rebounds Ahead of Monthly Low to Keep RSI Above 30

USD/JPY may consolidate ahead of the next Federal Open Market Committee (FOMC) rate decision September 18 as the selloff from earlier this month failed to produce a test of the January low (142.22).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the Relative Strength Index (RSI) may show the bearish momentum abating should the oscillator continue to hold above oversold territory, and developments coming out of the US may continue to sway the exchange rate as the Personal Consumption Expenditure (PCE) Price Index is anticipated to show sticky inflation.

US Economic Calendar

Although the headline reading is anticipated to hold steady at 2.5% in July, the core PCE, the Fed’s preferred gauge for inflation, is projected to increase to 2.7% from 2.6% per annum the month prior.

Evidence of persistent price growth may lead to a bullish reaction in the US Dollar as it limits the Fed’s scope to pursue a rate-cutting cycle, but a softer-than-expected PCE report may drag on the Greenback as it puts pressure on Charman Jerome Powell and Co. to support the economy throughout the remainder of the year.

With that said, the rebound from the monthly low (141.69) may unravel if USD/JPY fails to defend the advance from the start of the week, but the exchange rate may continue to trade within the monthly range to keep the RSI above 30.

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY snaps the recent series of lower highs and lows as it attempts to extend the advance from the weekly low (143.45), and a break/close above the 145.30 (78.6% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region may push the exchange rate back towards 148.90 (61.8% Fibonacci retracement).

- Need a break/close above 150.30 (61.8% Fibonacci extension) to open up the monthly high (150.89), with the next area of interest coming in around 151.40 (50% Fibonacci retracement) to 151.95 (2022 high).

- However, failure to defend the weekly low (143.45) may push USD/JPY back towards the monthly low (141.69), with a break/close below 141.50 (38.2% Fibonacci extension) bringing the January low (142.22) on the radar.

Additional Market Outlooks

British Pound Forecast: GBP/USD Rally Eyes 2023 High

Gold Price Forecast: XAU/USD Pullback Keeps RSI Below 70

AUD/USD Rally Pushes RSI Towards Overbought Territory

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong