USD/JPY technical analysis:

The 1-hour chart of USD/JPY shows a clear uptrend. And were it any major currency pair, I’d be happy with that, but we clearly have to factor in the BOJ and the potential for another intervention. Interestingly, the first two interventions saw USD/JPY retrace higher before topping out around the 61.8% level of the intervention range itself. This time around it has surpassed the 51.8% and edging towards the 78.6% level, near a high-volume node. Furthermore, the market spied above the 155 handle during the Asian session, and as this has not sparked any bearish volatility then I suspect the 155.5 handle could be tested in the coming hours.

Yet RSI (14) is tracking prices higher to confirm the gently rally, although it is teetering on the edge of the overbought zone. Ultimately I suspect the upside has further to go, which could allow for bullish intraday trend traders to step in. Yet I am also keeping an eye out for a spike of bearish volatility below 156, as I suspect the current rise from the third intervention has had a good enough run to warrant a pullback in due course.

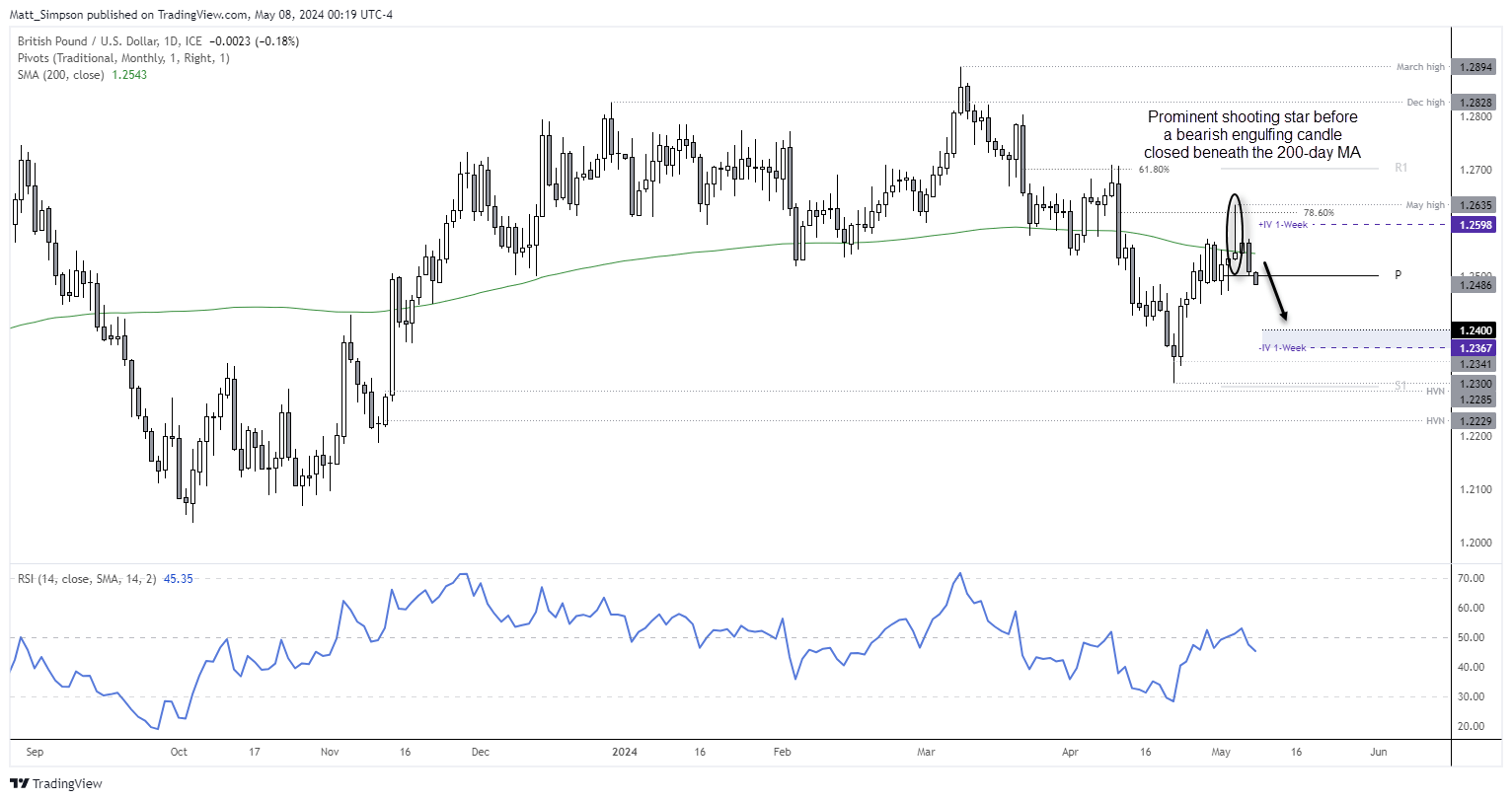

GBP/USD technical analysis

Out of all the FX majors, GBP/USD looks set to buckle against the USD irrespective of the dollar’s performance. Its strong rally from 1.23 formed a bearish pinbar around the 78.6% Fibonacci level, and subsequent bearish price action strongly suggests it was a noteworthy swing high.

Prices formed a bearish engulfing candle on Tuesday and continue beneath the monthly pivot during Asian trade on Wednesday. And it looks like it wants to fall to at least 1.24, just above the lower 1-week implied volatility band.

It seems traders are getting ahead of themselves for Thursday’s BOE meeting, where bets are on for indication of a June cut. But what if the BOE wobbles and doesn’t indicate such a move? The I’d expect some short covering and potentially a retest of the 200-day average. However, as most are in agreement that the BOE are on track to cut twice this year, having signalled ‘Fed independence’ regarding rates, an August cut followed by one in Q4 remains plausible. So even if prices do retrace higher, the bias remains bearish whilst prices remain beneath the May high.

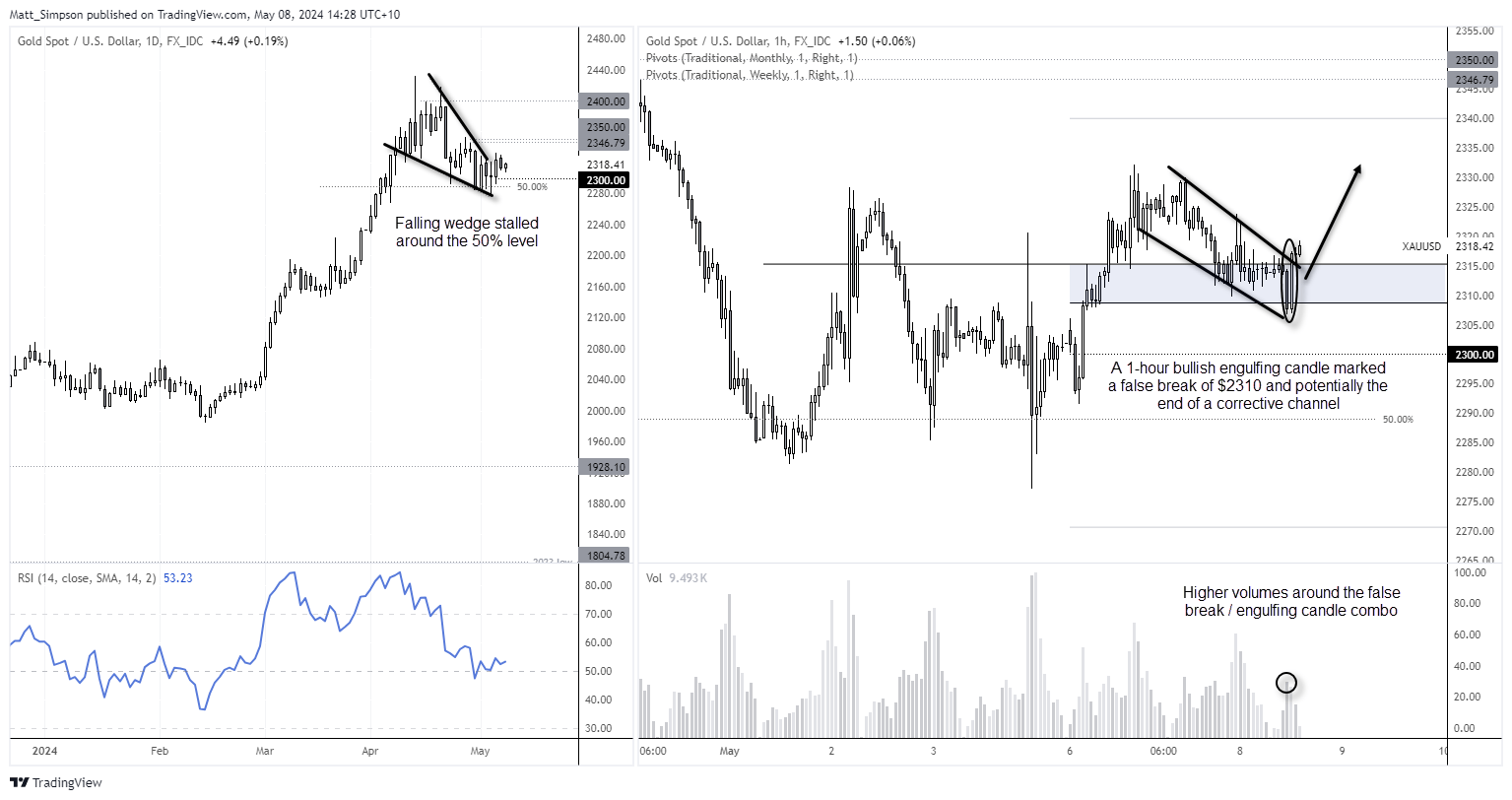

Gold technical analysis:

Last week I highlighted a bullish bias on gold, calling for the $2280 area to hold as support. Whilst we saw a minor breach of it following Friday’s NFP report, price action continues to suggest demand at those lows and potential leg higher.

A falling wedge has formed on the daily chart, which implies and upside target around $2400. I’ll reserve reservation for whether that will be reached, as we could also see gold deepen its correction before the anticipated break to new highs. But I think a move to at least the $2350 area seems feasible over the near term.

Gold has just formed a 1-hour bullish engulfing candle following a false break of $2310. Given high volumes formed on the false break and engulfing candle suggests the level was vigorously defended, and therefore demand may reside. Prices are now above the weekly and monthly pivot point, so today’s bias remains bullish above $2306 and for a move to $2030, a break above which brings $2350 into focus.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge