Risk aversion in ascendant in global markets following the escalation in the US-China trade war (see “China’s Trade Retaliation Has USD/CNH Bulls Eyeing Decade-Plus Highs Near 7.00” and “It is all about US-China trade war” for more). Global stocks are poised for their worst day this year, oil has seen a big bearish reversal, and economically-sensitive commodity dollars are the weakest currencies in the G10 space. Meanwhile, safe haven assets such as gold, bitcoin (tongue only partially in cheek!), treasury bonds, and the Japanese yen are on the rise.

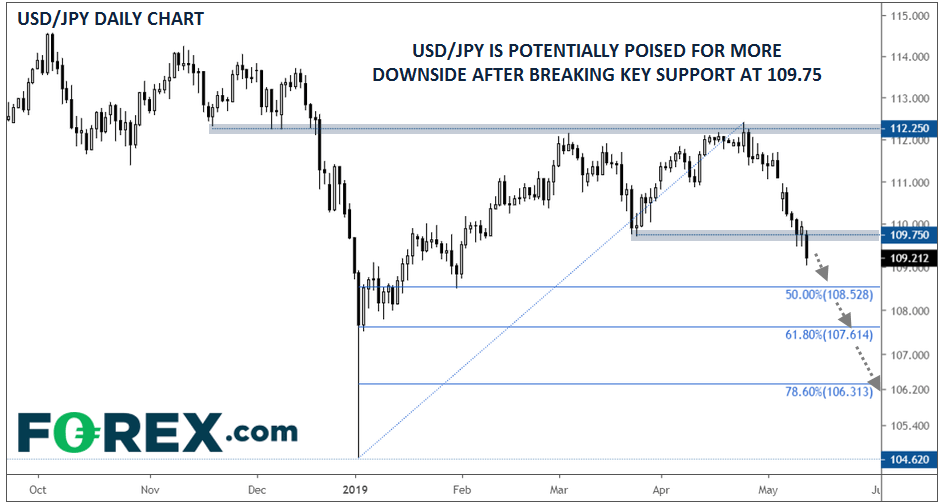

Looking at USD/JPY, rates have now broken definitively below the late March low near 109.75 after forming an “inside candle” on Friday, shifting the near-term trend to bearish. Moving forward, sellers may now look to target the Fibonacci retracements of this year’s rally near 108.50 (50%), 107.60 (61.8%) or 106.30 (78.6%). At this point, only a break back above 109.75 would eliminate the near-term bearish bias.

Source: TradingView, FOREX.com