US Dollar Outlook: USD/JPY

USD/JPY preserves the advance following the better-than-expected US Non-Farm Payrolls (NFP) report as the update to the Consumer Price Index (CPI) shows sticky inflation, but the exchange rate may struggle to retain the rebound from the monthly low (141.63) as the Federal Reserve is expected to retain the current policy.

USD/JPY Rate Outlook Hinges on Federal Reserve Interest Rate Decision

USD/JPY attempts to retrace the decline from the start of the month after failing to close below the 200-Day SMA (142.42), with the recent recovery in the exchange rate pulling the Relative Strength Index (RSI) out of oversold territory to indicate a textbook buy-signal.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, USD/JPY may hold near the weekly high (146.59) ahead of the Fed rate decision, but more of the same from Chairman Jerome Powell and Co. may produce headwinds for the Greenback as the central bank seems to at or nearing the end of its hiking-cycle.

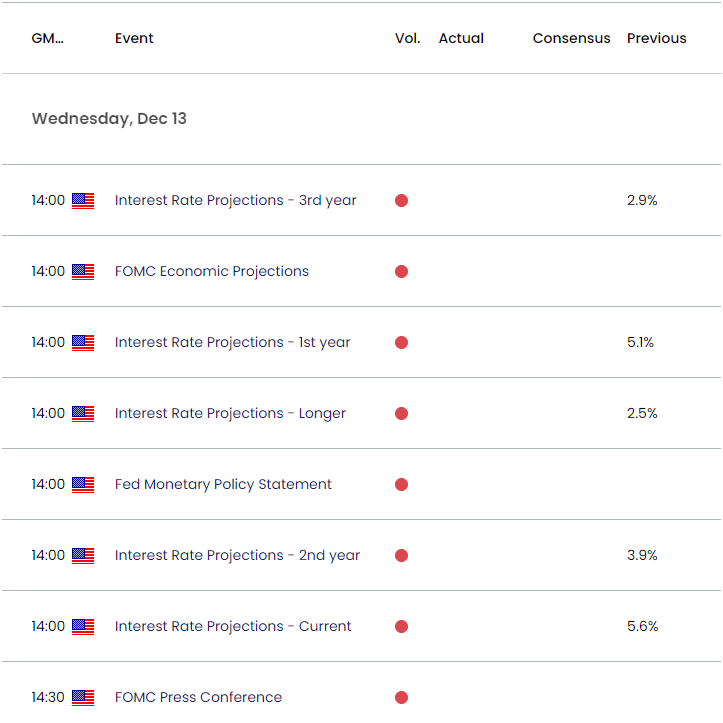

US Economic Calendar

In turn, the recent rebound in USD/JPY may unravel should the Federal Open Market Committee (FOMC) keep US interest rates unchanged, and the exchange rate may no longer respond to the positive slope in the long-term moving average should the update to the Summary of Economic Projections (SEP) reflect a looming change in regime.

At the same time, the fresh forecasts from Chairman Powell and Co. may generate a bullish reaction in the Greenback if the interest rate dot-plot shows the Fed Funds rate higher for longer, and the exchange rate may stage a large recovery ahead of the Bank of Japan (BoJ) meeting on December 19 as Governor Kazuo Ueda and Co. stick to Quantitative and Qualitative Easing (QQE) with Yield-Curve Control.

With that said, fresh developments coming out of the Fed rate decision may sway USD/JPY amid speculation for lower US interest rates in 2024, but the exchange rate may further retrace the decline from the monthly high (148.35) if the FOMC shows a greater willingness to further combat inflation.

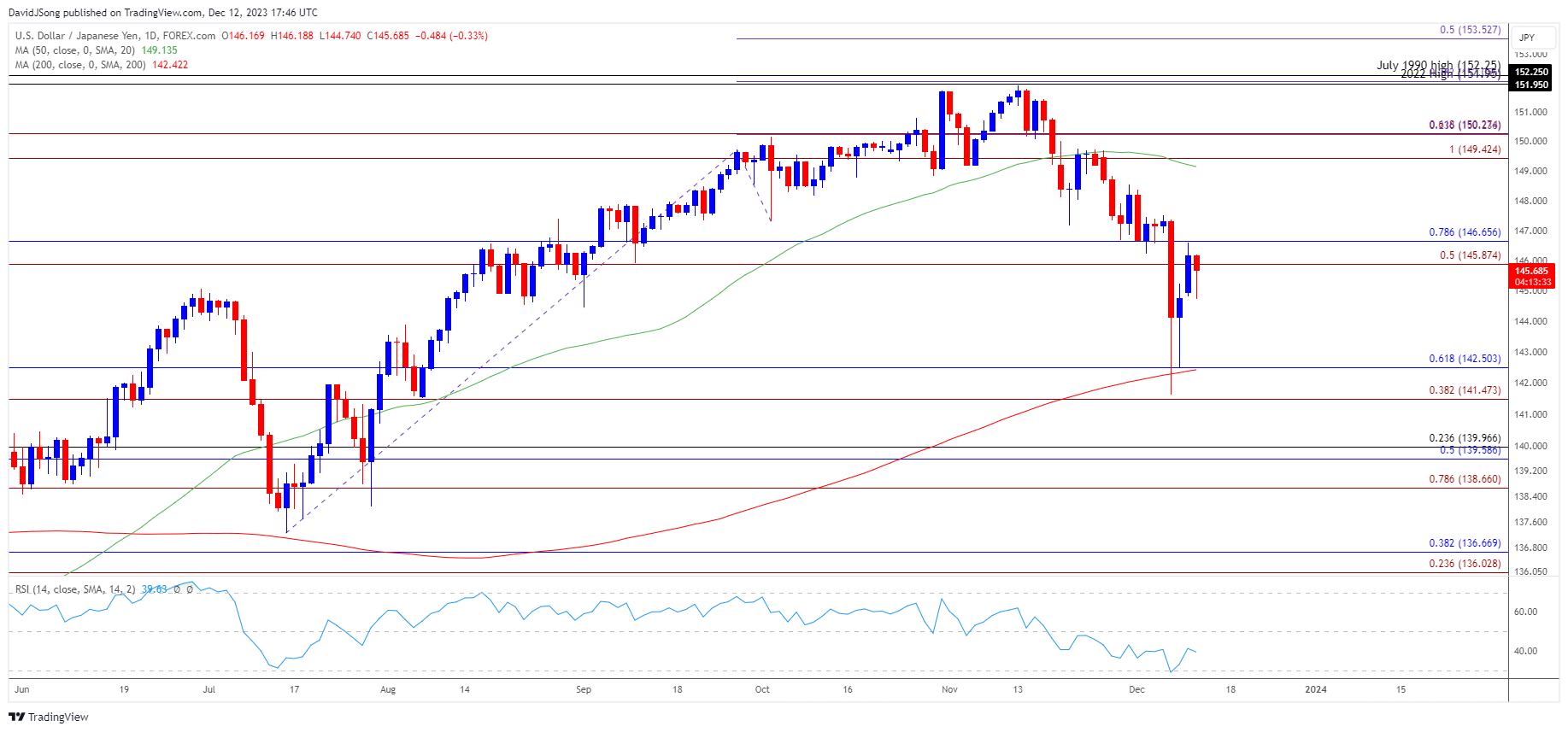

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY failed to close below the 200-Day SMA (142.22) as it bounced back ahead of the August low (141.52), with the rebound in the exchange rate pulling the Relative Strength Index (RSI) above 30 to indicate a textbook buy-signal.

- USD/JPY may try to track the positive slope in the long-term moving average as it attempts to retrace the decline from the start of December, with a close above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region bringing the monthly high (148.35) on the radar.

- Next area of interest coming in around 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension), but failure to close above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region may push USD/JPY back towards the 141.50 (38.2% Fibonacci extension) to 142.50 (61.8% Fibonacci retracement) zone.

Additional Market Outlooks:

US Dollar Forecast: GBP/USD Falls Toward Channel Support

US Dollar Forecast: EUR/USD Halts Six-Day Selloff Ahead of US NFP

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong