USD/JPY Outlook

USD/JPY pushed above the 200-Day SMA (137.12) to clear the December 2022 high (138.18), but recent developments in the Relative Strength Index (RSI) suggest the bullish momentum is abating as the oscillator reverses ahead of overbought territory.

USD/JPY Rally Fizzles with RSI Reversing Ahead of Overbought Zone

The recent advance in USD/JPY has been accompanied by a rise in US Treasury yields, but the exchange rate struggles to extend the series of higher highs and lows from earlier this week as it pulls back from a fresh monthly high (138.75).

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

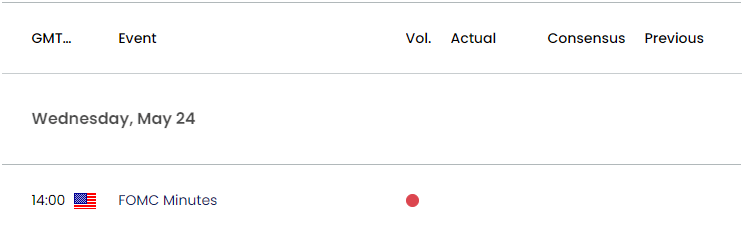

Looking ahead, the Federal Open Market Committee (FOMC) Minutes may sway USD/JPY as the central bank warns that ‘the economy is likely to face further headwinds from tighter credit conditions,’ and it seems as though the Fed is at or approaching the end of its hiking-cycle as ‘tighter credit conditions are likely to weigh on economic activity, hiring, and inflation.’

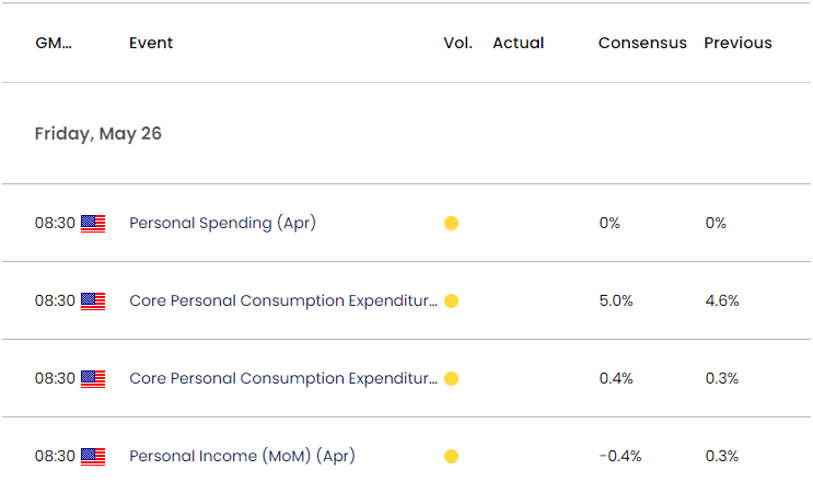

As a result, the FOMC may hint at a further adjustment in the forward guidance for monetary policy as the central bank is slated to update the Summary of Economic Projections (SEP) in June, but data prints coming out of the US may force Chairman Jerome Powell and Co. to pursue a more restrictive policy as the update to the Personal Consumption Expenditure (PCE) Price Index is anticipated to show persistent inflation.

The core PCE, the Fed’s preferred gauge for inflation, is expected to increase to 5.0% in April from 4.6% per annum the month prior, and evidence of sticky price growth may put pressure on the FOMC to deliver another 25bp rate hike at the next interest rate decision on June 14 as the central bank is ‘prepared to do more if greater monetary policy restraint is warranted.’

Until then, the Greenback may continue to appreciate against the Japanese Yen as the Bank of Japan (BoJ) sticks to Quantitative and Qualitative Easing (QQE) with Yield-Curve Control (YCC), and USD/JPY may attempt to further retrace the decline from last year as it clears the December 2022 high (138.18).

With that said, developments coming out of the US may keep USD/JPY afloat as the Fed keeps the door open to implement higher interest rates, but recent developments in the Relative Strength Index (RSI) raises the scope for a larger pullback in the exchange rate as the oscillator reverses ahead of overbought territory.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY cleared the December 2022 high (138.18) as it pushed above the 200-Day SMA (137.12), but the six-day rally appears to have fizzled amid the lack of momentum to push above the 138.70 (78.6% Fibonacci extension) to 140.00 (23.6% Fibonacci retracement) region.

- USD/JPY may struggle to hold above the long-term moving average as it fails to extend the recent series of higher highs and lows, and the Relative Strength Index (RSI) may show the bullish momentum abating as it reverses ahead of 70.

- A move below the 200-Day SMA (137.12) may push USD/JPY back towards the 136.00 (23.6% Fibonacci extension) handle, with the next area of interest coming in around 132.60 (38.2% Fibonacci retracement) to 133.90 (23.6% Fibonacci retracement), which incorporates the monthly low (133.50).

- Nevertheless, USD/JPY may stage further attempts to push above the 138.70 (78.6% Fibonacci extension) to 140.00 (23.6% Fibonacci retracement) region if it holds above the long-term moving average, with the next area of interest coming in around 141.50 (38.2% Fibonacci extension).

Additional Resources:

EUR/USD Outlook: Break of April Low Pushes RSI Toward Overbought Zone

Gold Price Vulnerable After Failing to Defend Monthly Opening Range

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong